you position:Home > new york stock exchange > new york stock exchange

Can an Indian Buy US Stocks? A Comprehensive Guide

![]() myandytime2026-01-22【us stock market today live cha】view

myandytime2026-01-22【us stock market today live cha】view

info:

Are you an Indian investor looking to diversify your portfolio? Have you ever wondered if you can buy US stocks? The answer is a resounding yes! Investing in US stocks can be a great way to diversify your investment portfolio and potentially earn higher returns. In this article, we will explore the process of buying US stocks for Indian investors, including the necessary steps, risks, and benefits.

Understanding the Basics

Before diving into the details, it's important to understand the basics of buying US stocks. US stocks are shares of ownership in a company listed on a US stock exchange, such as the New York Stock Exchange (NYSE) or the NASDAQ. When you buy a US stock, you become a partial owner of that company, and your investment can grow as the company's value increases.

Eligibility and Requirements

To buy US stocks, Indian investors need to meet certain requirements. Here's a quick rundown:

- Valid Passport: You need a valid Indian passport to open a brokerage account in the US.

- Bank Account: You'll need a US bank account to transfer funds for purchasing stocks.

- Tax Identification Number (TIN): This is required for tax purposes. You can obtain a TIN from the IRS (Internal Revenue Service) or through your brokerage firm.

- Brokerage Account: You need to open a brokerage account with a US-based brokerage firm to buy and sell stocks.

Opening a Brokerage Account

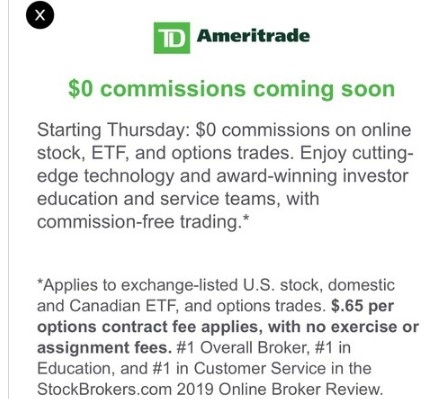

The first step in buying US stocks is to open a brokerage account. There are several reputable brokerage firms that cater to international investors, such as TD Ameritrade, E*TRADE, and Charles Schwab. Here's how to open a brokerage account:

- Research and Compare: Look for a brokerage firm that offers low fees, a user-friendly platform, and excellent customer service.

- Fill Out the Application: Provide the necessary information, including your personal details, financial information, and tax identification number.

- Fund Your Account: Transfer funds from your Indian bank account to your new US brokerage account.

Purchasing US Stocks

Once your brokerage account is funded, you can start purchasing US stocks. Here's how to do it:

- Research: Conduct thorough research on the stocks you're interested in. Consider factors such as the company's financial health, industry trends, and market conditions.

- Place an Order: Use your brokerage platform to place a buy order. You can choose to buy stocks at the market price or set a limit price.

- Monitor Your Investment: Keep an eye on your investment and adjust your strategy as needed.

Risks and Benefits

Like any investment, buying US stocks comes with risks and benefits:

- Benefits:

- Diversification: Investing in US stocks can help diversify your portfolio and reduce risk.

