you position:Home > us stock market today > us stock market today

Is the US Stock Market Overpriced? A Comprehensive Analysis

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In recent years, the US stock market has seen unprecedented growth, raising questions about whether it is currently overvalued. This article delves into the factors contributing to the market's current state, examines historical data, and explores the potential implications for investors.

Understanding Overvaluation

To determine if the US stock market is overpriced, it's essential to understand the concept of overvaluation. Overvaluation occurs when the market price of a stock or the overall market exceeds its intrinsic value. This can happen due to a variety of factors, including excessive optimism, speculative bubbles, or a lack of fundamental analysis.

Historical Context

Looking at historical data, the US stock market has experienced periods of both overvaluation and undervaluation. For instance, the dot-com bubble of the late 1990s and the housing market crash of 2008 were both instances where the market was significantly overvalued. However, the market has since recovered and reached new highs.

Current Market Conditions

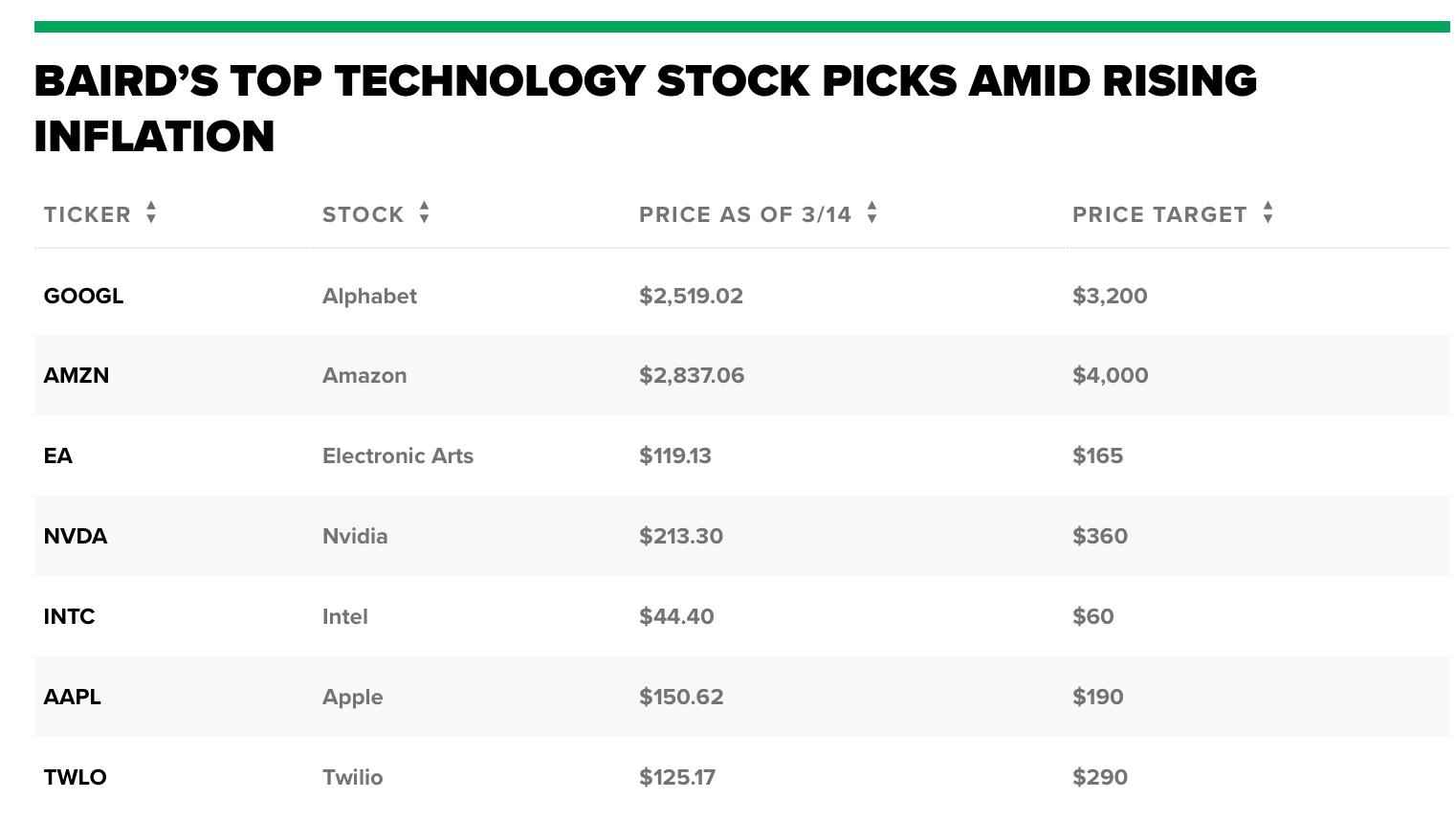

Several factors contribute to the current debate on whether the US stock market is overpriced. One of the primary concerns is the low-interest-rate environment, which has pushed investors to seek higher returns in the stock market. Additionally, the market has seen significant growth in technology and other high-flying sectors, leading to questions about whether these valuations are sustainable.

