you position:Home > new york stock exchange > new york stock exchange

Morgan Stanley Says US Stock Rally Has Limited Upside

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

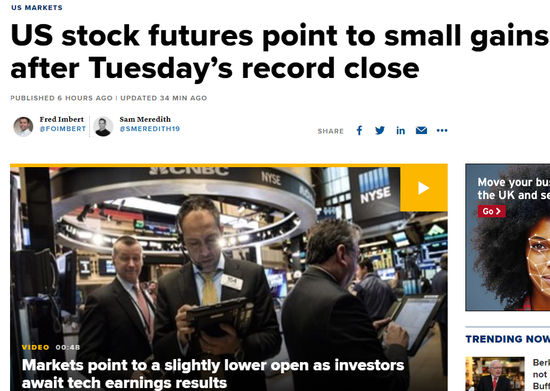

The U.S. stock market has seen a remarkable rally over the past few years, driven by low interest rates, strong corporate earnings, and a generally optimistic outlook. However, according to a recent report by Morgan Stanley, this rally may have reached its peak, and investors should be cautious about expecting further significant gains.

Market Dynamics and Trends

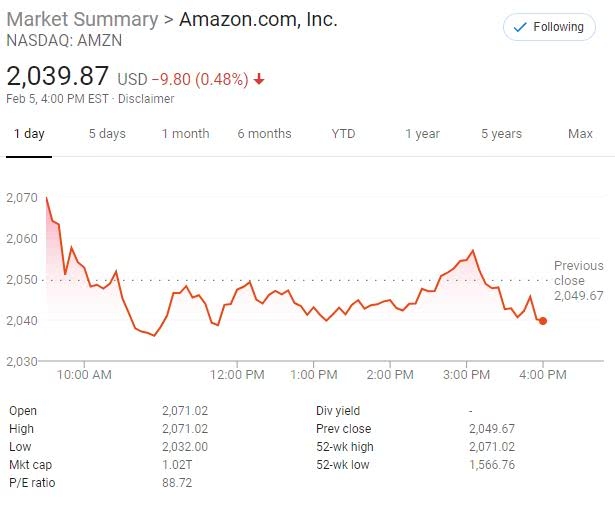

Morgan Stanley's analysis indicates that while the U.S. stock market has been on a strong upward trajectory, there are several factors that suggest this rally may have limited upside. Firstly, the Federal Reserve's interest rate hikes have begun to slow economic growth, which could negatively impact corporate earnings. Secondly, valuations have reached historically high levels, making the market vulnerable to any negative news or economic downturn.

Interest Rates and Economic Growth

The Federal Reserve's recent series of interest rate hikes has been a major factor in the current market dynamics. While low interest rates have been a boon to the stock market, the recent increases suggest that the Fed is concerned about inflation and is looking to cool down the economy. This shift in monetary policy could lead to a slowdown in economic growth and, subsequently, in corporate earnings.

Valuations and Market Vulnerability

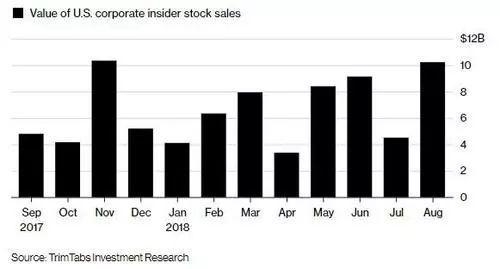

One of the most significant concerns highlighted by Morgan Stanley is the high valuations in the U.S. stock market. The Shiller P/E ratio, which compares the market's price to its average inflation-adjusted earnings over the past 10 years, currently sits at a level that has historically been associated with market corrections. This suggests that the market may be overvalued and could be vulnerable to a pullback.

Case Studies and Historical Context

To further illustrate this point, let's look at a few historical examples. In the late 1990s, the technology bubble saw stock valuations soar to unprecedented levels before bursting, leading to a significant market correction. Similarly, the dot-com bubble in the early 2000s saw a similar trend, with the market eventually correcting itself.

Investor Implications

For investors, these concerns suggest that it may be prudent to exercise caution and not to become overly optimistic about the market's future performance. This doesn't mean that the market will necessarily decline, but it does suggest that the potential for significant upside gains may be limited. Investors may want to consider diversifying their portfolios to mitigate risk and to focus on stocks with strong fundamentals and defensive characteristics.

Conclusion

In conclusion, while the U.S. stock market has experienced a strong rally in recent years, Morgan Stanley's analysis suggests that this rally may have limited upside. With interest rate hikes and high valuations presenting potential risks, investors should be cautious and consider diversifying their portfolios to protect against market volatility.

so cool! ()

last:How to Invest in Argentina Stocks from the US: A Comprehensive Guide

next:nothing

like

- How to Invest in Argentina Stocks from the US: A Comprehensive Guide

- Ferguson US Stock Price: Latest Trends and Analysis

- How to Buy US Stock in a TFSA: A Comprehensive Guide

- Ablus Stock: Unveiling the Potential of This Emerging Investment

- Is Us Foods a Good Stock to Buy?

- Best US Cannabis Stocks to Watch in 2024: A Comprehensive Guide

- Understanding Us Stock Exchanges: A Deep Dive into Bar Charts

- Nes Classic Toys R Us Stock: The Ultimate Guide to Finding the Best Deals

- Top Mining Stocks in the US: Your Guide to Investment Opportunities

- How to Sell Canadian Stock in the US: A Step-by-Step Guide

- International Students Can Invest in Stocks in the US: A Guide to Getting Started

- Hyundai US Stock: A Comprehensive Guide to Investing in the Korean Giant

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Morgan Stanley Says US Stock Rally Has Limited

Morgan Stanley Says US Stock Rally Has Limited

Title: Total US Stock Market Capitalization Au

Navigating the Current Economic Environment in

Title: Impact of US Government Shutdown on Ind

US MSO Cannabis Stocks: The Future of Legal Ca

Cryptocurrency on US Stock Exchange: The Emerg

http stocks.us.reuters.com stocks fulldescript

Earnings Calendar Next Week: US Stocks to Watc

US Stock Futures Stabilized Ahead of PCE Infla

Best Chinese Stocks Listed in the US: Your Gui

Reddit Galaxy S9 Plus Stock Firmware US Sprint

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- 1995-2000: The Bubble in Over-the-Counter Stoc"

- US Stock Collapse 2015: A Deep Dive into the M"

- US Steel Stock: Why Robinhood Investors Should"

- How to Buy Raspberry Pi Stock in the US"

- $1.11 Trillion Wiped Out from US Stock Market "

- Unveiling the US Hotel Stock: Trends, Insights"

- US Market Stock List: Comprehensive Guide to T"

- Advantages of Investing in the US Stock Market"

- Best Platform to Buy US Stocks in India: Your "

- Is Selling Gifted Stock Income Taxed in the US"