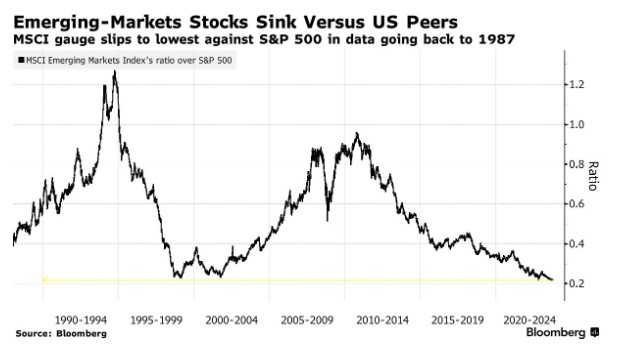

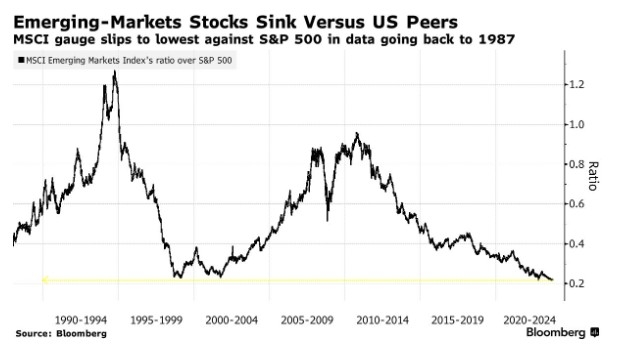

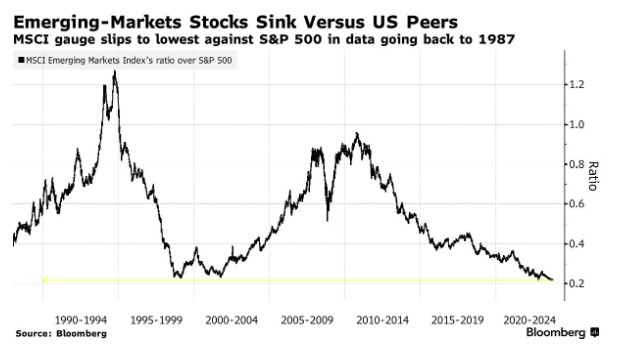

- Potential for Higher Returns: The US stock market has historically offered higher returns than other markets.

- Access to Top Companies: You can invest in some of the world's largest and most successful companies.

- Risks:

- Market Volatility: The US stock market can be volatile, leading to significant price fluctuations.

- Currency Risk: Changes in the exchange rate between the Indian rupee and the US dollar can impact your investment.

- Regulatory Risk: Different regulatory frameworks in the US and India can pose challenges.

Conclusion

Buying US stocks can be a great investment opportunity for Indian investors. By understanding the process, meeting the requirements, and conducting thorough research, you can successfully invest in US stocks and potentially earn higher returns. Remember to consider the risks and benefits before making any investment decisions.

so cool! ()

like

- Is China Buying Stocks in US? A Deep Dive into the Growing Investment Trend&q

- Moomoo Malaysia US Stock Fee: What You Need to Know

- Top Alcohol Stocks in the US: Investing Opportunities Unveiled

- US Large Cap Stocks Near 52 Week Lows: A Golden Opportunity in October 2024

- US Steel Co Stock Price Today: Key Insights and Analysis

- Understanding US Bancorp Preferred Stock Series B: A Comprehensive Guide

- US Missile Stocks: A Comprehensive Guide to Investing in Defense

- Stake Us Stocks: The Ultimate Guide to Investing in American Equity

- Toys "R" Us Stock Price in 2005: A Look Back at the Retail Gian

- Stock Options Tax Rate: A Comprehensive Look at Historical Data in the US&quo

- Best App to Buy Stocks in the US: Your Ultimate Guide

- Buying U.S. Stocks from Nigeria: A Guide to Investment Opportunities

hot stocks

Can I Buy US Stocks with CAD?

Can I Buy US Stocks with CAD?- Title: US Oil Companies Stocks: A Comprehensiv"

- Acronym and Name of US Stock Exchange: Codycro"

- Can I Buy US Stocks with CAD?"

- New Millennium Steel Dynamics: A Deep Dive int"

- Current Margin Debt in the US Stock Market: An"

- Sibanye Stillwater Stock US: A Comprehensive A"

- US Bank vs Wells Fargo Stock: A Comprehensive "

- US Army Christmas Stocking: A Symbol of Holida"

recommend

Can an Indian Buy US Stocks? A Comprehensive G

Can an Indian Buy US Stocks? A Comprehensive G

Understanding TFSA US Stocks Withholding Tax

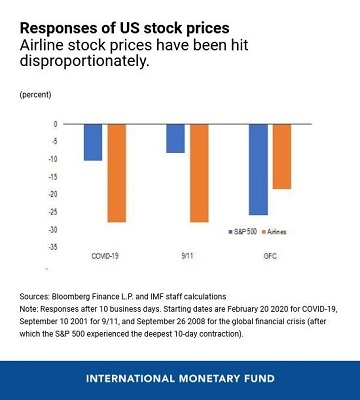

Coronavirus and Us Stock Market: The Unravelin

US Air Force Spouse Stock Photos: Capturing th

Stock Options: IFRS vs. US GAAP

Understanding US Capital Gains Tax on Stock Op

"US Bank Stocks with Low PE Ratio in

July 2025 US Stock Market Outlook: A Comprehen

US Fund Stock: Your Guide to Investing in Amer

Artificial Intelligence: A Game-Changer for US

Cronos Stock Price: What You Need to Know

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks games us stock silver etf

like

- Unlocking Opportunities: Top Cheap US Small Ca"

- US Antibiotics Stock: The Future of Healthcare"

- Trading US Stocks in Australia: A Comprehensiv"

- http stocks.us.reuters.com stocks fulldescript"

- Does Toys "R" Us Online Upda"

- US Stock Futures for Friday: What You Need to "

- How to Open a US Stock Trading Account"

- Unilever Stock Price US: Key Factors Influenci"

- CATL Stock US: Understanding the Market Dynami"

- Best AI Stocks in the US: Top Picks for 2023"