you position:Home > new york stock exchange > new york stock exchange

US Growth Stocks: Are They Really Cheaper Than You Think?

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

In the ever-evolving landscape of the stock market, growth stocks have always been a favorite among investors. These companies, known for their rapid revenue and earnings growth, have the potential to offer significant returns. However, the question on everyone's mind is: Are US growth stocks currently cheap, or are they just overvalued?

Understanding Growth Stocks

First, let's clarify what we mean by "growth stocks." These are companies that have a proven track record of high revenue and earnings growth, often exceeding the industry average. They typically reinvest their earnings back into the business to fuel further growth, rather than distribute them to shareholders as dividends.

Are Growth Stocks Cheaper Now?

In recent years, growth stocks have seen a surge in popularity, with many investors flocking to these high-flying companies. However, this has also led to a rise in their valuations. Are we now at a point where these growth stocks are actually cheaper than they were before?

Market Trends and Valuations

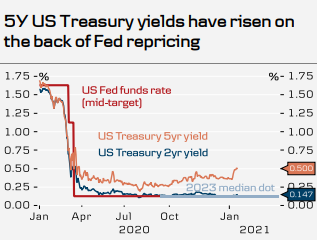

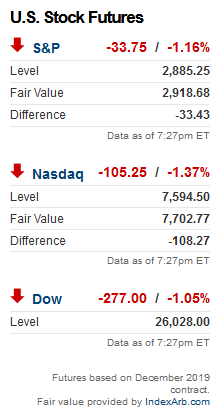

To determine whether growth stocks are currently cheap, we need to look at the broader market trends and valuations. As of early 2023, the S&P 500 Growth index has seen a decline in its price-to-earnings (P/E) ratio, which suggests that some growth stocks may indeed be more attractive from a valuation standpoint.

Key Factors to Consider

Economic Conditions: Economic conditions play a crucial role in the performance of growth stocks. During periods of economic growth, these companies tend to outperform. Conversely, during economic downturns, they may struggle.

Sector Performance: Different sectors within the growth stock universe have varying levels of risk and return potential. It's essential to analyze the performance of individual sectors to identify the most promising opportunities.

Valuation Metrics: Beyond the P/E ratio, other valuation metrics such as price-to-book (P/B) and enterprise value-to-EBITDA (EV/EBITDA) can provide additional insights into the attractiveness of growth stocks.

Case Studies

To illustrate the potential of growth stocks, let's look at a couple of recent case studies:

Tesla, Inc. (TSLA): As one of the most well-known growth stocks, Tesla has seen significant growth in both revenue and earnings. Despite its high valuation, the company's long-term potential remains a strong draw for investors.

Amazon.com, Inc. (AMZN): Amazon has been a dominant force in the e-commerce industry, with its revenue and earnings growing at a remarkable pace. While its valuation has been a topic of debate, the company's long-term growth prospects have made it an attractive investment for many.

Conclusion

In conclusion, while it's difficult to say definitively whether US growth stocks are currently cheap, there are signs that some of these companies may be more attractively valued. By considering market trends, sector performance, and valuation metrics, investors can make more informed decisions when selecting growth stocks for their portfolios. As always, it's essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

so cool! ()

last:US Penny Stocks List: Current Opportunities for Investors

next:nothing

like

- US Penny Stocks List: Current Opportunities for Investors

- Understanding US Stock Futures Trading Hours: What You Need to Know

- US Steel Stock MarketWatch: Navigating the Volatile Landscape

- Title: US Booze Stocks: A Comprehensive Guide to Investing in the Alcohol Industr

- Man United: A New Chapter on the US Stock Exchange

- Toys R Us Stock and Robinhood: A Dynamic Duo in Retail and Investment

- Illumina US Biotech Stocks: A Lucrative Investment Opportunity

- Is It US Stock Market Holiday Today? A Comprehensive Guide

- Holidays and the US Stock Market: What You Need to Know

- Stock Market Open in US: What You Need to Know

- Top US Stocks for 2024: A Comprehensive Guide

- Oil Companies US Stock: A Comprehensive Guide to Investing in Energy Giants

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

US Growth Stocks: Are They Really Cheaper Than

US Growth Stocks: Are They Really Cheaper Than

Stocks by Volume Traded in US Market Beat

Top 100 Cheapest Stocks in the US Market: A Co

Australia-US Stock Market: A Comprehensive Gui

Bump Stock Ban: A Federal Decision That Shaped

SBD Capital Corp US Stock Symbol: A Comprehens

Title: US Share of Global Stock Market Capital

http stocks.us.reuters.com stocks fulldescript

Ant Group Stock US: A Deep Dive into the Finan

Understanding RRSP US Stock Withholding Tax

What Time Does the US Stock Market Open?

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- ACB US Stock Listing: Everything You Need to K"

- RAAS US Stock: A Comprehensive Guide to Unders"

- Bny Mellon US Stock Index III Fund: A Comprehe"

- Foreign Companies on the US Stock Exchange: Op"

- Rare Earth US Stocks to Buy: A Guide to Invest"

- US Stock Calendar: Your Ultimate Guide to Mark"

- Evolution Gaming Stock US: A Deep Dive into th"

- US Electronic Stock Market Crossword"

- Us Laughing Stock: The Misunderstood Side of A"

- Top 100 Cheapest Stocks in the US Market: A Co"