you position:Home > us stock market today > us stock market today

US China Trade Stock Market: A Comprehensive Analysis

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

The US-China trade relationship has been a significant factor influencing the stock market for years. This article delves into the dynamics of this relationship and its impact on the stock market, providing a comprehensive analysis of the key factors at play.

Understanding the US-China Trade Relationship

The US and China have been the world's two largest economies for quite some time now. Their trade relationship has been complex, with both countries benefiting from the exchange of goods and services. However, tensions have been rising in recent years, primarily due to trade disputes and disagreements over intellectual property rights.

Impact on the Stock Market

The US-China trade relationship has a direct impact on the stock market. Here are some of the key ways in which this relationship affects the market:

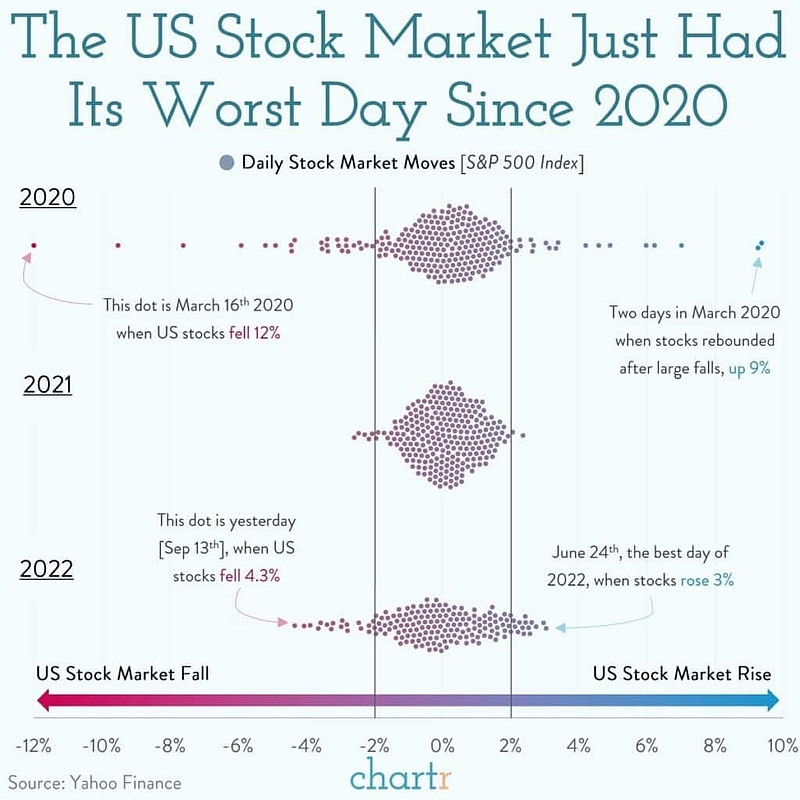

- Stock Market Volatility: Trade tensions often lead to increased market volatility. This is because investors are uncertain about the future of the trade relationship and its impact on the economy. For example, when the US imposed tariffs on Chinese goods in 2018, the stock market experienced significant volatility.

- Sector-Specific Impacts: Certain sectors are more affected by the US-China trade relationship than others. For instance, technology and consumer goods companies that rely heavily on Chinese manufacturing may see their stocks decline during trade disputes.

- Currency Fluctuations: The value of the US dollar and the Chinese yuan can be significantly affected by the trade relationship. A weaker yuan can make Chinese goods cheaper in the US, potentially benefiting companies that import from China. Conversely, a stronger yuan can have the opposite effect.

Recent Developments

In recent years, the US and China have reached several trade agreements, which have helped to ease tensions. However, the relationship remains complex, and trade disputes can flare up at any time.

One recent development that has had a significant impact on the stock market is the Phase One trade deal between the US and China. This deal included commitments from China to increase purchases of US goods and services, as well as to strengthen intellectual property protections. The stock market responded positively to this deal, with many investors viewing it as a sign of improved relations between the two countries.

