you position:Home > us energy stock > us energy stock

US Steel Companies Stock Prices: A Comprehensive Analysis

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

In the dynamic world of the stock market, the performance of steel companies is a topic of great interest. One of the most prominent players in this industry is U.S. Steel, whose stock prices have been a subject of analysis and speculation. This article aims to provide a comprehensive overview of U.S. Steel companies' stock prices, their factors, and future outlook.

Understanding U.S. Steel Companies' Stock Prices

U.S. Steel, a leading steel producer in the United States, has seen its stock prices fluctuate over the years. The primary factors influencing these prices include the company's financial performance, industry trends, and broader economic conditions.

Financial Performance

The financial performance of U.S. Steel is a key driver of its stock prices. This includes factors such as revenue, profit margins, and debt levels. A strong financial performance can lead to higher stock prices, while a weak performance can result in a decline.

Industry Trends

The steel industry is subject to various trends that can impact U.S. Steel's stock prices. These trends include changes in demand for steel, technological advancements, and regulatory changes. For instance, an increase in infrastructure spending can lead to higher demand for steel, thereby boosting U.S. Steel's stock prices.

Economic Conditions

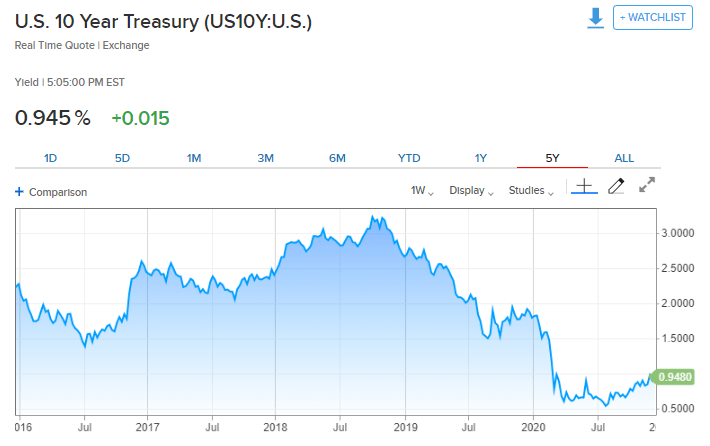

Economic conditions, both domestic and global, play a significant role in determining U.S. Steel's stock prices. Factors such as inflation, interest rates, and currency fluctuations can all impact the company's performance and, consequently, its stock prices.

Case Study: U.S. Steel's Stock Price Performance in 2020

One notable example of U.S. Steel's stock price performance is in 2020. The year began with strong stock prices, driven by a recovering economy and increased demand for steel. However, the COVID-19 pandemic disrupted global supply chains and caused a significant decline in demand for steel. As a result, U.S. Steel's stock prices fell sharply.

However, as the pandemic situation improved and demand for steel began to recover, U.S. Steel's stock prices started to rise again. This demonstrates how economic conditions and industry trends can significantly impact stock prices.

Future Outlook for U.S. Steel Companies' Stock Prices

Looking ahead, the future of U.S. Steel companies' stock prices appears to be promising. Several factors contribute to this optimism, including:

- Increased Infrastructure Spending: The U.S. government's focus on infrastructure spending is expected to boost demand for steel, benefiting U.S. Steel.

- Technological Advancements: U.S. Steel is investing in advanced technologies to improve efficiency and reduce costs, which can enhance its financial performance.

- Global Economic Recovery: The global economy is expected to recover from the pandemic, leading to increased demand for steel.

However, it is important to note that stock prices are subject to volatility and can be influenced by unforeseen events. Investors should keep a close eye on economic conditions, industry trends, and U.S. Steel's financial performance to make informed decisions.

In conclusion, U.S. Steel companies' stock prices are influenced by a variety of factors, including financial performance, industry trends, and economic conditions. While the future outlook appears promising, investors should remain vigilant and stay informed about the latest developments in the steel industry.

so cool! ()

like

- HDFC Securities Invests in US Stocks: A Strategic Move for Global Expansion

- Buy Us Stock from Australia: A Smart Investment Strategy

- Title: Best ETFs for Mid Cap and Small Cap US Stocks

- Can Malaysians Buy US Stock? A Comprehensive Guide

- Is the US Stock Market Open on Christmas?

- US Stock Earnings This Week: Key Highlights and Implications

- Money Invested in the US Stock Market by Foreigners: A Growing Trend

- Top Performing US Stocks Q1 2025: A Deep Dive into the Market's Winners

- Toys "R" Us Items Located in Stock: Your Ultimate Guide to Find

- US Graphite Stock Price: A Comprehensive Analysis

- Ark Pharm US Stock: A Comprehensive Analysis

- Contact Us Page Corporate Stock Photos: Enhancing Professionalism and Engagement

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

US Steel Companies Stock Prices: A Comprehensi

US Steel Companies Stock Prices: A Comprehensi

How to Buy US Stocks in Jamaica

US Stock Day Trade: The Ultimate Guide to Day

Title: Free Stock Photos: Road Map of the US

The Stock and Flow of US Firearms: Understandi

Title: Stock Market US Election 2016: How the

Kura Sushi US Stock Price: An In-Depth Analysi

Multibagger Stocks: How US Paid Services Can H

Latitude 64 Opto Air Bolt in Stock at US Retai

Buy Samsung Stock in US: A Strategic Investmen

What Are the Stock Exchanges in the US?

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Warren Buffett Stocks: The Secret to Investmen"

- US News Articles on Stock Valuation: Unveiling"

- Atvi Stock US: A Comprehensive Guide to Unders"

- Military Stocks: A Smart Investment for Savvy "

- Motley Fool Us Stocks: Unveiling the Investmen"

- US Fabric Stock: Your Ultimate Guide to the Be"

- CATL Stock Buy in US: A Smart Investment for t"

- Best Growth Stocks: How to Identify and Invest"

- Desalination Companies in Israel and Their Pre"

- Alternative Investments to US Stocks in 2024: "