you position:Home > us stock market today > us stock market today

US Electronic Stock Market: The Future of Investing

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In the rapidly evolving world of finance, the US electronic stock market has become a cornerstone for investors seeking to capitalize on the global economy. This article delves into the intricacies of this digital marketplace, highlighting its benefits, challenges, and the impact it has on the broader financial landscape.

What is the US Electronic Stock Market?

The US electronic stock market refers to the trading of stocks, bonds, and other securities through digital platforms. Unlike traditional stock exchanges, such as the New York Stock Exchange (NYSE), these markets operate 24/7 and provide investors with instant access to global financial instruments. This convenience has revolutionized the way individuals and institutions alike engage in the stock market.

Benefits of the US Electronic Stock Market

Accessibility: The US electronic stock market breaks down geographical barriers, allowing investors to trade from anywhere in the world with an internet connection. This accessibility has democratized investing, making it more inclusive than ever before.

Speed and Efficiency: Digital platforms offer real-time data and execute trades almost instantaneously. This speed and efficiency are crucial for active traders looking to capitalize on market movements.

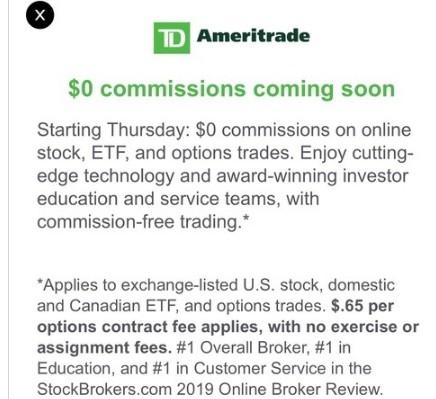

Low Costs: Online brokers have significantly reduced the costs associated with stock trading, making it more affordable for retail investors. This cost-effectiveness has contributed to the rise of the "millennial investor" demographic.

Diverse Investment Opportunities: The US electronic stock market provides access to a vast array of global stocks, bonds, and other financial instruments. This diversity allows investors to build well-diversified portfolios tailored to their risk tolerance and investment objectives.

Challenges of the US Electronic Stock Market

Market Volatility: The 24/7 nature of the US electronic stock market can lead to increased volatility, as markets are open around the clock. This volatility can create both opportunities and risks for investors.

Regulatory Concerns: The rapid growth of the digital stock market has raised regulatory challenges. Ensuring fair and transparent trading practices while protecting investors from fraud remains a top priority for regulators.

Cybersecurity Risks: The digital nature of the US electronic stock market makes it vulnerable to cyberattacks. Protecting sensitive investor data and preventing unauthorized access is a constant concern.

Case Study: Robinhood

One of the most notable developments in the US electronic stock market is the rise of online brokerage platforms like Robinhood. By offering commission-free trading and user-friendly interfaces, Robinhood has attracted millions of new investors to the stock market. This case study highlights the power of digital platforms in democratizing investing and reshaping the financial landscape.

Conclusion

The US electronic stock market has transformed the way we invest, offering unparalleled accessibility, speed, and cost-effectiveness. While challenges remain, the potential benefits are undeniable. As the digital stock market continues to evolve, investors should stay informed and adapt to the changing landscape to maximize their chances of success.

so cool! ()

like

- Contact Us Stock Photo Free: Enhance Your Website with Professional Imagery

- Bavarian Nordic Stock: The US Perspective on a European Biotech Leader

- Is There a New Stock Market Opening in the US?

- Unilever Stock US: A Comprehensive Guide to Investment Opportunities

- US Stock Market Hits the 1 Trillion Milestone: What It Means for Investors

- Marc Faber on US Stocks: What You Need to Know

- Stock Trading Holidays in the US: What You Need to Know

- Mountain Motor Pro Stock US Nationals: A Thrilling Showdown of Off-Road Excellenc

- Title: Cannabis Companies on US Stock Market: A Comprehensive Guide

- US Stock Market Bubbles: Understanding the Risks and Implications

- Penny Stocks: An Exciting Investment Opportunity in US Companies

- Strong U.S. Stocks Fundamentals: The Pillars of Market Resilience

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- http www.mdcdiamonds.com engagementdetails.cfm"

recommend

US Electronic Stock Market: The Future of Inve

US Electronic Stock Market: The Future of Inve

Understanding IRS Capital Gains Tax on U.S. St

US Airport Stocks: A Flight Path to Profitabil

Best US Stock to Buy in 2020: Top Picks for In

How to Buy a US Stock: A Step-by-Step Guide

Title: Current US and Europe Stock Market: Ins

Market Wiped Out Almost $1 Trillion from US St

107 Stockings Brook Rd, Berlin, CT, US: A Prim

Splunk Us Stocks: A Comprehensive Guide to Tra

Highest P/E Ratio Stocks in the US: A Deep Div

International vs US Stocks: A Comparative Anal

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Are Stock Markets Open Today in the US?"

- Top US Momentum Stocks: Strong Performance in "

- Best US Stocks for DCA Long-Term Investment in"

- US Rare Earth Stock: A Lucrative Investment Op"

- Current US Stock Market Valuation Metrics: CAP"

- Contact Us Stock Photo Free: Enhance Your Webs"

- US Airline Stock Price: What You Need to Know"

- TRMR US Stock: A Comprehensive Guide to Unders"

- Title: US Mexico Tariff Stock Market: Understa"

- How to Buy US Stocks in Thailand"