you position:Home > us energy stock > us energy stock

Small Cap US Tech Stocks: A Lucrative Investment Opportunity

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In the ever-evolving world of technology, small-cap companies have emerged as a compelling investment opportunity for savvy investors. These companies, often overlooked by the mainstream market, offer a unique blend of growth potential and affordability. In this article, we will delve into the world of small cap US tech stocks, exploring their benefits, risks, and how to identify promising investments within this niche market.

Understanding Small Cap US Tech Stocks

Small cap US tech stocks refer to companies with a market capitalization of less than $2 billion. These companies are typically in the early stages of growth, with the potential to experience rapid expansion in the coming years. While they may not have the same level of market exposure as larger tech giants, they often offer higher growth prospects and a more significant upside potential.

Benefits of Investing in Small Cap US Tech Stocks

- Higher Growth Potential: Small cap tech stocks often experience exponential growth as they scale up their operations. This makes them an attractive investment for those seeking substantial capital gains.

- Affordability: Investing in small cap companies is more affordable compared to larger tech giants, making it easier for retail investors to participate in the market.

- Diversification: Including small cap tech stocks in your portfolio can help diversify your investments, reducing the overall risk of your portfolio.

- Innovation: Small cap companies are often at the forefront of innovation, bringing cutting-edge technologies to the market.

Risks of Investing in Small Cap US Tech Stocks

- Volatility: Small cap stocks are generally more volatile than their larger counterparts, experiencing significant price fluctuations in a short period.

- Liquidity: Small cap stocks may have lower liquidity, making it challenging to buy or sell shares at desired prices.

- Regulatory Risks: Small cap companies may face regulatory challenges as they grow, impacting their operations and profitability.

Identifying Promising Small Cap US Tech Stocks

- Research: Conduct thorough research on potential investments, including the company's business model, management team, financials, and competitive landscape.

- Market Trends: Stay updated on market trends and identify companies that are well-positioned to capitalize on emerging opportunities.

- Technical Analysis: Utilize technical analysis tools to identify promising entry and exit points for your investments.

Case Study: Shopify (SHOP)

One notable small cap US tech stock is Shopify (SHOP), a cloud-based e-commerce platform that enables businesses to build and manage their online stores. Since its IPO in 2015, Shopify has experienced remarkable growth, with its market capitalization soaring to over $100 billion. This success can be attributed to its innovative platform, strong management team, and ability to adapt to changing market trends.

In conclusion, small cap US tech stocks present a lucrative investment opportunity for those willing to take on higher risks in exchange for substantial growth potential. By conducting thorough research and staying informed about market trends, investors can identify promising investments within this niche market.

so cool! ()

like

- US Companies Listed on Shanghai Stock Exchange: Opportunities and Challenges

- The Stock and Flow of US Firearms: Understanding the Dynamics of Gun Ownership

- Understanding the iShares Total U.S. Stock Market Index NAV

- FLST US Stock Exchange: A Comprehensive Guide to Understanding and Investing

- AMC Stock Invest US: Understanding the Potential of AMC Theatres Stock

- Russian Companies Listed on US Stock Exchange: A Comprehensive Guide

- Penny Stocks to Invest In: A Guide for Aspiring Investors

- Bud Stock Price US: The Current Status and Future Prospects

- Are Bump Stocks Illegal in the US?

- Air US Stock: Exploring the World of American Airline Stocks

- 1970 US Stock Market: A Decisive Year in Financial History

- US Stock Market 2025 Chart: A Glimpse into the Future

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Small Cap US Tech Stocks: A Lucrative Investme

Small Cap US Tech Stocks: A Lucrative Investme

Title: US Digital Currency Stock: The Future o

Best US Stocks Under $10: A Smart Investment S

All Stock Symbols for US and Canada: A Compreh

Best US Stock Market App: Your Ultimate Invest

Should I Sell US Steel Stock?

FLST US Stock Exchange: A Comprehensive Guide

Micron US Stock: A Comprehensive Guide to Inve

Nintendo Switch Back in Stock in US: The Ultim

Good US Stocks to Buy Now for Long-Term Invest

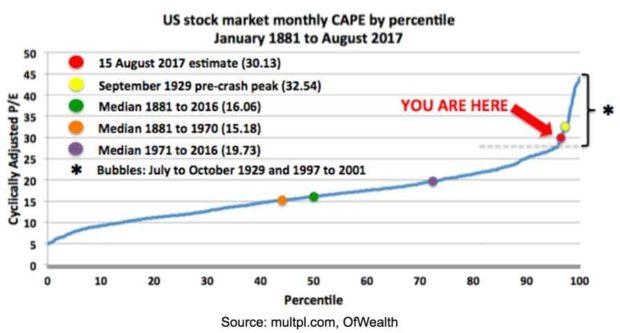

Title: Current CAPE Ratio in the US Stock Mark

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- http stocks.us.reuters.com stocks fulldescript"

- Green Energy Stocks in the US: A Lucrative Inv"

- Should I Sell My Stocks?"

- Kraken US Stocks: A Comprehensive Guide to Tra"

- ADRs: Unlocking the Potential of U.S. Stocks f"

- Pharmaceutical Stocks: A Lucrative Investment "

- Art Company US Stock Market: A Thriving Sector"

- Title: "Technology Stocks: A Guide to"

- Oil Stocks: A Strategic Investment for Energy-"

- US Stocks to Buy Now: Top Picks for Investors "