you position:Home > us stock market today > us stock market today

Title: Stock Market Outlook 2025 US

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

As we approach the dawn of a new decade, investors are eager to grasp the stock market outlook for 2025 in the United States. The landscape of the stock market has evolved significantly over the past few years, and it's crucial to understand the potential trends and challenges that may shape the market in the coming years. In this article, we will delve into the key factors that could influence the US stock market outlook for 2025.

Economic Growth and Interest Rates

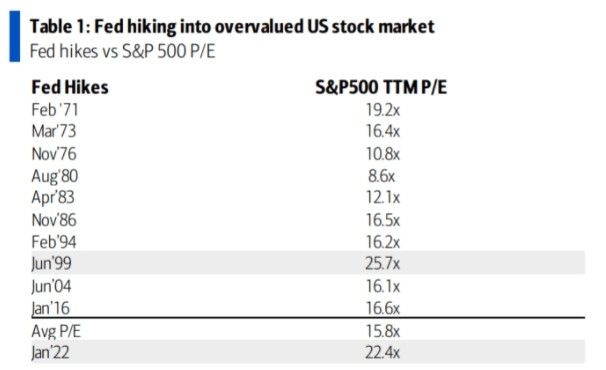

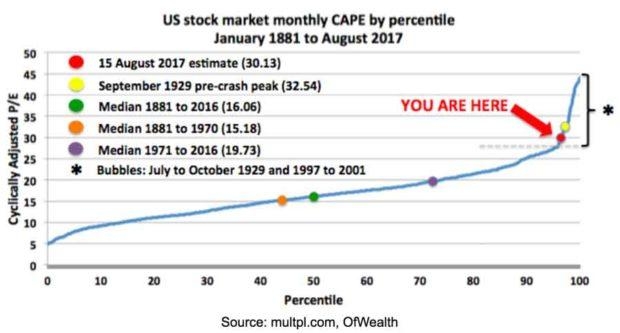

Economic growth and interest rates are two critical factors that can significantly impact the stock market. Over the past decade, the US economy has shown resilience, and it's expected to continue growing at a moderate pace in the coming years. However, the Federal Reserve's interest rate policies will play a pivotal role in determining the market's trajectory.

The Federal Reserve has been gradually increasing interest rates to combat inflation. If the central bank continues to raise rates, it could lead to higher borrowing costs for companies, potentially slowing down economic growth. Conversely, if the Fed decides to keep rates low, it may stimulate economic activity and boost stock prices.

Tech Stocks and Innovation

Technology stocks have been a driving force behind the US stock market's performance in recent years. Companies like Apple, Microsoft, and Google have seen significant growth, and it's expected that tech stocks will continue to play a crucial role in the market outlook for 2025.

Innovation will remain a key driver for tech stocks in the coming years. Advancements in artificial intelligence, machine learning, and 5G technology are expected to create new opportunities for growth. Companies that can leverage these technologies effectively will likely see their stock prices rise.

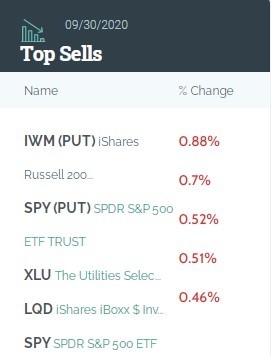

Sector Rotation and Diversification

In the past, investors have often seen a sector rotation from growth stocks to value stocks. This trend may continue in the coming years as investors seek to diversify their portfolios. Value stocks, which are often undervalued by the market, may attract investors looking for stable returns.

It's important for investors to diversify their portfolios across various sectors and asset classes to mitigate risks. A well-diversified portfolio can help protect against market downturns and maximize returns over the long term.

International Factors

The global economy has become increasingly interconnected, and international factors can significantly impact the US stock market. Geopolitical tensions, trade disputes, and economic downturns in other countries can create uncertainty and volatility in the market.

Investors should pay close attention to international events and developments, as they can have a significant impact on the US stock market outlook for 2025.

Case Studies: Tech Giants and Value Stocks

To illustrate the potential trends in the stock market outlook for 2025, let's consider two case studies: Apple and Walmart.

Apple has been a dominant force in the technology sector, with its stock prices consistently rising over the past decade. As innovation continues to drive growth in the tech industry, Apple is likely to remain a key player in the market.

On the other hand, Walmart has been a solid performer in the value stock category. With its strong fundamentals and diverse revenue streams, Walmart may continue to attract investors seeking stable returns.

In conclusion, the stock market outlook for 2025 in the United States is shaped by a variety of factors, including economic growth, interest rates, tech innovation, sector rotation, and international events. By understanding these factors and maintaining a well-diversified portfolio, investors can navigate the market's challenges and opportunities in the coming years.

so cool! ()

last:Understanding the US Military Stock Market

next:nothing

like

- Understanding the US Military Stock Market

- Superhero Us Stocks: The Unstoppable Force of Top Performing Companies

- How My US Penny in Each Stock Strategy Has Paid Off

- Title: Best Indian Stocks Listed in US

- Adani US Stocks: A Comprehensive Guide to Investing in the Adani Group

- Santa Picture Frame: The Perfect Stocking Stuffers for Toys "R"

- Top Growth Stocks to Watch in the US in 2025

- Are U.S. Stock Exchanges Open Today?

- Best US Utility Stocks to Watch in 2025

- Switch 2 Stock Tracker US: Your Ultimate Tool for Investment Success

- Is the US Stock Market Overpriced? A Comprehensive Analysis

- Title: US Government Crude Oil Stock: An In-Depth Look

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- http www.mdcdiamonds.com engagementdetails.cfm"

recommend

Title: Stock Market Outlook 2025 US

Title: Stock Market Outlook 2025 US

Top Growth Stocks to Watch in the US in 2025

High Dividend US Stocks 2017: A Guide to Top-Y

Good Stocks to Buy Now: Top Picks for Investor

http stocks.us.reuters.com stocks fulldescript

Canadian Stock: A Lucrative Investment for U.S

US Large Cap Momentum Stocks: Best Performers

Top US Mining Stocks to Watch in 2023

US Stock Futures Monday: A Comprehensive Guide

US Military Family Stock Photo: Capturing the

Understanding the US Military Stock Market

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- QCOM US Stock Price: A Comprehensive Analysis"

- Cpg Us Stock: A Comprehensive Guide to Investi"

- Good Stocks to Buy Now: Top Picks for Investor"

- US Real Estate Stock Index: A Comprehensive Gu"

- Largest US Bank Stocks: The Powerhouses Shapin"

- Title: US Alliance Stock Price: A Comprehensiv"

- The Significance of Investment in the US Stock"

- Australian Buying US Stocks: A Growing Trend i"

- Current US Stock Market Valuation Metrics: CAP"

- Organigram Stock US: A Comprehensive Guide to "