you position:Home > new york stock exchange > new york stock exchange

Understanding the US Stock Indexes: A Comprehensive Guide

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

In the ever-evolving world of finance, stock indexes play a crucial role in providing investors with a snapshot of the overall market's performance. In the United States, several key stock indexes are widely followed by investors, analysts, and traders. This article aims to provide a comprehensive guide to understanding the most important stock indexes in the US.

Dow Jones Industrial Average (DJIA)

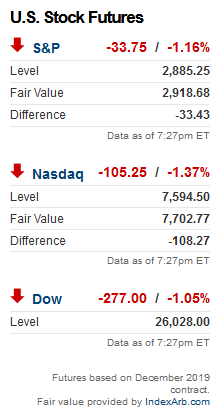

The Dow Jones Industrial Average (DJIA) is one of the most well-known and oldest stock indexes in the world. It tracks the performance of 30 large, publicly-traded companies across various sectors, including technology, finance, and healthcare. The DJIA is often used as a benchmark for the overall health of the US stock market.

S&P 500

The S&P 500 is another widely followed stock index, representing the performance of 500 large companies listed on stock exchanges in the US. This index is considered a broader representation of the US stock market compared to the DJIA, as it includes companies from a variety of sectors. The S&P 500 is often used as a benchmark for the performance of the US stock market as a whole.

NASDAQ Composite

The NASDAQ Composite is a stock market index that includes all domestic and international common stocks listed on the NASDAQ stock exchange. This index is particularly known for its representation of technology companies, making it a popular choice for investors interested in the tech sector.

Russell 3000

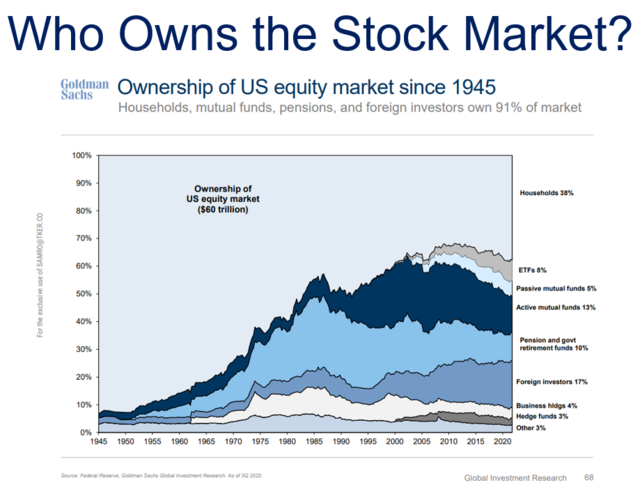

The Russell 3000 is a broader index that includes the 3000 largest US companies, representing approximately 98% of the investable US equity market. This index is often used as a benchmark for large-cap companies and is considered a comprehensive representation of the US stock market.

What to Look for in Stock Indexes

When analyzing stock indexes, investors should consider several factors, including:

- Sector Representation: Look for indexes that include companies across various sectors to gain a comprehensive view of the market.

- Market Capitalization: Consider the market capitalization of the companies included in the index, as this can provide insight into the overall size and stability of the index.

- Dividends: Look for indexes that include companies with strong dividend policies, as dividends can provide additional income for investors.

Case Study: The Impact of the 2020 Stock Market Crash

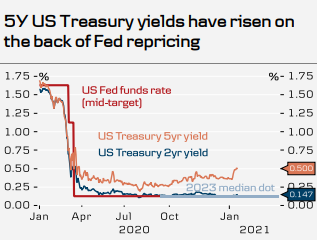

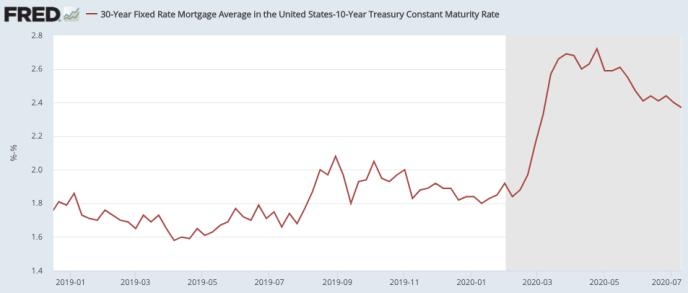

One notable case study is the 2020 stock market crash, which was caused by the global COVID-19 pandemic. During this period, the DJIA, S&P 500, and NASDAQ Composite all experienced significant declines. However, the market quickly recovered, with the S&P 500 reaching new all-time highs by the end of 2020. This case study highlights the volatility of the stock market and the importance of diversifying investments across various indexes.

In conclusion, understanding the key stock indexes in the US is essential for investors looking to gain insight into the overall market's performance. By considering factors such as sector representation, market capitalization, and dividends, investors can make informed decisions about their investments.

so cool! ()

like

- Fidelity US LG Cap Grth Stock Fund: A Comprehensive Analysis of the Symbol

- Average US Stock Market Growth: Key Insights and Trends

- In-Depth Analysis: ARNC.K Stock Performance on Reuters

- Unlocking the Potential of Tech Stocks: A Comprehensive Guide to Investing in Tec

- Empirical Market Impact Coefficients: A Deep Dive into US Stocks

- Dow Jones Industrial Average: The pulse of the US Stock Market"

- How to Trade in US Stocks from India: A Comprehensive Guide

- Stock Price for US Bank: A Comprehensive Guide to Understanding and Analyzing Tre

- List of REITs Stocks in the US: Your Ultimate Guide to Real Estate Investment

- Babies R Us Overnight Stocker Pay: Comprehensive Insights and Tips

- Online Stock Broker for Non-US Citizens: Your Ultimate Guide

- Unlocking the Potential of US Futures Stocks: A Comprehensive Guide

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Understanding the US Stock Indexes: A Comprehe

Understanding the US Stock Indexes: A Comprehe

Understanding the Moving Average in the US Sto

Unlocking the Potential of Hemlock US Stock: A

http stocks.us.reuters.com stocks fulldescript

TFSA US Stocks Reddit: Your Ultimate Guide to

Title: List of Fintech Stocks US: Top Investme

How to Invest in the US Stock Market from Indi

How Foreigners Buy U.S. Stocks: A Comprehensiv

US Lumber Companies Stock: A Comprehensive Ana

US Army Christmas Stocking: A Symbol of Holida

Unlocking the Potential of Tech Stocks: A Comp

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games us stock silver etf

like

- Do Foreigners Pay Capital Gains Tax on US Stoc"

- Does Toys "R" Us Online Upda"

- Indian Stock Market vs US Stock Market: A Comp"

- Hive US Stock Price: An In-Depth Analysis"

- US Momentum Stocks: Top Performers Past 5 Days"

- Title: US Role on Japanese Stock Market Crash "

- Understanding RRSP US Stock Withholding Tax"

- TFSA US Stocks Reddit: Your Ultimate Guide to "

- Barclays Buys US Stocks: A Strategic Move for "

- Is Stock Market Open Tomorrow in US?"