you position:Home > us energy stock > us energy stock

US Stock Earnings This Week: Key Highlights and Implications

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

This week has been a pivotal one for the US stock market, as a number of major companies have released their earnings reports. The reports have provided investors with valuable insights into the current state of the economy and the prospects for the future. Below, we delve into some of the key highlights and their implications for the stock market.

1. Tech Giants Lead the Charge

Amazon, Apple, and Microsoft were among the tech giants that reported earnings this week. All three companies surpassed market expectations, driven by strong revenue growth and robust demand for their products and services.

- Amazon reported earnings of

13.6 billion, with revenue of 229.4 billion, a 7% increase from the same quarter last year. - Apple's earnings came in at

17.7 billion, with revenue of 124.8 billion, marking a 10% increase. - Microsoft reported earnings of

21.5 billion, with revenue of 49.4 billion, a 15% increase.

The strong performance of these tech giants highlights the resilience of the tech sector and the increasing importance of technology in our daily lives.

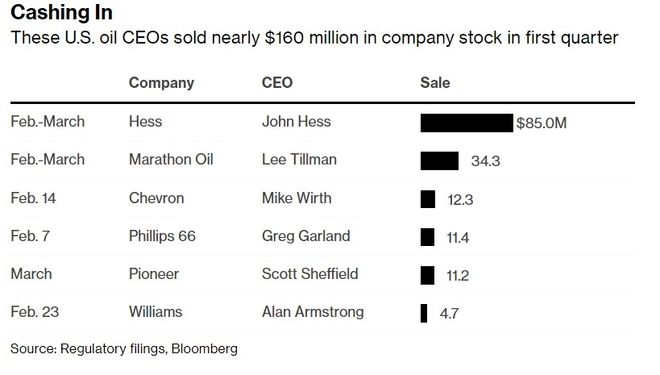

2. Energy Sector Impacts

The energy sector also made significant headlines this week, with oil and gas companies reporting strong earnings due to higher commodity prices.

- Exxon Mobil reported earnings of

2.2 billion, with revenue of 75.6 billion, a 40% increase from the same quarter last year. - Chevron reported earnings of

2.1 billion, with revenue of 55.9 billion, a 27% increase.

The surge in energy sector earnings can be attributed to the recovery in oil prices, which have been supported by global demand and supply constraints.

3. Implications for the Stock Market

The strong earnings reports from major companies have bolstered investor confidence and pushed the stock market higher. However, it's important to note that the market remains volatile and that there are still risks to consider.

- Inflation concerns: The Federal Reserve has been raising interest rates to combat inflation, which could lead to a slowdown in economic growth and a potential bear market.

- Global economic uncertainty: Geopolitical tensions and supply chain disruptions are adding to the uncertainty in the global economy.

Despite these risks, the strong earnings reports suggest that the US stock market is well-positioned to weather the current economic challenges.

4. Case Study: Tesla

Tesla, the electric vehicle (EV) manufacturer, also reported earnings this week. The company's earnings were slightly below market expectations, but its revenue growth and strong order book were still impressive.

- Tesla reported earnings of

1.9 billion, with revenue of 24.6 billion, a 49% increase from the same quarter last year. - The company's order book stands at a record $190 billion, indicating strong demand for its products.

Tesla's earnings report underscores the growing importance of the EV market and the potential for significant growth in the coming years.

In conclusion, this week's US stock earnings have provided valuable insights into the current state of the economy and the prospects for the future. While there are still risks to consider, the strong performance of major companies suggests that the US stock market is well-positioned to weather the current economic challenges. Investors should continue to monitor key economic indicators and market trends to make informed decisions.

so cool! ()

last:Money Invested in the US Stock Market by Foreigners: A Growing Trend

next:nothing

like

- Money Invested in the US Stock Market by Foreigners: A Growing Trend

- Top Performing US Stocks Q1 2025: A Deep Dive into the Market's Winners

- Toys "R" Us Items Located in Stock: Your Ultimate Guide to Find

- US Graphite Stock Price: A Comprehensive Analysis

- Ark Pharm US Stock: A Comprehensive Analysis

- Contact Us Page Corporate Stock Photos: Enhancing Professionalism and Engagement

- Understanding US Money Stock Measures: M1

- US Regulation on Chinese Stocks: What You Need to Know

- STN Stock US: A Comprehensive Guide to Understanding and Investing

- Impact of Dollar Decline on US Stocks

- Swedish Companies on the US Stock Exchange: Opportunities and Insights

- US Hoka Stock Clearance: Unbeatable Deals on Top-Notch Running Shoes

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

US Stock Earnings This Week: Key Highlights an

US Stock Earnings This Week: Key Highlights an

US Stock Market April 7, 2025 Closing Summary

Title: Toys "R" Us Highest S

How Indian Investors Can Buy US Stocks: A Comp

Edu US Stock: Exploring the Intersection of Ed

Title: Stock X Contact Us: Your Gateway to Exc

PS5 US Stock Update: The Latest on Availabilit

Medtronic US Stocks: A Comprehensive Guide to

How Many Individuals Are Invested in the US St

US Stock Market: Bear or Bull? A Comprehensive

Companies Listed on US Stock Markets: A Compre

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Clean Energy Stocks: A Wise Investment for a S"

- International ETFs: A Guide to Diversifying Yo"

- Paytm Money US Stocks: A Comprehensive Guide f"

- US Graphene Companies Stock: A Comprehensive O"

- Apple Stock Post US-China Trade War: The Impac"

- Robotics Stocks: A Lucrative Investment Opport"

- Kura Sushi US Stock Price: An In-Depth Analysi"

- Title: Convertible Bond: Understanding the Ver"

- Strong US Stocks: A Guide to Investment Opport"

- Title: Leveraged ETFs: Your Gateway to High-Yi"