you position:Home > us stock market today > us stock market today

Chart Us Index: Understanding the Stock Market

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

In the fast-paced world of finance, staying ahead of the curve is crucial. One of the most significant indicators of the stock market's health is the US Index Stock Market. This comprehensive overview offers investors and traders valuable insights into market trends and potential opportunities. In this article, we will delve into the intricacies of the US Index Stock Market, highlighting its importance and providing a guide to understanding its key components.

What is the US Index Stock Market?

The US Index Stock Market refers to a collection of stock market indices that track the performance of a basket of stocks representing the broader market. The most well-known indices include the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite. These indices serve as a benchmark for investors, providing a snapshot of the overall market's health and direction.

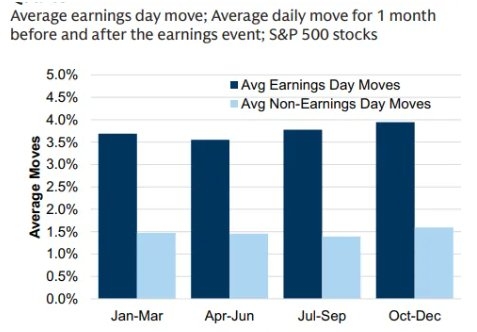

Understanding the S&P 500

The S&P 500 is a widely followed index that includes the top 500 companies listed on the New York Stock Exchange (NYSE) and NASDAQ. It represents approximately 80% of the total market capitalization of all stocks listed in the United States. The S&P 500 is often considered a bellwether for the broader market, as it covers a diverse range of industries and company sizes.

The Importance of the Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA) is another key index that tracks the performance of 30 large, publicly traded companies in the United States. These companies represent various sectors of the economy, including technology, finance, and consumer goods. The DJIA is often used as a gauge of the overall market's performance and is closely watched by investors and traders.

Exploring the NASDAQ Composite

The NASDAQ Composite is a broader index that includes all domestic and international common stocks listed on the NASDAQ Stock Market. It is particularly popular among technology companies and is often considered a bellwether for the tech sector. The NASDAQ Composite provides a comprehensive view of the technology industry's performance and is a crucial indicator for investors in this space.

How to Analyze the US Index Stock Market

To effectively analyze the US Index Stock Market, investors and traders should consider several key factors:

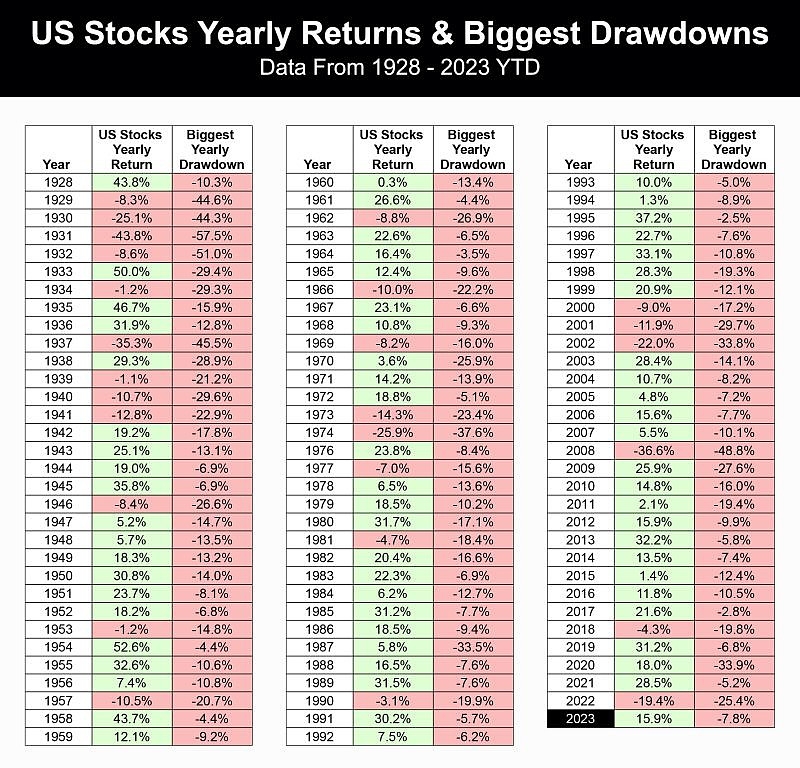

- Historical Performance: Reviewing past performance can help identify trends and patterns in the market.