Valuation Metrics

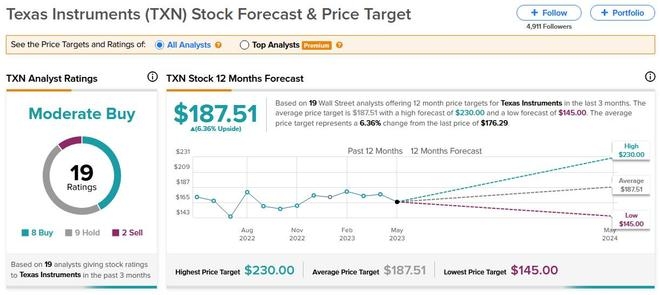

Several valuation metrics can be used to assess whether the US stock market is overpriced. The most common metrics include the price-to-earnings (P/E) ratio, the price-to-book (P/B) ratio, and the cyclically adjusted price-to-earnings (CAPE) ratio.

Price-to-Earnings (P/E) Ratio: This ratio compares the market price of a stock to its earnings per share (EPS). A P/E ratio above 20 is often considered to be overvalued, although this can vary depending on the industry and market conditions.

Price-to-Book (P/B) Ratio: This ratio compares the market price of a stock to its book value per share. A P/B ratio above 2 is often considered to be overvalued.

Cyclically Adjusted Price-to-Earnings (CAPE) Ratio: This ratio is similar to the P/E ratio but uses a 10-year average of earnings to smooth out cyclicality. A CAPE ratio above 30 is often considered to be overvalued.

As of the latest data, the S&P 500 has a P/E ratio of around 22, a P/B ratio of around 3, and a CAPE ratio of around 31. These metrics suggest that the market may be overvalued, although it's important to consider other factors as well.

Sector Analysis

Another key factor to consider is the performance of different sectors within the market. For example, the technology sector has seen significant growth in recent years, leading to concerns about whether these valuations are sustainable. While technology stocks may offer high growth potential, they also come with higher levels of risk.

Conclusion

In conclusion, while the US stock market may be overvalued based on certain valuation metrics, it's important to consider a variety of factors before making a definitive conclusion. Investors should conduct thorough research and consider their own risk tolerance and investment goals before making investment decisions.

so cool! ()

last:Title: US Government Crude Oil Stock: An In-Depth Look

next:nothing

like

- Title: US Government Crude Oil Stock: An In-Depth Look

- Title: US Oil Stock Ticker: A Comprehensive Guide to Understanding Oil Stocks

- Top Moving US Stocks Today: A Closer Look

- US Stock Market Brokers in the Philippines: A Comprehensive Guide

- Safest US Stocks for Retirees: Your Guide to Secure Investments

- TRMR US Stock: A Comprehensive Guide to Understanding and Investing

- Shipbuilding Stocks in the U.S.: A Deep Dive into the Marine Industry's Futu

- After Hours: Most Active Stocks Today in the US

- Best US Stock to Invest in Today: Top Pick for Long-Term Growth

- Title: US Steel Stock Price Future: What You Need to Know

- Title: Stock Exchange Holidays in the US in 2019: A Comprehensive Guide

- Samsung Note 5 US Cellular Stock ROM: A Comprehensive Guide

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- http www.mdcdiamonds.com engagementdetails.cfm"

recommend

Is the US Stock Market Overpriced? A Comprehen

Is the US Stock Market Overpriced? A Comprehen

Title: TD Direct Investing US Stocks: Your Ult

Title: Best Oil Stocks in the US: A Comprehens

US Stock Futures: A Comprehensive Guide to Und

Current US Stock Market Valuation Metrics: CAP

Reddit US Stock Market: The Emerging Trendsett

Stock Market Performance During U.S. Governmen

Toys R Us Stock Checker UK: The Ultimate Guide

IBM US Stock: A Comprehensive Guide to Investi

Title: Stock Exchange Holidays in the US in 20

Title: Top 25 Stock Brokers in the US Online

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- April 15, 2018: A Pivotal Day in the US Stock "

- Best US Stocks for DCA Long-Term Investment in"

- Cresco Labs US Stock: A Comprehensive Overview"

- Days the US Stock Market is Closed: Understand"

- How to Buy MediaTek Stock in the US"

- Top US Aluminum Stocks: A Comprehensive Guide "

- Title: US Mexico Tariff Stock Market: Understa"

- Title: US Foods Stock Yards Meat Buffalo NY 14"

- Manipulate the US Stock Market: Understanding "

- Top Drone Stocks in the US: A Comprehensive Gu"