you position:Home > us stock market today > us stock market today

Current US Stock Market Valuation Metrics: CAPE Ratio 2025

![]() myandytime2026-01-14【us stock market today live cha】view

myandytime2026-01-14【us stock market today live cha】view

info:

The CAPE ratio, also known as the Cyclically Adjusted Price-to-Earnings ratio, is a popular tool for analyzing the valuation of the U.S. stock market. This ratio, which is used to measure whether stocks are overvalued or undervalued, is recalculated every year, providing a valuable indicator of the market's direction. In this article, we delve into the current US stock market valuation metrics for 2025 and examine how the CAPE ratio can help investors make informed decisions.

Understanding the CAPE Ratio

The CAPE ratio is calculated by dividing the price of a stock or index by the average earnings over a period of ten years. This metric is particularly useful because it takes into account the economic cycle and provides a more accurate valuation compared to traditional price-to-earnings (P/E) ratios, which are based on just one year's earnings.

The CAPE ratio was developed by Professor Robert Shiller of Yale University and has become a widely used tool among investors and economists. A CAPE ratio above 20 is often considered to indicate that the stock market is overvalued, while a CAPE ratio below 15 is generally seen as undervalued.

CAPE Ratio 2025: Key Findings

As of 2025, the CAPE ratio for the U.S. stock market stands at 24.3, indicating that the market is slightly overvalued. This figure is higher than the long-term average of 16.9 but lower than the peak of 43.2 recorded in 2000, just before the dot-com bubble burst.

What Does the CAPE Ratio Mean for Investors?

A CAPE ratio of 24.3 suggests that investors may want to proceed with caution. While the market is not in a bubble territory, it is also not particularly undervalued. Investors looking for undervalued opportunities may want to focus on specific sectors or individual stocks that are trading at a discount to their intrinsic value.

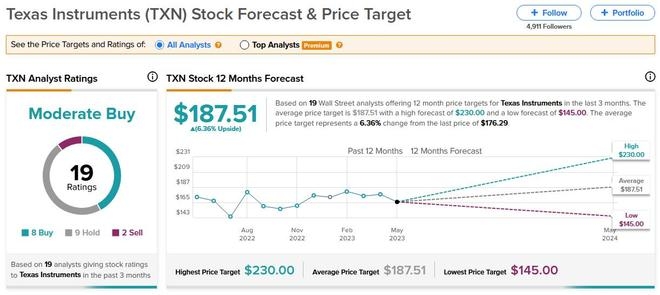

Case Study: Tech Stocks

In the technology sector, some companies are trading at a higher CAPE ratio than the overall market. For example, Amazon.com (AMZN) and Facebook (META) are currently trading at a CAPE ratio of 38.6 and 31.2, respectively. This suggests that these companies may be overvalued and that investors should exercise caution when considering these stocks.

What to Look Out for in 2025

In 2025, several factors could impact the CAPE ratio and the overall market. Here are some key factors to consider:

- Inflation: With rising inflation rates, companies may face increased costs and may need to raise prices to maintain profit margins.

- Economic Growth: Economic growth rates are a key driver of earnings and can significantly impact the CAPE ratio.

