you position:Home > us energy stock > us energy stock

US Dow Jones Stock Chart Since Trump: A Comprehensive Analysis

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

Since the election of Donald Trump as the 45th President of the United States in 2016, the US stock market has experienced a rollercoaster ride. One of the most closely watched indicators of market performance is the Dow Jones Industrial Average (DJIA). In this article, we will delve into the US Dow Jones stock chart since Trump's presidency, analyzing the key trends and factors that have influenced it.

The Trump Effect on the Stock Market

Upon taking office, President Trump embarked on an ambitious agenda aimed at boosting economic growth and job creation. His policies, including tax cuts, deregulation, and infrastructure spending, were widely expected to have a positive impact on the stock market. Indeed, the Dow Jones experienced a significant surge in the early years of Trump's presidency.

From the day Trump was elected until the end of 2017, the DJIA rose by nearly 30%. This period was marked by strong corporate earnings, low unemployment rates, and a robust economic recovery. Several factors contributed to this upward trend:

Tax Cuts: The Tax Cuts and Jobs Act of 2017, which reduced corporate tax rates from 35% to 21%, provided a significant boost to the stock market. Companies used the extra cash to increase dividends, repurchase shares, and invest in new projects.

Deregulation: Trump's administration rolled back numerous regulations, which helped businesses to operate more efficiently and increase their profits.

Trade Policies: While Trump's trade policies were often controversial, they also contributed to market optimism. The administration's efforts to renegotiate trade agreements and impose tariffs on certain countries were seen as a way to protect American interests and boost domestic industries.

The Turbulence of 2020

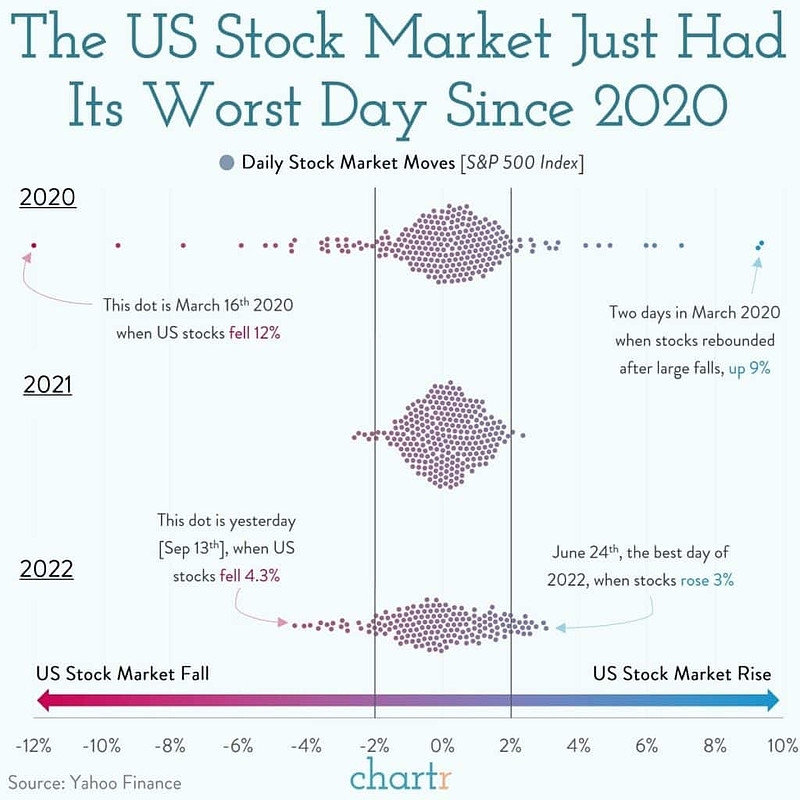

However, the stock market's upward trajectory was not without its challenges. In 2020, the COVID-19 pandemic caused a global economic downturn, leading to a sharp decline in the DJIA. The stock market recovered relatively quickly, but the recovery was not without its setbacks.

COVID-19 Pandemic: The outbreak of the pandemic led to widespread lockdowns, which caused a significant drop in economic activity. The DJIA fell by nearly 35% from its all-time high in February 2020 to its lowest point in March 2020.

Political Turmoil: The 2020 presidential election and the subsequent political unrest also contributed to market volatility. Despite these challenges, the DJIA managed to recover and even reached new all-time highs by the end of 2020.

The Current State of the Market

As of early 2021, the US Dow Jones stock chart since Trump's presidency shows a mixed picture. While the market has experienced significant growth, it has also faced numerous challenges. Here are some key trends and factors to consider:

Inflation Concerns: The recent surge in inflation has raised concerns about the future of the stock market. However, many analysts believe that inflation will be temporary and that the Federal Reserve will take appropriate measures to control it.

Economic Recovery: The US economy is gradually recovering from the COVID-19 pandemic. As the economy continues to improve, the stock market is likely to benefit.

Technology Stocks: Technology stocks have played a significant role in the DJIA's performance since Trump's presidency. As the technology sector continues to grow, it is likely to contribute to the overall market's upward trend.

In conclusion, the US Dow Jones stock chart since Trump's presidency has been marked by significant growth, but it has also faced numerous challenges. Understanding the key trends and factors that have influenced the market can help investors make informed decisions.

so cool! ()

like

- US Standard Atmosphere 1976 Stock No 003 017 00323 0: Unveiling the Secrets of th

- Title: Money Laundering in the US Stock Market: A Closer Look

- US Humanoid Robot Stocks: A Growing Investment Opportunity

- US Steel Companies Stock Prices: A Comprehensive Analysis

- HDFC Securities Invests in US Stocks: A Strategic Move for Global Expansion

- Buy Us Stock from Australia: A Smart Investment Strategy

- Title: Best ETFs for Mid Cap and Small Cap US Stocks

- Can Malaysians Buy US Stock? A Comprehensive Guide

- Is the US Stock Market Open on Christmas?

- US Stock Earnings This Week: Key Highlights and Implications

- Money Invested in the US Stock Market by Foreigners: A Growing Trend

- Top Performing US Stocks Q1 2025: A Deep Dive into the Market's Winners

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

US Dow Jones Stock Chart Since Trump: A Compre

US Dow Jones Stock Chart Since Trump: A Compre

Analyst Picks: US Stocks with Short-Term Momen

Understanding the Importance of US Stock Annou

Buy Samsung Stock in US: A Strategic Investmen

Toys "R" Us Out of Stock FAQ

Paytm Money US Stocks: A Comprehensive Guide f

The US Stock Market is Like a Drunken Party

Title: Money Laundering in the US Stock Market

Today's Momentum Stocks in the US Market

US Stock Day Trade: The Ultimate Guide to Day

1970 US Stock Market: A Decisive Year in Finan

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Indian Banks Listed in US Stock Exchange: A Co"

- Small Cap US Tech Stocks: A Lucrative Investme"

- Momentum Trading: A Strategic Approach to Capi"

- Title: Is Stocks More Powerful Than the US Dol"

- March 2020 IPOs: A List of Companies That Shap"

- Title: Total US Stock Market Capitalization: A"

- Title: How Much Money Has the US Stock Market "

- US Stock APA Yahoo: A Comprehensive Guide to S"

- Understanding Pfizer's Dividend: A Compre"

- Toys "R" Us Public Stock: A "