you position:Home > us stock market today > us stock market today

Understanding the US Stock Exchange Market Structure

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

The US stock exchange market structure is a complex and dynamic system that plays a crucial role in the global financial landscape. It encompasses various exchanges, each with its unique features and regulations. In this article, we will delve into the key aspects of the US stock exchange market structure, including its major players, trading mechanisms, and regulatory framework.

Major Stock Exchanges in the US

The United States boasts several major stock exchanges, each catering to different types of investors and companies. The most prominent ones include:

New York Stock Exchange (NYSE): Established in 1792, the NYSE is the oldest and largest stock exchange in the world. It is home to many of the world's largest and most influential companies, such as Apple, Microsoft, and General Electric.

NASDAQ Stock Market: Launched in 1971, NASDAQ is known for its technology-focused companies. It has become a popular platform for tech giants like Amazon, Google, and Facebook.

Chicago Stock Exchange (CHX): Founded in 1882, the CHX is the oldest stock exchange in the Midwest. It offers a wide range of trading services, including equities, options, and futures.

BATS Global Markets: BATS operates several exchanges worldwide, including the BATS BZX Equities Exchange and the BATS Y-Exchange. It is known for its high-speed trading capabilities.

Trading Mechanisms

The US stock exchange market structure employs various trading mechanisms to facilitate efficient and fair transactions. These include:

Order Book Trading: This is the most common trading mechanism, where buyers and sellers submit orders to buy or sell stocks. The exchange matches these orders based on price and time, ensuring a transparent and efficient trading process.

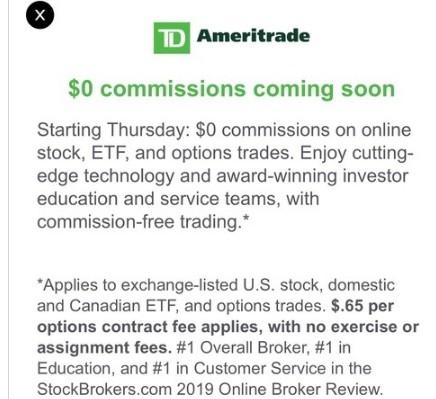

Electronic Trading: The advent of electronic trading has revolutionized the stock exchange market structure. It allows for high-speed and low-cost transactions, making it accessible to both institutional and retail investors.

Market Makers: Market makers are responsible for providing liquidity in the market by buying and selling stocks. They help maintain fair prices and ensure that there is always a buyer or seller for every stock.

Regulatory Framework

The US stock exchange market structure is governed by strict regulations to ensure fair and transparent trading. The key regulatory bodies include:

Securities and Exchange Commission (SEC): The SEC is responsible for regulating the securities industry, including stock exchanges. It enforces laws and regulations to protect investors and maintain fair and orderly markets.

Financial Industry Regulatory Authority (FINRA): FINRA is a self-regulatory organization that oversees brokerage firms and their registered representatives. It ensures compliance with securities laws and regulations.

Case Studies

To illustrate the impact of the US stock exchange market structure, let's consider a few case studies:

Facebook's IPO: In 2012, Facebook conducted the largest IPO in history on the NASDAQ. The IPO was a significant event that showcased the power and influence of the US stock exchange market structure.

Tesla's Market Cap: Tesla's market capitalization soared after its inclusion in the S&P 500 index. This event highlighted the importance of stock exchanges in shaping the perception and value of companies.

In conclusion, the US stock exchange market structure is a vital component of the global financial system. Its unique features, trading mechanisms, and regulatory framework contribute to its reputation as a fair and efficient marketplace. As the financial landscape continues to evolve, the US stock exchange market structure will undoubtedly play a crucial role in shaping the future of global finance.

so cool! ()

last:US Healthcare Stocks 2018: A Comprehensive Analysis

next:nothing

like

- US Healthcare Stocks 2018: A Comprehensive Analysis

- Title: Momentum Stocks: The US Market's Hidden Gems

- Jollibee Stock in the US: A Comprehensive Analysis

- Best US Pot Stocks for 2021: Top Picks for Investors

- Title: US Chinese Bubble Stock Market Reverse: Understanding the Shift and Its Im

- Title: US Defense Stocks 2017: A Comprehensive Review

- Title: "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&

- Title: US Multibagger Stocks 2022: A Guide to High-Growth Investments

- US Stock Exchange: A Comprehensive Analysis of January and February

- IGM US Stock Price: A Comprehensive Guide

- Stock R Us Cebu: Your Ultimate Destination for Quality Stocks in the Philippines

- Title: TD Direct Investing US Stocks: Your Ultimate Guide to Investing in the Ame

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- http www.mdcdiamonds.com engagementdetails.cfm"

recommend

Understanding the US Stock Exchange Market Str

Understanding the US Stock Exchange Market Str

Largest US Bank Stocks: The Powerhouses Shapin

Can I Buy Aston Martin Stock on the US Stock E

Title: "http stocks.us.reuters.com st

http stocks.us.reuters.com stocks fulldescript

How to Buy a US Stock: A Step-by-Step Guide

Title: "Note 8 US Stock Unlocked Firm

EV Charging US Stock: The Future of Electric V

Sephora US Stock Price: A Comprehensive Analys

Buy Toys "R" Us Stock: A Str

Title: Swiss Central Bank Sells US Stocks: Imp

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Trump's 90-Day Tariff Pause Causes Major "

- Title: "http stocks.us.reuters.com st"

- Organigram Stock US: A Comprehensive Guide to "

- Toys "R" Us Items Located in"

- Title: Top Marijuana Stocks in the US"

- Title: Momentum Stocks: The US Market's H"

- Title: Top Large Cap Growth Stocks to Watch in"

- Manipulate the US Stock Market: Understanding "

- Understanding the US Stock Market Opening Hour"

- Tilt Stock: US Ticker to Watch"