you position:Home > new york stock exchange > new york stock exchange

China Deal Affecting US Stock Market

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

The recent trade deal between China and the United States has sparked a significant debate in the financial world, particularly regarding its impact on the US stock market. This article delves into the implications of this deal and how it is likely to influence the stock market in the near future.

Understanding the China Deal

The trade deal, which was officially signed on January 15, 2021, aims to resolve the long-standing trade disputes between the two nations. It involves a series of agreements, including the reduction of tariffs, the purchase of American goods by China, and the enforcement of intellectual property rights.

Impact on the US Stock Market

The implications of this deal on the US stock market are multifaceted.

1. Tariff Reduction

One of the key aspects of the deal is the reduction of tariffs. The removal of tariffs can lead to a decrease in the cost of goods imported from China, thereby boosting the profits of companies that rely on these imports. This could potentially lead to an increase in stock prices for these companies.

2. Increased Demand for American Goods

Under the deal, China has agreed to purchase a significant amount of American goods. This increased demand could boost the revenue and profits of American companies, which could, in turn, positively impact their stock prices.

3. Intellectual Property Rights

The deal also includes provisions for the enforcement of intellectual property rights, which is a major concern for American companies operating in China. A stronger enforcement of intellectual property rights can protect the profits of these companies, leading to a potential increase in their stock prices.

Case Study: Apple Inc.

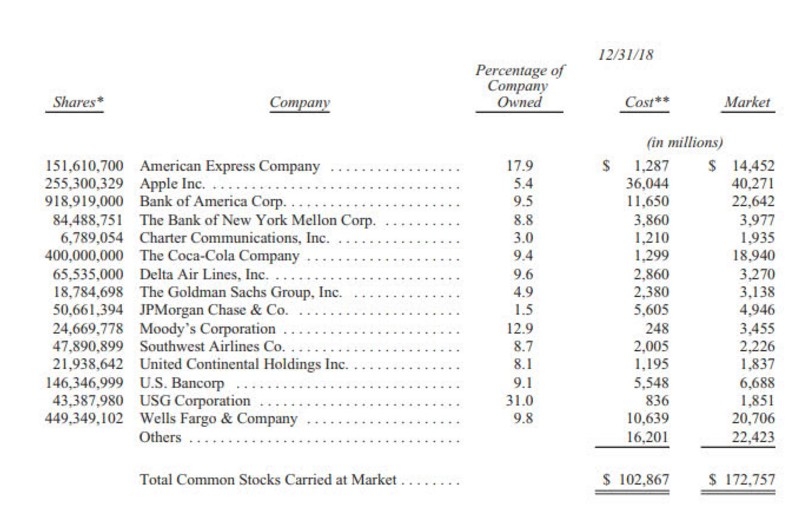

A prime example of how the deal could impact the stock market is Apple Inc. Apple is one of the largest importers of goods from China, and the reduction of tariffs and increased demand for American goods could significantly boost its profits. Additionally, the enforcement of intellectual property rights could protect its profits in China, further enhancing its stock price.

Conclusion

The recent China deal is likely to have a significant impact on the US stock market. The reduction of tariffs, increased demand for American goods, and stronger enforcement of intellectual property rights could all contribute to a positive outlook for the stock market. However, it is important to note that the actual impact of the deal will depend on its implementation and the overall economic conditions.

so cool! ()

last:Total US Stock Market vs S&P 500: A Comprehensive Comparison

next:nothing

like

- Total US Stock Market vs S&P 500: A Comprehensive Comparison

- US Stock Live Update: Real-Time Market Trends and Analysis

- US Momentum Stocks: Top Performers Past 5 Days (August 2025)

- High Dividend US Stocks 2022: A Guide to Top-Yielding Investments

- How Australian Investors Can Buy US Tech Stocks

- 3 Major Stock Exchanges in the US: A Comprehensive Guide

- Title: Defense Stocks ETF US: A Strategic Investment for Diversified Growth

- US Steel Stock: Why Robinhood Investors Should Take Notice

- Top US Stocks for 2021: Your Ultimate Guide to Investment Success

- Travel Stocks: US Investors' New Frontier

- Title: Stock Invest US Top 100: The Ultimate Guide to America's Most Valuabl

- Buying US Stocks in Malaysia: A Comprehensive Guide

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

China Deal Affecting US Stock Market

China Deal Affecting US Stock Market

Title: Latest Momentum Stocks in the US

How Can Canadians Buy US Stocks?

Understanding the Implications of US Stock Deb

Artificial Intelligence: A Game-Changer for US

How to Invest in the US Stock Market: A Compre

Brainsway Stock in US Dollars: A Comprehensive

Tech Stocks: US Indexes Lower Amid Market Vola

Momentum Stocks: Best Performing Large Cap US

TGOD US Stock: A Comprehensive Guide to Invest

Top US Restaurant Stocks: A Guide to Investing

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- July 2025 US Stock Market Outlook: A Comprehen"

- Stock R Us Cebu: Your Ultimate Destination for"

- Online Stock Broker US: Your Ultimate Guide to"

- How Australian Investors Can Buy US Tech Stock"

- Title: If US Legalized Marijuana Stocks to Inv"

- Institutional Investors Net Sellers of US Stoc"

- US Bank Stock Outlook: What to Expect in 2023"

- How Is the Stock Market Doing Today in US?"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Army Christmas Stocking: A Symbol of Holida"