you position:Home > aphria us stock > aphria us stock

US Home Builder Stock Index: A Comprehensive Guide

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

In the ever-evolving real estate market, the US Home Builder Stock Index has emerged as a vital indicator of the sector's health and potential for growth. This index tracks the performance of leading home construction companies, providing investors with a snapshot of the industry's trajectory. In this article, we'll delve into the significance of the US Home Builder Stock Index, its components, and the factors influencing its movements.

Understanding the US Home Builder Stock Index

The US Home Builder Stock Index is a composite measure of the stock prices of the largest and most influential home construction companies in the United States. It serves as a benchmark for investors looking to gauge the overall performance of the home building sector. The index includes companies like D.R. Horton, PulteGroup, and Lennar, which are among the top players in the industry.

Components of the Index

The US Home Builder Stock Index is constructed using a market capitalization-weighted approach, meaning that the weight of each company's stock in the index is proportional to its market value. This ensures that the index accurately reflects the influence of each company on the overall sector.

Factors Influencing the Index

Several factors can impact the US Home Builder Stock Index, including:

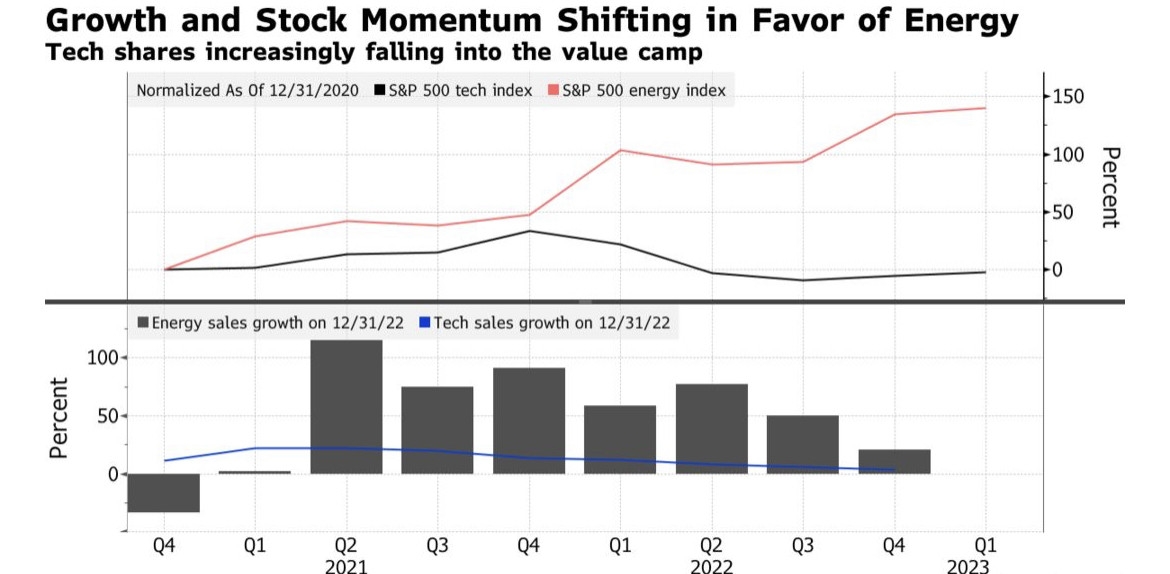

- Economic Conditions: Economic indicators such as GDP growth, employment rates, and consumer confidence play a crucial role in the home building sector. A strong economy typically leads to increased demand for new homes, driving up stock prices.

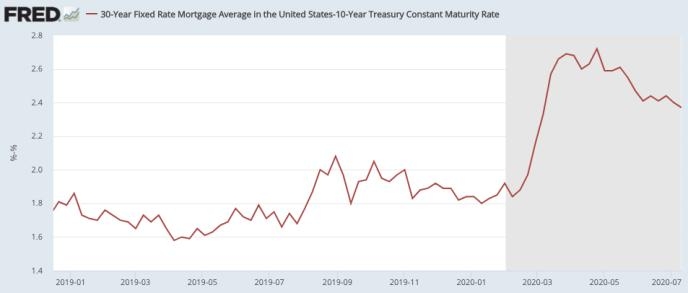

- Interest Rates: The cost of borrowing is a significant factor in the home building industry. Higher interest rates can make mortgages more expensive, potentially dampening demand for new homes and negatively impacting stock prices.

