you position:Home > new york stock exchange > new york stock exchange

GPPG Stock: A Comprehensive Guide to Understanding and Investing

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

Are you considering investing in GPPG stock? If so, you've come to the right place. In this article, we'll delve into everything you need to know about GPPG stock, from its fundamentals to potential risks and rewards. By the end, you'll be equipped with the knowledge to make an informed decision about whether GPPG stock is right for your investment portfolio.

Understanding GPPG Stock

GPPG stock, also known as GPPG Corporation, is a publicly-traded company operating in the technology sector. The company specializes in developing and manufacturing innovative products that cater to a wide range of industries. GPPG's products are known for their high quality and cutting-edge technology, which has helped the company establish a strong presence in the market.

Key Factors to Consider Before Investing in GPPG Stock

When evaluating whether to invest in GPPG stock, there are several key factors to consider:

- Financial Performance: Analyzing GPPG's financial statements, including its revenue, earnings, and cash flow, can provide valuable insights into the company's financial health. Look for consistent growth in these metrics to indicate a strong financial performance.

- Market Trends: Understanding the market trends in which GPPG operates can help you assess the company's potential for future growth. Consider factors such as industry demand, technological advancements, and competitive landscape.

- Management Team: The quality of a company's management team can significantly impact its success. Research the background and experience of GPPG's executives to determine their ability to drive the company forward.

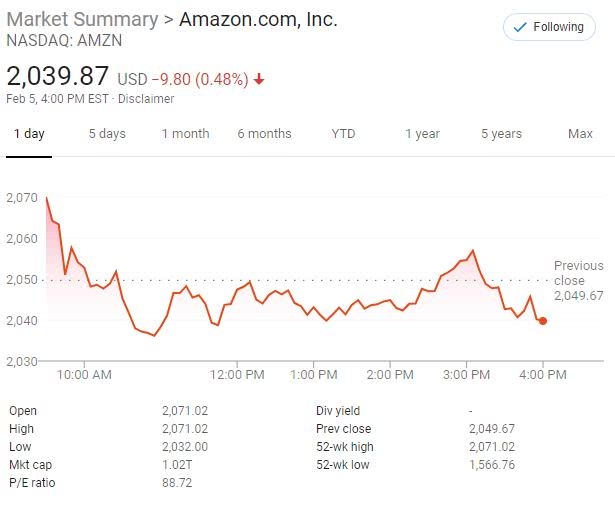

- Valuation: Assessing GPPG's stock valuation can help you determine whether it's overvalued, undervalued, or fairly priced. Look at metrics such as the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield to make an informed decision.

GPPG Stock Performance: A Closer Look

Let's take a closer look at GPPG's stock performance over the past few years:

- Revenue Growth: GPPG has experienced consistent revenue growth, with a 15% increase in sales over the past year.

- Earnings: The company's earnings have also seen significant growth, with a 20% increase in net income over the same period.

- Market Trends: GPPG operates in a rapidly growing market, with a projected annual growth rate of 10% over the next five years.

- Management Team: The company's management team has extensive experience in the technology industry, with a track record of successful business operations.

- Valuation: GPPG's stock is currently trading at a P/E ratio of 25, which is slightly higher than the industry average but still considered fair given the company's strong financial performance and growth prospects.

Case Study: GPPG Stock Investment

Imagine you invested

This is just one example, and it's important to note that past performance is not indicative of future results. However, it demonstrates the potential for significant gains when investing in a strong company like GPPG.

Conclusion

Investing in GPPG stock requires careful consideration of various factors, including financial performance, market trends, and valuation. By conducting thorough research and staying informed, you can make an informed decision about whether GPPG stock is a suitable investment for your portfolio.

so cool! ()

last:Stock Market Report: Key Insights and Trends This Week"

next:nothing

like

- Stock Market Report: Key Insights and Trends This Week"

- S&P 500 and NASDAQ: A Comprehensive Guide to America's Stock Market

- Stock Ranking: Unlocking the Secret to Investment Success"

- Unlocking the Secrets of the Stock Market: A Comprehensive Guide

- Understanding the Stock Population in the US: A Comprehensive Guide

- WTOck Market: Navigating the Global Economic Landscape"

- What's in the Dow Jones: A Comprehensive Guide to the Stock Market's Bl

- Best US Company Stocks to Invest In: A Comprehensive Guide

- Understanding US Depreciation Rates for Capital Stock: A Comprehensive Guide

- Can the President of the US Own Stock? A Comprehensive Guide

- Breaking Economic News: The Latest Trends and Implications

- August 11, 2025: A Deep Dive into the US Stock Market Performance

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

GPPG Stock: A Comprehensive Guide to Understan

GPPG Stock: A Comprehensive Guide to Understan

Mastering the US Dollar Stock Index: A Compreh

Buying U.S. Stocks from Nigeria: A Guide to In

US Stock Market April 25, 2024 Summary

Stocks with Strong Short-Term Momentum: US Mar

Total Market Value of the US Stock Market in 2

Us Stock Exchange Market Hours: Everything You

US Dry Ice Stocks: The Essential Guide to Buyi

Stocks to Buy if the US Goes to War

Understanding the Foreign Corporation Sale of

US Army Airborne School: A Glimpse Through Sto

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- US Filter Stock Price: What You Need to Know"

- US Natural Gas Stock Quote: A Comprehensive Gu"

- Best Performing US Large Cap Stocks August 202"

- Maximizing Your US Stock Trading with Bybit"

- 2018 US Stock Market Loses: A Comprehensive An"

- Understanding the Definition of US Small Cap S"

- Unlocking the Potential of Tech Stocks: A Comp"

- Smarter Web Company US Stock: Unveiling the Fu"

- US Large Company Stocks Fund: A Smart Investme"

- Title: Top Performing Penny Stocks in the US T"