you position:Home > new york stock exchange > new york stock exchange

Us Foods Holdings Stock: A Comprehensive Analysis

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

In the highly competitive food industry, Us Foods Holdings Inc. has emerged as a leading player, capturing the attention of investors and industry analysts alike. This article delves into the stock performance of Us Foods Holdings, providing an in-depth analysis of its market trends, financial health, and future prospects.

Understanding Us Foods Holdings Stock

Us Foods Holdings Inc. (NYSE: USFD) is a Fortune 100 company that specializes in distributing food and related products to more than 300,000 customers, including restaurants, healthcare and educational facilities, and government entities. The company operates through two segments: Direct Store Delivery (DSD) and Retail Ready. The DSD segment delivers food and non-food products to customers, while the Retail Ready segment provides foodservice products to convenience stores and other retail locations.

Market Trends and Performance

Over the past few years, Us Foods Holdings has demonstrated strong market trends and performance. The company's revenue has consistently grown, driven by increased demand for its products and services. According to a recent report, Us Foods Holdings' revenue for the fiscal year 2021 was approximately $54.6 billion, marking a significant increase from the previous year.

Financial Health

When it comes to financial health, Us Foods Holdings has a robust balance sheet and strong profitability. The company has maintained a low debt-to-equity ratio, indicating its ability to manage financial obligations effectively. Moreover, Us Foods Holdings has generated substantial earnings over the years, with net income for the fiscal year 2021 reaching $1.2 billion.

Key Factors Influencing Us Foods Holdings Stock

Several factors have influenced the stock performance of Us Foods Holdings. One of the most significant factors is the company's strategic focus on expanding its market presence and diversifying its product offerings. For instance, Us Foods Holdings has made strategic acquisitions and partnerships to enhance its product portfolio and distribution capabilities.

Another crucial factor is the company's commitment to sustainability and social responsibility. Us Foods Holdings has implemented various initiatives to reduce its environmental footprint and support local communities. These efforts have not only improved the company's reputation but also attracted environmentally conscious investors.

Case Studies

To illustrate the impact of Us Foods Holdings' strategic initiatives, let's consider two case studies:

Acquisition of GPA: In 2019, Us Foods Holdings acquired GPA, a leading foodservice distributor in the Eastern United States. This acquisition has significantly expanded the company's market reach and strengthened its position in the industry. As a result, Us Foods Holdings' revenue has increased by approximately 20% since the acquisition.

Sustainability Initiatives: Us Foods Holdings has implemented various sustainability initiatives, such as reducing food waste and improving energy efficiency. For instance, the company has partnered with food rescue organizations to donate excess food to those in need. These efforts have not only helped the company reduce its environmental impact but also improved its brand image, attracting more customers and investors.

Conclusion

In conclusion, Us Foods Holdings Inc. has demonstrated impressive stock performance, driven by its strategic focus, financial health, and commitment to sustainability. As the food industry continues to evolve, Us Foods Holdings is well-positioned to capitalize on emerging opportunities and maintain its leadership position. Investors looking for a stable and profitable investment should consider Us Foods Holdings as a promising option.

so cool! ()

last:Stock Broker Salary in the US: A Comprehensive Breakdown"

next:nothing

like

- Stock Broker Salary in the US: A Comprehensive Breakdown"

- How Much Did the US Stock Market Lose Today? A Detailed Analysis"

- US Retirement Funds Heavy on Stocks Brace for Losses

- Best US Aluminum Stocks: Top Picks for Investors in 2023

- Strong Fundamentals: Why US Stocks Are a Solid Investment

- Small Stock Investment for Non-US Citizens: A Guide to Global Opportunities

- Best Dividend Stocks in the US Market: Top Picks for 2023

- In-Depth Analysis: AEPi.O Stock Performance and Future Outlook

- US Stock Collapse 2015: A Deep Dive into the Market's Turmoil

- Unlocking the Potential of Knorr Co Stock: A Deep Dive into the US Stock Market

- Understanding the Daily Volume of the US Stock Market

- Best US Penny Stocks to Buy in 2017: Top Picks for Investors

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

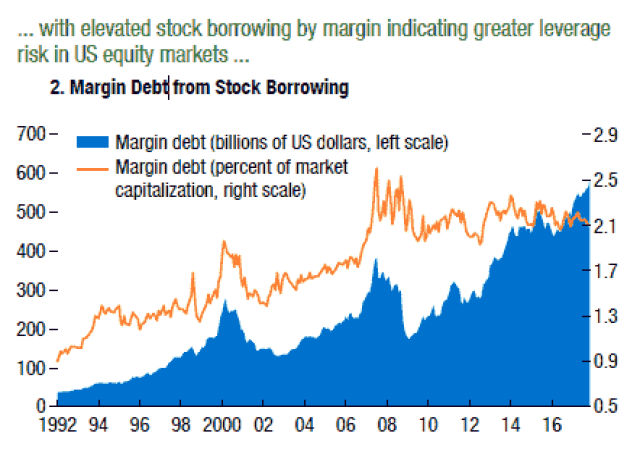

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Us Foods Holdings Stock: A Comprehensive Analy

Us Foods Holdings Stock: A Comprehensive Analy

Marine Harvest US Stock: An In-Depth Analysis

Unlocking the Secrets of US Liquor Stock: A Co

Man United: A New Chapter on the US Stock Exch

The Number of Companies Listed on US Stock Exc

US Air Force Spouse Stock Photos: Capturing th

US Stock Market Astrology Predictions for 2022

Buy Shiba Stock in the US: A Guide to Investin

Number of Listed Stocks in the US 2017: A Deep

Title: Size of the US Stock Market in 2018: A

Top US Mid Cap Stocks: A Guide to Investment O

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Stem Cell Clinic Stock: A Game-Changer in R"

- Investing in ETF US Value Stocks: A Strategic "

- LG Chem Stock in US Dollars: A Comprehensive G"

- Title: Size of the US Stock Market in 2018: A "

- Title: In-Depth Analysis of Snap Inc. (SNAP) S"

- US Large Cap Stocks: Highest Gains Past Week M"

- Rare Earth US Stocks to Buy: A Guide to Invest"

- Title: Stock Market Percentage in the US: A Co"

- US Magnesium LLC Stock Price: A Comprehensive "

- IPOs March 2020: A Deep Dive into the US Stock"