you position:Home > new york stock exchange > new york stock exchange

Trade US Stocks from Indonesia: A Comprehensive Guide

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

Introduction

Investing in US stocks from Indonesia can be a lucrative venture for investors looking to diversify their portfolios. With the rise of online trading platforms, it has become easier than ever to invest in the American stock market from anywhere in the world. This guide will provide you with all the necessary information to start trading US stocks from Indonesia, including the benefits, risks, and the steps involved.

Benefits of Trading US Stocks from Indonesia

- Diversification: Investing in US stocks allows you to diversify your portfolio, reducing your exposure to the Indonesian stock market's volatility.

- High-Quality Stocks: The US stock market is home to some of the world's largest and most successful companies, offering investors a wide range of investment opportunities.

- Access to Information: The US stock market is highly regulated, providing investors with access to a wealth of information that can help them make informed decisions.

- Potential for High Returns: Historically, the US stock market has provided higher returns than many other markets, making it an attractive option for investors.

Risks of Trading US Stocks from Indonesia

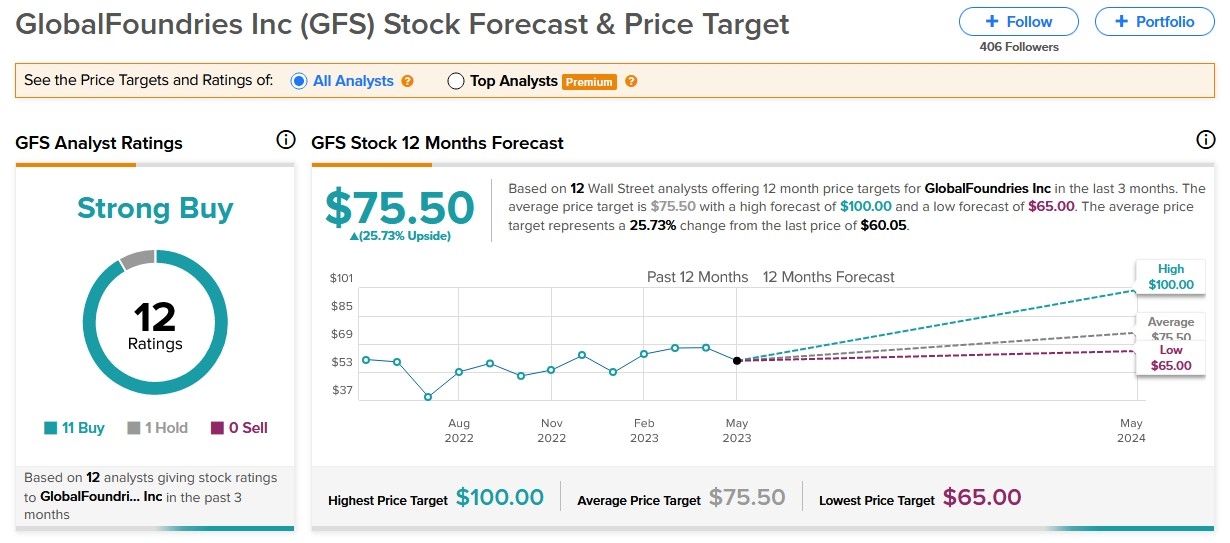

- Currency Fluctuations: The value of your investments can be affected by currency fluctuations between the Indonesian Rupiah and the US Dollar.

- Regulatory Differences: There are differences in regulations between the Indonesian and US stock markets, which can pose challenges for investors.

- Tax Implications: Tax laws in Indonesia and the US can differ, which may affect your investment returns.

Steps to Trade US Stocks from Indonesia

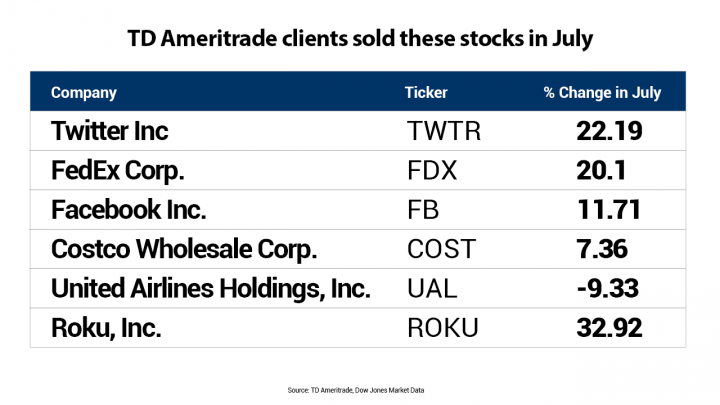

Choose a Broker: Research and select a reputable online broker that offers US stock trading services. Some popular options include TD Ameritrade, E*TRADE, and Fidelity.

