you position:Home > new york stock exchange > new york stock exchange

US Foods Stock Dividend: Everything You Need to Know

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the ever-evolving world of investments, understanding the dividend policies of companies is crucial for investors looking to maximize their returns. One such company that has caught the attention of many investors is US Foods. This article delves into the US Foods stock dividend, providing you with all the essential information you need to make informed decisions.

Understanding Dividends

A dividend is a portion of a company's earnings distributed to its shareholders. It is typically paid out in the form of cash or additional shares of stock. Dividends can be a significant source of income for investors, especially those looking for stable, long-term investments.

US Foods Stock Dividend Overview

US Foods, a leading foodservice distributor in North America, has a history of paying dividends to its shareholders. As of the latest available data, the company has a dividend yield of approximately 1.2%. This yield is calculated by dividing the annual dividend per share by the stock's current price.

Dividend Payment History

US Foods has a strong track record of paying dividends to its shareholders. The company has increased its dividend payments for several consecutive years, which is a positive sign for investors. Here's a brief overview of the company's dividend payment history:

- 2020: $0.90 per share

- 2019: $0.84 per share

- 2018: $0.76 per share

- 2017: $0.70 per share

Dividend Payout Ratio

The dividend payout ratio is an important metric to consider when analyzing a company's dividend policy. It represents the percentage of a company's earnings that are paid out as dividends. For US Foods, the payout ratio is approximately 50%. This indicates that the company is able to sustain its dividend payments while retaining enough earnings for reinvestment and growth.

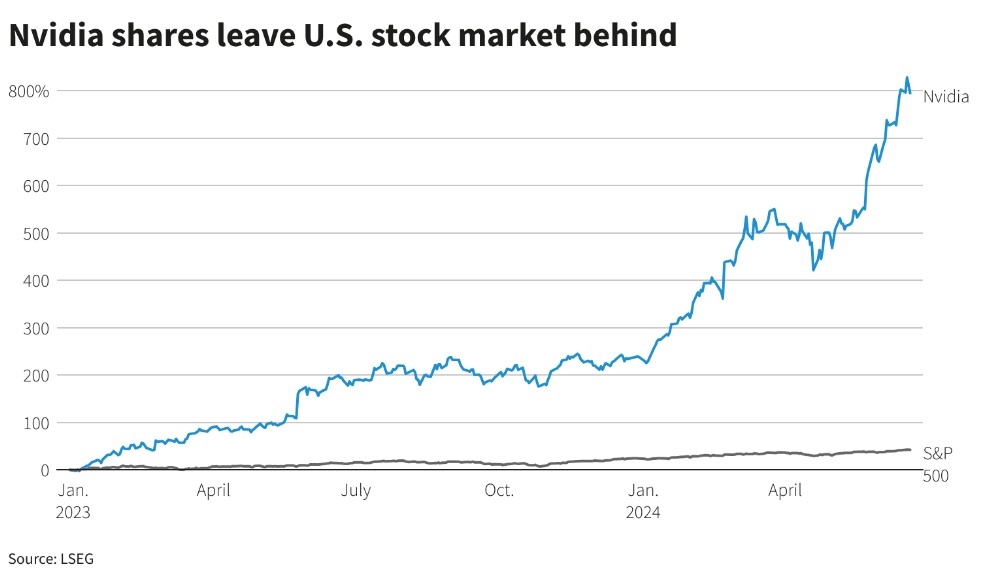

Dividend Yield vs. Market Averages

Comparing US Foods' dividend yield to the broader market can provide additional context. As of the latest data, the S&P 500 index has a dividend yield of around 1.8%. While US Foods' dividend yield is slightly lower than the market average, the company's strong track record and potential for future growth make it an attractive investment for dividend investors.

Dividend Reinvestment Plan

US Foods offers a dividend reinvestment plan (DRIP) to its shareholders. This plan allows investors to reinvest their dividends in additional shares of the company, potentially increasing their ownership stake over time. The DRIP is a great way for investors to compound their returns and benefit from the power of compounding interest.

Conclusion

Investing in US Foods stock can be a wise decision for dividend investors looking for a stable, long-term investment. The company's strong dividend payment history, attractive dividend yield, and potential for future growth make it an appealing option. However, as with any investment, it's important to conduct thorough research and consider your own financial goals and risk tolerance before making a decision.

so cool! ()

like

- February 2020 US Stock Market IPO Companies List: A Comprehensive Overview

- Stocks and Shares ISA: A Comprehensive Guide for U.S. Citizens

- Us Large Cap Stocks Current Stock Prices August 2025: A Comprehensive Overview&am

- In-Depth Analysis of UPS Stock: Everything You Need to Know"

- Check the US Bank Stock Price: A Comprehensive Guide

- Name the 3 Major Stock Exchanges in the US: A Comprehensive Guide

- Live Us Stock Market TV: Your Ultimate Guide to Financial News and Analysis

- Understanding the US Stock Indexes: A Comprehensive Guide

- Fidelity US LG Cap Grth Stock Fund: A Comprehensive Analysis of the Symbol

- Average US Stock Market Growth: Key Insights and Trends

- In-Depth Analysis: ARNC.K Stock Performance on Reuters

- Unlocking the Potential of Tech Stocks: A Comprehensive Guide to Investing in Tec

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

US Foods Stock Dividend: Everything You Need t

US Foods Stock Dividend: Everything You Need t

How Will the US Election Affect the Stock Mark

Title: US Cushing Stocks: The Cornerstone of E

Emak S.p.A. US Stock Symbol: What You Need to

Title: Size of US Stock Market Capitalization:

The Intricate Link Between US Elections and St

Prefilled Xmas Stockings US: The Ultimate Guid

Bayer Stock in US: A Comprehensive Guide to In

NVIDIA and FedEx Warnings Send Us Stocks Plumm

Uranium Stocks in the US: A Comprehensive Guid

US Large Cap Stocks Value Screening Tools: Unv

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games us stock silver etf

like

- February 2020 US Stock Market IPO Companies Li"

- Title: 20 Shares of US Bank Stock: A Comprehen"

- Understanding DBS US Stock Trading Fees: What "

- Dyson Stock Price US: A Comprehensive Analysis"

- Can I Buy Celltrion Stock in the US? A Compreh"

- US 1 Industries Stock Quote: A Comprehensive G"

- How Is the Stock Market Doing Today in US?"

- Title: Mednax US Stocks: A Comprehensive Guide"

- US Airlines Stocks: A Comprehensive Guide to I"

- How to Sell Canadian Stock in the US: A Step-b"