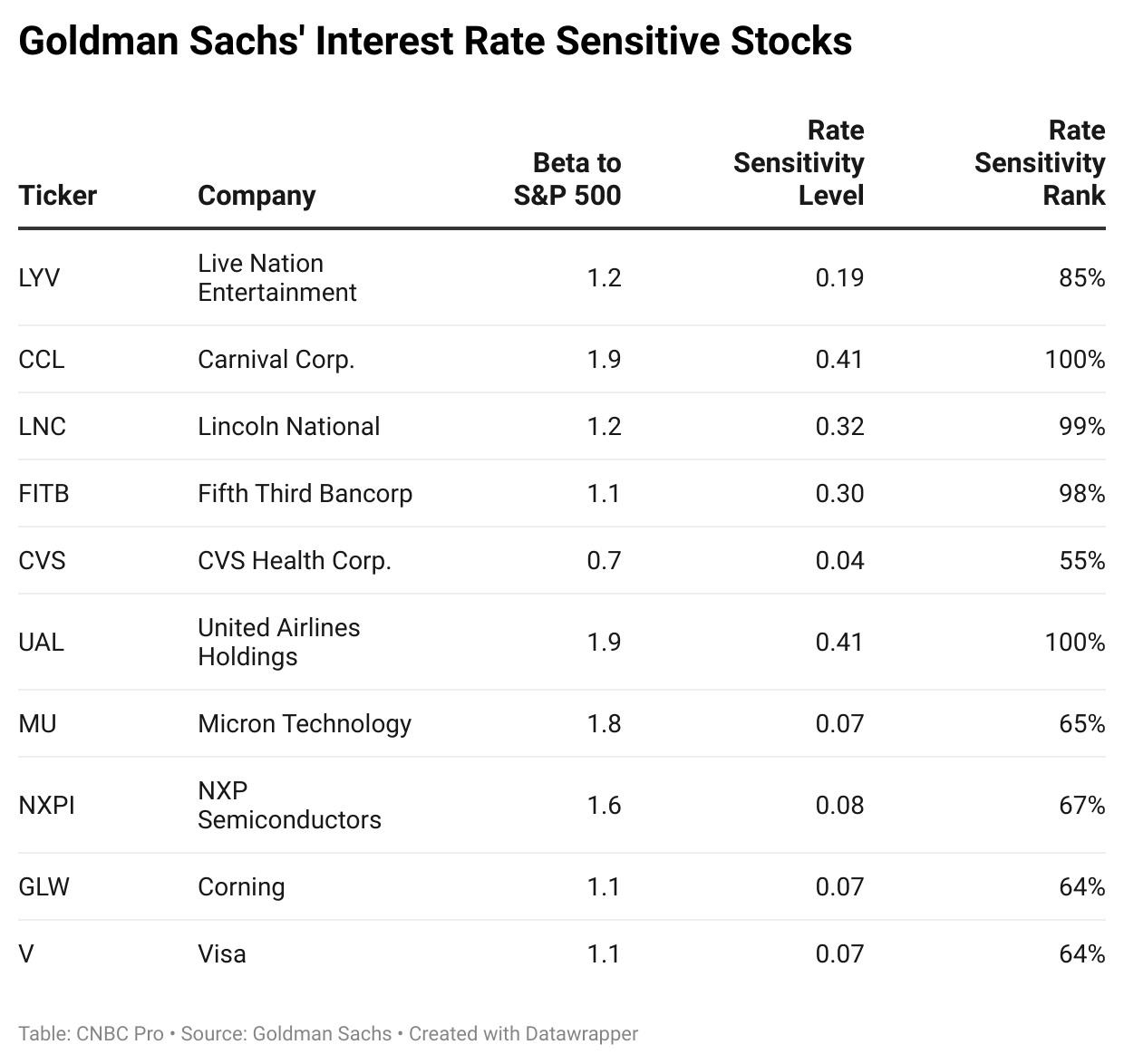

- Interest Rates: The Federal Reserve's decision on interest rates can influence investor sentiment and market valuations.

- Global Events: Geopolitical tensions and international trade disputes can also impact the U.S. stock market.

In conclusion, the CAPE ratio provides valuable insights into the current valuation of the U.S. stock market. As of 2025, the market is slightly overvalued, and investors should be cautious. However, with the right strategy and due diligence, it is still possible to find attractive investment opportunities.

so cool! ()

like

- Title: Highest Dividend US Stocks: Your Guide to Maximizing Returns

- Title: US Stock Market Performance on May 9, 2025

- PDD US Stock Price: A Comprehensive Analysis

- Jet's US Stock: Unveiling the Investment Potential in America's Emergin

- Auro Canibui US Stock Quote: Unveiling the Investment Potential

- How Much Is the Total US Stock Market Worth?

- When Does the US Stock Market Close Today? Understanding Market Hours and Closing

- 107 Stockings Brook Rd, Berlin, CT, US: A Prime Real Estate Gem in the Heart of C

- Best US Rare Earth Mining Stocks: A Comprehensive Guide

- How Much US vs. International Stocks: A Comprehensive Comparison

- Nintendo Stock Symbol: US

- Novonix Stock US: A Comprehensive Analysis

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest Dividend Yield Stocks in the US: Top P"

- Does Among Us Have Stock? A Comprehensive Guid"

- How to Buy a US Stock: A Step-by-Step Guide"

- Timings of the US Stock Market: A Comprehensiv"

- Title: ETF US Stock: A Comprehensive Guide to "

- Delek US Holdings Stock Price: A Comprehensive"

recommend

Title: Highest Dividend US Stocks: Your Guide

Title: Highest Dividend US Stocks: Your Guide

Current US Stock Market Valuation Metrics: CAP

Ericsson Stock US: A Comprehensive Guide to In

Is the US Stock Market Open Next Monday?

Highest Dividend Yield Stocks in the US: Top P

How to Buy MediaTek Stock in the US

April 15, 2018: A Pivotal Day in the US Stock

Title: ETF US Stock: A Comprehensive Guide to

Nintendo Stock Symbol: US

Nintendo US Stock Quote: A Comprehensive Guide

Does Among Us Have Stock? A Comprehensive Guid

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Major US Stock Market Indices: Understanding t"

- Is NASDAQ an US Stock Index?"

- Ericsson Stock US: A Comprehensive Guide to In"

- When Does the US Stock Market Open?"

- Can I Buy Aston Martin Stock on the US Stock E"

- Is the US Stock Market Open Next Monday?"

- When Does the US Stock Market Close Today? Und"

- Nintendo Stock: A Dive into the US Dollar Mark"

- Canadian Cannabis Traded in US Stock Market: A"

- Current US Stock Market Valuation Metrics: CAP"