- Building Materials Prices: The cost of building materials, such as lumber and steel, can fluctuate significantly. Higher material costs can reduce profit margins for home builders, leading to lower stock prices.

- Government Policies: Government policies, such as tax incentives for home buyers and regulations affecting the construction industry, can also influence the US Home Builder Stock Index.

Case Studies

To illustrate the impact of these factors on the US Home Builder Stock Index, let's consider a few case studies:

- 2008 Financial Crisis: The 2008 financial crisis had a devastating impact on the home building industry, leading to a significant decline in the US Home Builder Stock Index. The crisis was primarily caused by the bursting of the housing bubble, high levels of mortgage default, and a subsequent credit crunch.

- COVID-19 Pandemic: The COVID-19 pandemic initially caused a temporary decline in the US Home Builder Stock Index as the economy shut down. However, as the pandemic subsided and demand for new homes surged, the index recovered and reached new highs.

- Interest Rate Hikes: In 2022, the Federal Reserve raised interest rates to combat inflation. This led to a decline in the US Home Builder Stock Index as higher interest rates made mortgages more expensive and reduced demand for new homes.

Conclusion

The US Home Builder Stock Index is a valuable tool for investors looking to gain insights into the home building sector. By understanding the factors that influence the index and analyzing historical trends, investors can make informed decisions about their investments. As the real estate market continues to evolve, the US Home Builder Stock Index will remain a key indicator of the industry's health and potential for growth.

so cool! ()

last:Should I Buy US Bank Stock?

next:nothing

like

- Should I Buy US Bank Stock?

- Top Trending US Stocks Today: A Comprehensive Guide

- US Military M14 Fiberglass Stock: A Comprehensive Guide

- Understanding the IDBI NS Stock Ratios: A Comprehensive Analysis

- Title: US-Japan Stock Trading Jobs: A Lucrative Career Path in the Financial Worl

- Understanding the US Stock Income Tax Rate: What You Need to Know

- Kratos Defense Stock Surges on New US Drone Export Policy

- Best Momentum Stocks Large Cap US This Week: Your Guide to Investment Opportuniti

- TNA US Stock: Everything You Need to Know

- US Bank Stocks Decline: Understanding the Market Shift

- Stock Market and the US Dollar: A Comprehensive Guide

- Title: How Much Was the US Stock Market Down in 2018?

recommend

US Home Builder Stock Index: A Comprehensive G

US Home Builder Stock Index: A Comprehensive G

How to Trade in the US Stock Market from Singa

Title: US Stock Future Index: A Comprehensive

Rheinmetall US Stock: A Comprehensive Analysis

Title: Stock Market Regulation in the US: Navi

Understanding the "US Dollar Stock Sy

Can You Buy Oppo Stock in the US?

TSMC Stock US: A Comprehensive Guide to Invest

Understanding the Fair Value of US Stock Futur

Lin Stock US: The Ultimate Guide to Understand

US Stock Market August 9, 2017 Fall Prediction

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- How Will Russia and Ukraine Affect the US Stoc"

- US ADR Stocks: A Comprehensive Guide to Invest"

- Title: Scynthian Stock Ticker US: Unveiling th"

- US Bombs Iran Stock Market: The Impact on the "

- Stocks Yesterday Closing Chart: A Comprehensiv"

- Is the US Stock Market Open Today? Live Update"

- Top Short-Term Momentum Stocks in the US Marke"

- How Much Is the US Stock Market Down? A Compre"

- income investing"

- US Stock Earnings: A Comprehensive Overview"