Open an Account: Once you have chosen a broker, open an account and fund it with your preferred currency. Be sure to read the terms and conditions carefully before proceeding.

Understand the Platform: Familiarize yourself with the broker's trading platform, including the tools and resources available to help you make informed decisions.

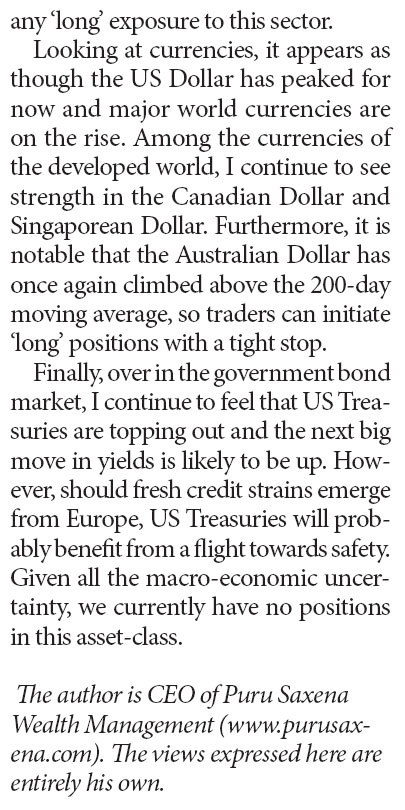

Research Stocks: Conduct thorough research on the stocks you are interested in, including their financial health, market trends, and potential risks.

Place Your Trades: Once you have identified a stock you want to invest in, place your trade through the broker's platform. Be sure to set stop-loss and take-profit orders to manage your risk.

Monitor Your Investments: Regularly review your investments to ensure they align with your investment strategy and make adjustments as needed.

Case Study: Investing in Apple Inc. (AAPL)

Let's say you want to invest in Apple Inc. (AAPL), one of the world's most valuable companies. After conducting thorough research, you determine that AAPL is a solid investment and decide to purchase 100 shares at $150 per share.

After a few months, the stock price increases to

Conclusion

Trading US stocks from Indonesia can be a rewarding experience for investors looking to diversify their portfolios and access high-quality investment opportunities. By following the steps outlined in this guide and conducting thorough research, you can start trading US stocks from Indonesia with confidence.

so cool! ()

like

- Us Stock Broker Philippines: Your Gateway to Global Investment Opportunities&

- Progreen US Stock: A Sustainable Investment Opportunity

- US Stock Market Astrology Predictions for 2022: Fact or Fiction?

- Unlocking the Growth Potential of Mid Cap US Stocks

- Total Market Capitalization of US Stock Market 2025: A Comprehensive Analysis

- Unveiling the US Hotel Stock: Trends, Insights, and Opportunities

- Title: In-Depth Analysis of Snap Inc. (SNAP) Stock: Full Description and Investme

- HSBC US Stock Trading: A Comprehensive Guide to Investing with HSBC

- Most Active US Stocks Today: Top Performers in the Market

- US Steel Stock Price Today: Live Updates and Analysis

- Navigating the Current Economic Environment in the US Stock Market

- Is the US Stock Market Open Now on April 6, 2025? Here’s What You Need to Know

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Trade US Stocks from Indonesia: A Comprehensiv

Trade US Stocks from Indonesia: A Comprehensiv

Major US Airlines Stock: A Comprehensive Analy

Number of Listed Stocks in the US 2017: A Deep

US Stock Market All-Time Graph: A Comprehensiv

Daily US Stock Market News Updates: September

Buying US Stocks in Malaysia: A Comprehensive

DJ US Software Total Stock Market Index: A Com

Is the US Stock Market Closing Early Today? Ev

Top Momentum Stocks: September 2025 US Large C

Newest Meme Stocks US September 2025: A Compre

Artificial Intelligence: A Game-Changer for US

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Online Stock Broker US: Your Ultimate Guide to"

- Toys R Us Stock Checker: Your Ultimate Guide t"

- Can I Buy Celltrion Stock in the US? A Compreh"

- Understanding the US Building Stock: A Compreh"

- Convert Us Air Stock Certificates: A Comprehen"

- GDC Stock US: Unveiling the Potential of a Ris"

- Top US Penny Stocks to Buy Now: Your Guide to "

- How Will the US Election Affect the Stock Mark"

- All Stock Exchanges in the US: A Comprehensive"

- Is the US Stock Market Open on January 2, 2023"