Case Studies

To illustrate the impact of the US-China trade relationship on the stock market, let's look at a few case studies:

- Apple: Apple is one of the largest companies affected by the US-China trade relationship. In 2018, when the US imposed tariffs on Chinese goods, Apple's stock price fell. However, after the Phase One trade deal was announced, the stock price recovered.

- Nike: Nike relies heavily on Chinese manufacturing. When the US imposed tariffs on Chinese goods, Nike's stock price fell. However, the company was able to mitigate the impact of the tariffs by shifting some of its production to other countries.

Conclusion

The US-China trade relationship is a complex and dynamic factor that can have a significant impact on the stock market. Understanding the key factors at play can help investors make informed decisions. As the relationship continues to evolve, it will be important to stay informed about the latest developments and their potential impact on the stock market.

so cool! ()

like

- Top US Aluminum Stocks: A Comprehensive Guide to Investment Opportunities

- Canadian Stock: A Lucrative Investment for U.S. Citizens

- Shipping Company Stocks: A Comprehensive Guide to US Market

- QCOM US Stock Price: A Comprehensive Analysis

- Best US Stocks for DCA Long-Term Investment in 2025

- Tilt Stock: US Ticker to Watch

- How Much Time Left Until Our Market Starts Stock Trading?

- Gulf Stocks Markets Fall Amid US Tariffs

- Title: Unveiling the Best US Office Products Stocks

- US Cellular Phones in Stock: Your Ultimate Guide to Finding the Best Deals

- Title: David Ryan - The Stock Trading Champion in the US

- Stock Market Performance During U.S. Government Shutdowns: Historical Analysis

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

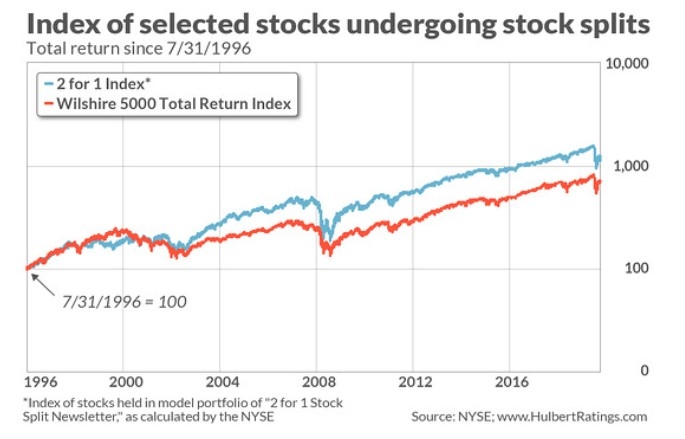

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Toys "R" Us Items Located in"

- How to Trade Nintendo Stock in the US"

recommend

US China Trade Stock Market: A Comprehensive A

US China Trade Stock Market: A Comprehensive A

T-Mobile US to Give Away Stock to Customers: A

107 Stockings Brook Rd, Berlin, CT, US: A Prim

Top Drone Stocks in the US: A Comprehensive Gu

QCOM US Stock Price: A Comprehensive Analysis

Get List of All US Stocks: A Comprehensive Gui

Title: US Stock Market Performance on May 9, 2

Cpg Us Stock: A Comprehensive Guide to Investi

Primers in Stock: Your Ultimate Guide to High-

US Quantum Stocks: The Future of Innovation an

Title: Highest Dividend US Stocks: Your Guide

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Stock Market 2022 Performance: A Comprehens"

- Canadian Stock: A Lucrative Investment for U.S"

- Understanding US Stock Market Holidays in 2025"

- Title: ETF US Stock: A Comprehensive Guide to "

- US Solar Penny Stocks: A Lucrative Investment "

- Delek US Holdings Stock Price: A Comprehensive"

- Title: US Stock Market Adhere to International"

- US Stock Futures: A Comprehensive Guide to Und"

- US Listed Pot Stocks: A Comprehensive Guide to"

- Cpg Us Stock: A Comprehensive Guide to Investi"