you position:Home > us stock market today > us stock market today

Title: US Mexico Tariff Stock Market: Understanding the Impacts

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

Introduction: The relationship between the United States and Mexico has always been a significant factor in the global economy. The recent imposition of tariffs by the U.S. on Mexican goods has caused considerable concern in the stock market. In this article, we will delve into the implications of these tariffs on the stock market and analyze how they have affected various sectors.

Understanding the Tariffs

On June 5, 2019, the U.S. imposed tariffs on

Impact on the Stock Market

The imposition of tariffs has had a significant impact on the stock market. The uncertainty surrounding these tariffs has led to volatility in various sectors, particularly those heavily reliant on Mexican imports.

Automotive Industry: The automotive industry is one of the most affected sectors due to the high dependency on Mexican imports. Companies like Ford, General Motors, and Fiat Chrysler have seen their stocks decline. The tariffs have led to increased production costs, which could potentially lead to higher prices for consumers.

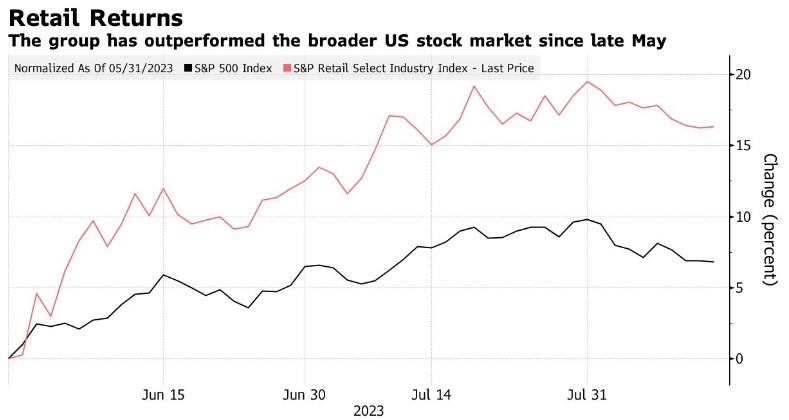

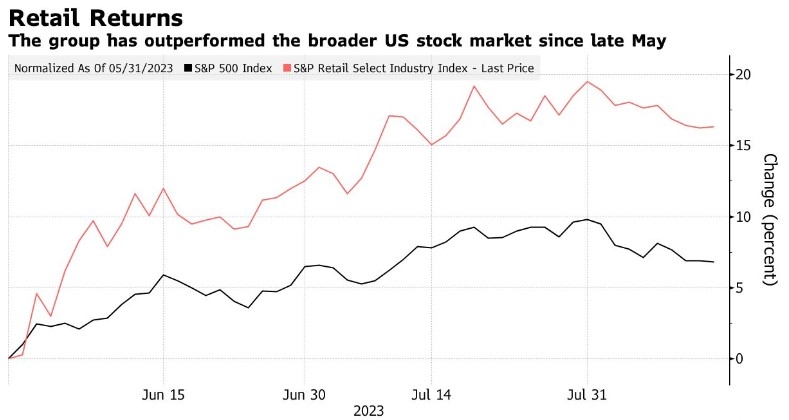

Retail Sector: The retail sector, which includes giants like Walmart and Target, has also been affected. These companies heavily rely on Mexican imports for various products. The tariffs have resulted in increased costs for these retailers, who are now passing the burden to consumers in the form of higher prices.

Technology Sector: The technology sector has also been impacted, with companies like Apple and Dell sourcing components from Mexico. The tariffs have caused a rise in the cost of these components, leading to potential price increases for consumer electronics.

Case Studies

A prime example of the impact of tariffs on the stock market is the case of Ford. The company's stock has seen a significant decline since the imposition of tariffs. Ford's CEO, Jim Hackett, has expressed concerns about the impact of tariffs on the company's profitability. The situation is similar for General Motors and Fiat Chrysler.

Another case in point is that of Walmart. The company has reported that the tariffs have increased its costs by $300 million. Walmart's CEO, Doug McMillon, has stated that the tariffs are a significant concern for the company, and they are actively working to mitigate the impact.

Conclusion:

The imposition of tariffs by the U.S. on Mexican goods has had a profound impact on the stock market. The uncertainty and increased costs associated with these tariffs have affected various sectors, leading to volatility and a decline in stock prices. As the situation continues to unfold, it remains to be seen how the stock market will respond to further developments in the U.S.-Mexico relationship.

so cool! ()

last:US Stock Market 2022 Performance: A Comprehensive Analysis

next:nothing

like

- US Stock Market 2022 Performance: A Comprehensive Analysis

- Title: Sakura Us Stock: Unveiling the Japanese Beauty in the American Market

- Most Expensive US Stocks: A Closer Look at the Market's High-End Players

- Soybean US Stock Price: Key Factors Influencing Market Trends

- US Large Cap Momentum Stocks: Best Performers in September 2025

- Top Performing US Stocks Past 5 Days: Unveiling the Momentum

- Sephora US Stock Price: A Comprehensive Analysis

- Best Cannabis Stocks to Buy for US Legalization: A Comprehensive Guide

- US Stock Flag: A Comprehensive Guide to Understanding and Navigating the U.S. Sto

- Understanding the Dynamics of a US Stock Investment Group

- NVIDIA Stock Price in the US Market on May 23, 2025: What to Expect

- How Many Trillions is the US Stock Market Worth?

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Pyrogenesis Stock US: A Deep Dive into Investm"

- Highest Dividend Yield Stocks in the US: Top P"

- Is the US Stock Market Open Today on Columbus "

- Infineon US Stock: A Comprehensive Analysis"

- Does Among Us Have Stock? A Comprehensive Guid"

- How to Buy a US Stock: A Step-by-Step Guide"

recommend

Title: US Mexico Tariff Stock Market: Understa

Title: US Mexico Tariff Stock Market: Understa

Today's US Stock Futures: A Comprehensive

Title: Stock Invest US Price: Understanding th

T-Mobile US to Give Away Stock to Customers: A

How Many Trillions is the US Stock Market Wort

Does Among Us Have Stock? A Comprehensive Guid

Title: Sakura Us Stock: Unveiling the Japanese

PDD US Stock Price: A Comprehensive Analysis

Constructing a US Stock Market Portfolio with

Title: Highest Dividend US Stocks: Your Guide

Reuters US Stock News: Stay Ahead of the Curve

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Top Stocks to Buy in July 2025: US Market Insi"

- Covid 19 US Stock: The Impact of the Pandemic "

- Best Cannabis Stocks to Buy for US Legalizatio"

- How Many Trillions is the US Stock Market Wort"

- Canadian Cannabis Traded in US Stock Market: A"

- US Rare Earth Stock: A Lucrative Investment Op"

- How to Buy MediaTek Stock in the US"

- Does Among Us Have Stock? A Comprehensive Guid"

- IBM US Stock: A Comprehensive Guide to Investi"

- Highest Dividend Yield Stocks in the US: Top P"