- Economic Indicators: Monitoring economic indicators, such as GDP growth, unemployment rates, and inflation, can provide insights into the overall health of the economy and its impact on the stock market.

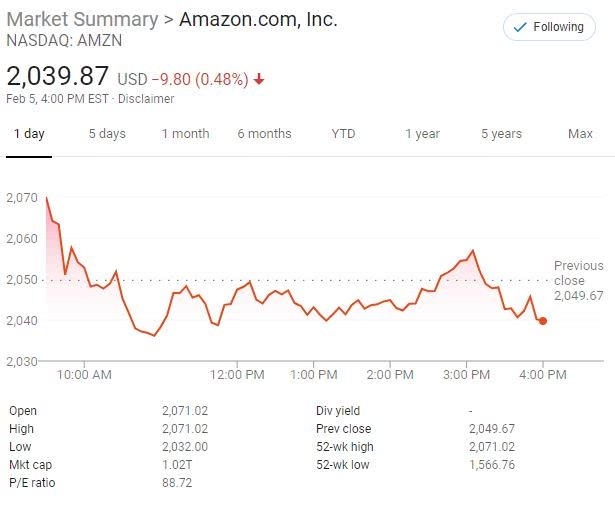

- Sector Performance: Analyzing the performance of different sectors can help identify potential opportunities and risks.

- Market Sentiment: Keeping an eye on market sentiment can help gauge investor confidence and its impact on stock prices.

Case Study: The 2020 Stock Market Crash

One notable example of the US Index Stock Market's volatility is the 2020 stock market crash, triggered by the COVID-19 pandemic. The S&P 500 and other major indices experienced significant declines, with the S&P 500 falling more than 30% in just a few weeks. However, the market quickly recovered, with the S&P 500 bouncing back to pre-crash levels within a year. This case study highlights the importance of understanding market dynamics and being prepared for unexpected events.

In conclusion, the US Index Stock Market is a crucial tool for investors and traders looking to gain insights into market trends and potential opportunities. By understanding the key components of the market and analyzing various factors, investors can make informed decisions and navigate the complexities of the stock market with confidence.

so cool! ()

last:Can I Trade US Stock in Australia? A Comprehensive Guide

next:nothing

like

- Can I Trade US Stock in Australia? A Comprehensive Guide

- Understanding the US Stock Exchange Market Structure

- US Healthcare Stocks 2018: A Comprehensive Analysis

- Title: Momentum Stocks: The US Market's Hidden Gems

- Jollibee Stock in the US: A Comprehensive Analysis

- Best US Pot Stocks for 2021: Top Picks for Investors

- Title: US Chinese Bubble Stock Market Reverse: Understanding the Shift and Its Im

- Title: US Defense Stocks 2017: A Comprehensive Review

- Title: "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&

- Title: US Multibagger Stocks 2022: A Guide to High-Growth Investments

- US Stock Exchange: A Comprehensive Analysis of January and February

- IGM US Stock Price: A Comprehensive Guide

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- http www.mdcdiamonds.com engagementdetails.cfm"

recommend

Chart Us Index: Understanding the Stock Market

Chart Us Index: Understanding the Stock Market

June 22, 2025 US Stock Market Summary

High Dividend Stocks US 2022: Top Picks for In

How Much Time Left Until Our Market Starts Sto

How Much Is the Total US Stock Market Worth?

Title: TD Direct Investing US Stocks: Your Ult

US Stock Futures for 1/25/2019: A Comprehensiv

How to Buy MediaTek Stock in the US

Title: "http stocks.us.reuters.com st

Crowdstrike US Stock: A Deep Dive into the Cyb

Title: US Marijuana Stocks Listed in Canada: A

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Jollibee Stock in the US: A Comprehensive Anal"

- Title: Foreign Corporation Ownership of US Sto"

- Days the US Stock Market is Closed: Understand"

- Best AI Stocks in the US: A Comprehensive Guid"

- How Many Trillions is the US Stock Market Wort"

- Understanding US Stock Exchange Gold Prices: T"

- Stock R Us Cebu: Your Ultimate Destination for"

- Buy Toys "R" Us Stock: A Str"

- Title: US Stock Market Bailout: A Comprehensiv"

- Shionogi Stock US: A Comprehensive Guide to In"