you position:Home > aphria us stock > aphria us stock

Stock Market and the US Dollar: A Comprehensive Guide

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

In today's global economy, the stock market and the US dollar play a pivotal role in shaping financial landscapes. Understanding the intricate relationship between these two is crucial for investors and market enthusiasts alike. This article delves into the impact of the stock market on the US dollar, the role of the US dollar in the stock market, and practical strategies for navigating these dynamics.

The Impact of the Stock Market on the US Dollar

The stock market has a significant influence on the value of the US dollar. When the stock market is performing well, investors often flock to US stocks, driving up demand for the US dollar. Conversely, a struggling stock market can lead to a weaker dollar.

For instance, during the 2008 financial crisis, the stock market plummeted, causing the US dollar to strengthen as investors sought safe havens. Conversely, in 2019, when the stock market experienced a strong rally, the US dollar weakened as investors sought higher returns in other markets.

The Role of the US Dollar in the Stock Market

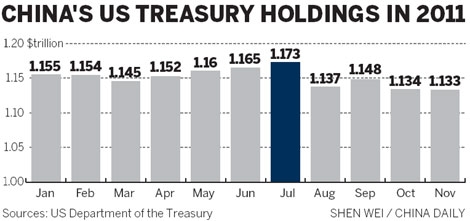

The US dollar serves as the world's primary reserve currency and is the most widely used currency in global trade and finance. This unique position allows the US stock market to attract significant international investment.

The strength of the US dollar can impact stock market performance. A strong dollar makes US stocks more expensive for foreign investors, potentially leading to lower demand and lower stock prices. Conversely, a weaker dollar makes US stocks more attractive to foreign investors, potentially boosting demand and pushing up stock prices.

Strategies for Navigating Stock Market and US Dollar Dynamics

Investors looking to navigate the complex relationship between the stock market and the US dollar should consider the following strategies:

Diversification: Diversifying your portfolio across different asset classes, including international stocks, can help mitigate the impact of currency fluctuations and market volatility.

Understanding Currency Fluctuations: Stay informed about currency trends and economic indicators that can influence currency values. This knowledge can help you make informed investment decisions.

Risk Management: Implement risk management strategies, such as stop-loss orders and position sizing, to protect your portfolio from sudden market shifts.

Stay Informed: Keep up-to-date with market news, economic reports, and political events that can impact both the stock market and the US dollar.

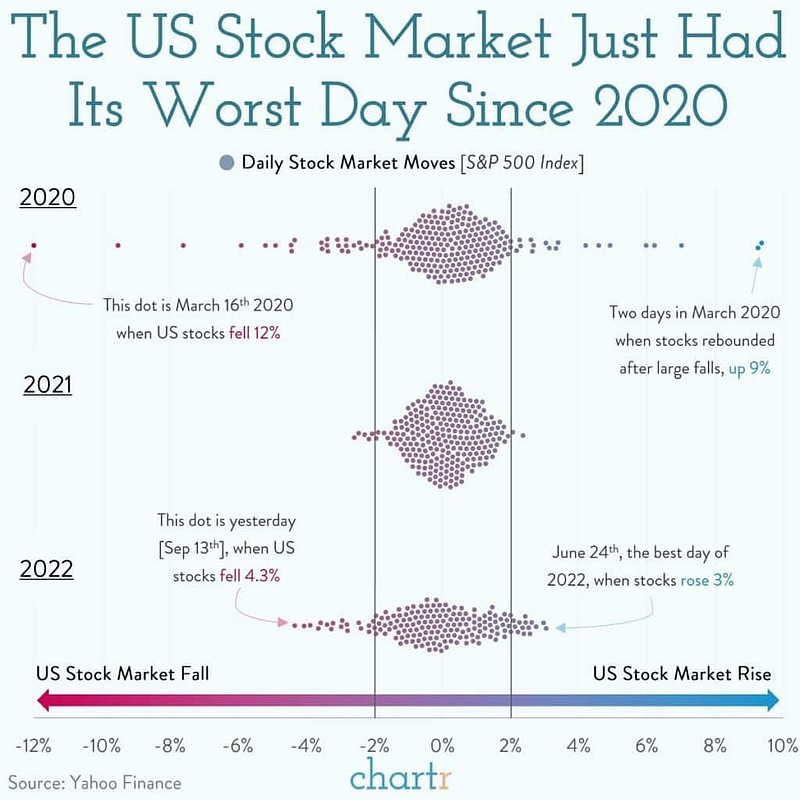

Case Study: The 2020 Stock Market Crash and the US Dollar

In early 2020, the stock market experienced a historic crash due to the COVID-19 pandemic. Amidst this turmoil, the US dollar strengthened as investors sought safety. However, as the pandemic subsided and economies began to recover, the US dollar weakened, and the stock market recovered significantly.

This case study highlights the dynamic nature of the relationship between the stock market and the US dollar and the importance of staying informed and adapting your investment strategy accordingly.

In conclusion, understanding the intricate relationship between the stock market and the US dollar is essential for investors seeking to navigate the complex global financial landscape. By staying informed, diversifying your portfolio, and implementing effective risk management strategies, you can position yourself for success in the ever-changing market environment.

so cool! ()

last:Title: How Much Was the US Stock Market Down in 2018?

next:nothing

like

- Title: How Much Was the US Stock Market Down in 2018?

- High Dividend Stocks US 2023: Your Guide to Top Yielding Investments

- Is Today a Stock Market Holiday in the US?

- US News Dassault Systèmes Stock: A Deep Dive into the Future of Technology

- MMAT US Stock: A Comprehensive Guide to Investing in Mixed Martial Arts

- Understanding US Stock Futures Hours: A Comprehensive Guide

- Kinross Gold Stock US: A Comprehensive Guide to Investing in Gold Mining

- US Anesthesia Partners Stock: A Comprehensive Analysis

- Title: US Stock Market 2016-2017: A Comprehensive Analysis

- Meg Energy Corp US Stock Symbol: Understanding the Investment Potential

- List of Bank Stocks in US: Your Ultimate Guide to Investment Opportunities

- Title: Time in the US Stock Market: Strategies for Maximizing Returns

recommend

Stock Market and the US Dollar: A Comprehensiv

Stock Market and the US Dollar: A Comprehensiv

Title: "Single Stock Inverse ETF List

Battery Stocks US: A Comprehensive Guide to In

US Stock Low PE Rankings: Identifying Value St

US Stock Index History: A Comprehensive Overvi

US Springfield Model 1873 Stock: A Timeless Cl

Are U.S. Stock Markets Closed?

Current High Momentum Stocks in the US Market

How Much Is the US Stock Market Down? A Compre

Toys "R" Us Seasonal Off-Hou

Title: Size of US Bond Market vs Stock Market:

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- rivian stock forecast"

- Title: Japan Stock Banks in US Markets: A Comp"

- Illumina US Healthcare Stocks: A Promising Inv"

- price action"

- airbnb stock forecast"

- How to Open a Stock Account in the US: A Compr"

- Title: TS1935B Stock in the US: A Comprehensiv"

- Stock Associate Toys "R" Us:"

- Title: Global Financial Collapse and the Impac"

- Lowes Stock US: A Comprehensive Analysis"