you position:Home > new york stock exchange > new york stock exchange

Understanding Us Stock Exchanges: A Deep Dive into Bar Charts

![]() myandytime2026-01-21【us stock market today live cha】view

myandytime2026-01-21【us stock market today live cha】view

info:

Investing in the stock market can be a daunting task, especially for beginners. One of the key tools that investors use to analyze market trends and make informed decisions is the bar chart. In this article, we will explore the importance of bar charts in understanding US stock exchanges and how they can help you make better investment choices.

What Are Bar Charts?

Bar charts, also known as OHLC (open, high, low, close) charts, are graphical representations of stock price movements over a specified period. Each bar on the chart represents the price of a stock for a particular day. The vertical line of the bar represents the range of prices throughout the day, while the horizontal lines at the top and bottom of the bar indicate the opening and closing prices, respectively.

Why Are Bar Charts Important in US Stock Exchanges?

Visual Representation: Bar charts provide a visual representation of stock price movements, making it easier for investors to identify trends and patterns.

Identifying Trends: By analyzing the bar charts, investors can identify upward or downward trends in the stock market. This helps them make informed decisions about buying or selling stocks.

Support and Resistance Levels: Bar charts help investors identify key support and resistance levels, which are crucial in determining the strength of a stock's price movement.

Volume Analysis: The volume indicator on a bar chart shows the number of shares traded during a specific period. This information can help investors gauge the popularity of a stock and its potential for price movement.

Key Components of Bar Charts

Open (O): The opening price of the stock at the start of the trading day.

High (H): The highest price the stock reached during the trading day.

Low (L): The lowest price the stock fell to during the trading day.

Close (C): The closing price of the stock at the end of the trading day.

Types of Bar Charts

Candlestick Charts: These charts use red and green bars to represent upward and downward movements in stock prices, respectively. The length of the bars indicates the price range, while the color indicates the trend.

Line Charts: These charts use a single line to connect the closing prices of stocks over a specific period. They are simple to read but do not provide as much information as candlestick charts.

Bar Charts: These charts are similar to candlestick charts but use open, high, low, and close values to represent stock price movements.

Case Studies

Let's take a look at a couple of case studies to understand how bar charts can be used to analyze stock movements.

Apple Inc. (AAPL): In the past year, Apple's stock price has shown a consistent upward trend, as indicated by the candlestick chart. Investors who analyzed the bar chart and identified this trend would have made a profitable investment in the company.

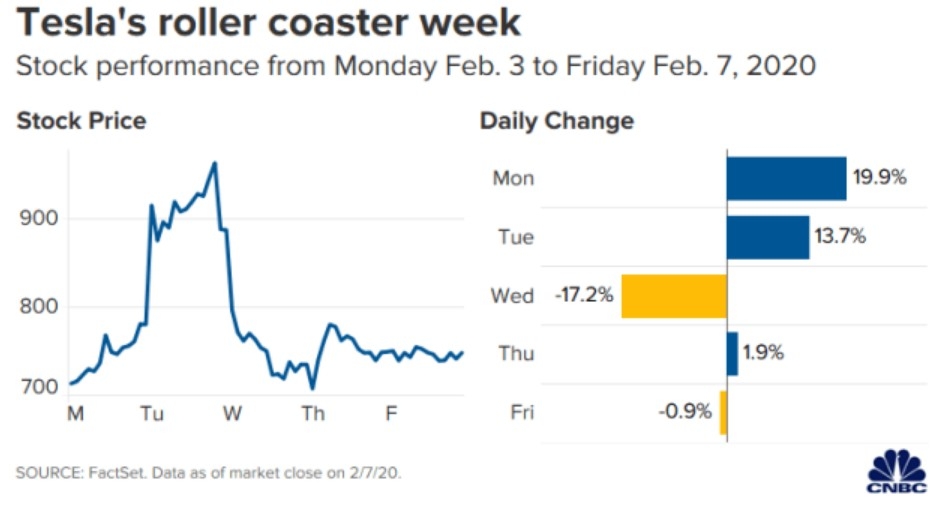

Tesla Inc. (TSLA): Tesla's stock price has experienced significant volatility in the past few years. By analyzing the bar chart, investors could have identified the key support and resistance levels and made informed decisions about buying or selling the stock.

Conclusion

Bar charts are a valuable tool for investors looking to analyze stock price movements and make informed decisions in the US stock market. By understanding the key components and types of bar charts, investors can gain a better understanding of market trends and identify profitable investment opportunities.

so cool! ()

like

- Nes Classic Toys R Us Stock: The Ultimate Guide to Finding the Best Deals

- Top Mining Stocks in the US: Your Guide to Investment Opportunities

- How to Sell Canadian Stock in the US: A Step-by-Step Guide

- International Students Can Invest in Stocks in the US: A Guide to Getting Started

- Hyundai US Stock: A Comprehensive Guide to Investing in the Korean Giant

- In-Depth Analysis of Oxy Stock: What You Need to Know"

- Top US Online Stock Brokers: Your Ultimate Guide to Investment Success

- Understanding US Capital Stock Quarterly Data: A Comprehensive Guide

- List of US-Based Stock Markets: Comprehensive Guide

- Latest US Stock Market News: October 5, 2025 - Key Developments and Analysis

- The Intricate Link Between US Elections and Stock Market Fluctuations"

- Allianz US Stock: A Comprehensive Guide to Investing in One of the World’s Larg

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Understanding Us Stock Exchanges: A Deep Dive

Understanding Us Stock Exchanges: A Deep Dive

Title: "President Trump's Tariff

US Robo ETF Stock Price: A Comprehensive Guide

July 6, 2025: A Pivotal Day in the US Stock Ma

Bilibili US Stock: A Comprehensive Analysis

Buzz Us Stocks on the Move: Unveiling the Most

Title: List of Fintech Stocks US: Top Investme

Us Laughing Stock: The Misunderstood Side of A

TLS US Stock: A Comprehensive Guide to Underst

US Steel Stock Price Today: Live Updates and A

Best Performing US Large Cap Stocks August 202

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games silver etf us stock

like

- Best Cannabis Stock: How to Invest in the Grow"

- Title: Best US Stocks App: Your Ultimate Inves"

- US Stock Futures Ticker: A Comprehensive Guide"

- Best Stocks to Buy Today: US Markets Analysis"

- US Capitol Building Stock Image: A Visual Jour"

- Unlocking the Potential of US Hybrid Corp Stoc"

- US Robo ETF Stock Price: A Comprehensive Guide"

- Foreign Ownership of US Stocks Chart: A Compre"

- US Post Office Stock: A Comprehensive Guide to"

- Stock Market Can Us Currency: How It Influence"