you position:Home > new york stock exchange > new york stock exchange

Motilal Oswal US Stocks Charges: A Comprehensive Guide

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

Investing in US stocks can be a lucrative venture, but it's crucial to understand the associated charges. One of the most renowned financial services firms, Motilal Oswal, offers a range of services for investors looking to invest in the US stock market. In this article, we will delve into the charges levied by Motilal Oswal for investing in US stocks, providing you with a comprehensive guide.

Understanding Motilal Oswal's US Stock Charges

Motilal Oswal offers various services for US stock investments, including research, execution, and account management. Here's a breakdown of the charges you can expect:

1. Research and Advisory Fees

Motilal Oswal charges a flat fee for its research and advisory services. This fee is typically a percentage of the total investment amount. The exact percentage may vary depending on the service package you choose.

2. Execution Fees

When you place a trade with Motilal Oswal, you will incur execution fees. These fees are usually a percentage of the trade value and can vary depending on the type of trade (market, limit, or stop-loss).

3. Account Management Fees

For investors who opt for account management services, Motilal Oswal charges a monthly fee. This fee covers the cost of portfolio management, rebalancing, and regular updates on market trends.

4. Account Opening and Maintenance Fees

Opening an account with Motilal Oswal requires an initial fee, which covers the cost of setting up the account. Additionally, there may be an annual maintenance fee to keep the account active.

5. Other Fees

In addition to the above charges, you may also incur other fees, such as wire transfer fees, currency conversion fees, and regulatory fees. It's important to review the fee schedule provided by Motilal Oswal to understand all potential charges.

Case Study: John's Investment Journey

John, a first-time investor, decided to invest in US stocks through Motilal Oswal. He chose a research and advisory package that cost him 1% of his total investment amount. Over the course of a year, John invested a total of $100,000 in US stocks.

Here's a breakdown of the charges he incurred:

- Research and Advisory Fees:

1,000 (1% of 100,000) - Execution Fees: $100 (assuming a 0.1% fee on each trade)

- Account Management Fees:

50 per month (assuming a 600 annual fee) - Account Opening and Maintenance Fees: $100 (one-time fee)

In addition to these charges, John also incurred wire transfer fees and currency conversion fees amounting to $200.

Conclusion

Investing in US stocks through Motilal Oswal comes with various charges. Understanding these charges is crucial for making informed investment decisions. By carefully reviewing the fee schedule and considering the potential costs, investors like John can make the most of their investment journey.

so cool! ()

last:Us Citizens Are Stock Snopes: The Truth Behind the Trend

next:nothing

like

- Us Citizens Are Stock Snopes: The Truth Behind the Trend

- Title: US Steel Stock Drop in 1929: The Significance and Aftermath

- Current US Stock Market Trends: A Comprehensive Overview

- Uranium Stocks in the US: A Comprehensive Guide to Investing in the Nuclear Energ

- US Silica Stock Premarket: What You Need to Know

- 2025 US Stock Market Themes: What to Expect and How to Prepare

- Us Stock Market Account Opening: A Comprehensive Guide for Beginners

- Buzz Us Stocks on the Move: Unveiling the Most Exciting Investment Opportunities

- Title: Site CDN.US Fish Stock: Optimizing Your Online Experience

- Title: US China Trade Tensions Stocks: Understanding the Impact on the Market

- Stocks That Trend with Copper Prices: A Guide for US Investors

- US Growth Stocks: Are They Really Cheaper Than You Think?

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Motilal Oswal US Stocks Charges: A Comprehensi

Motilal Oswal US Stocks Charges: A Comprehensi

Marine Harvest US Stock: An In-Depth Analysis

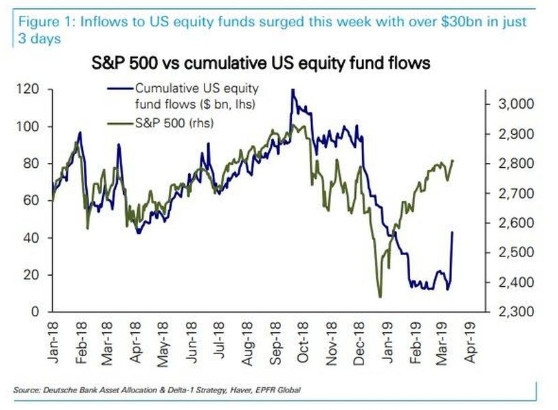

BOFA Hartnett US Stock Flows: A Deep Dive into

Joint Stock Company Definition: A Deep Dive in

Top US Stocks for 2021: Your Ultimate Guide to

Title: List of US Technology Stocks: Your Ulti

Latest US Stock Market News August 2025: A Com

Understanding the Taxation of Stock Options in

Hive US Stock Price: An In-Depth Analysis

Ignite Us Stock: Unleashing the Power of Growt

How to Invest in the Stock Market in the US fo

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Title: US Stock Aftermarket: A Comprehensive G"

- US Large Cap Stocks Momentum Analysis 2024"

- Title: Top Performing US Stocks Last 5 Trading"

- Meli Us Stock Price: A Comprehensive Analysis"

- The First Stock Market in the US: A Pivotal Mi"

- New Millennium Steel Dynamics: A Deep Dive int"

- Momentum Stocks: Top Performers in the US Larg"

- About Us Stock Image: Capturing the Essence of"

- Title: Unlocking Growth: The Power of US Bank "

- Stock Definition: A Deep Dive into US History "