you position:Home > aphria us stock > aphria us stock

Should I Buy US Bank Stock?

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

Are you considering investing in US bank stocks? If so, you've come to the right place. This article delves into the factors you should consider before making your decision. From financial health to market trends, we'll explore everything you need to know to make an informed choice.

Understanding the Banking Industry

The banking industry is a crucial component of the global economy. Banks play a vital role in providing financial services to individuals, businesses, and governments. However, the industry is subject to various risks and regulations, which can impact the performance of individual bank stocks.

US Bank Stock Performance

Over the past few years, US bank stocks have shown mixed performance. While some banks have delivered impressive returns, others have struggled. To make an informed decision, it's essential to analyze the financial health and performance of individual banks.

Financial Health

One of the most critical factors to consider when evaluating US bank stocks is their financial health. Look for banks with strong capital reserves, low levels of non-performing loans, and solid profitability. A few key metrics to consider include:

- Return on Assets (ROA): Measures how efficiently a bank uses its assets to generate earnings.

- Return on Equity (ROE): Measures how effectively a bank utilizes its shareholders' equity to generate profits.

- Capital Adequacy Ratio (CAR): Indicates a bank's ability to withstand financial shocks and maintain its operations.

Market Trends

Market trends can also significantly impact the performance of US bank stocks. Some factors to consider include:

- Interest Rates: Changes in interest rates can affect a bank's net interest margins and profitability.

- Economic Growth: A growing economy can lead to increased lending and higher profits for banks.

- Regulatory Environment: Changes in regulations can impact a bank's operations and profitability.

Case Studies

Let's take a look at a few notable US banks and their recent performance:

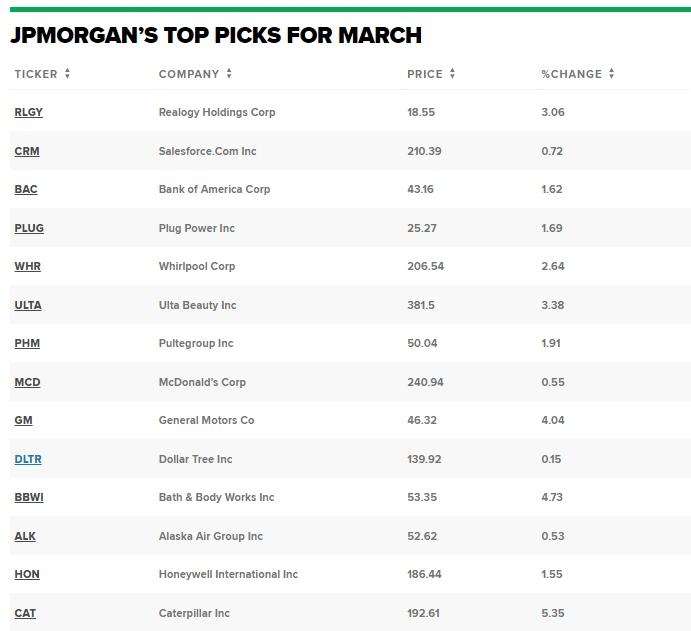

- JPMorgan Chase: One of the largest banks in the United States, JPMorgan Chase has demonstrated strong financial health and consistent profitability. The bank has a solid capital position and a diverse business model, which helps mitigate risks.

- Wells Fargo: Wells Fargo has faced significant challenges in recent years, including a series of scandals. However, the bank has made strides in improving its financial health and has seen improvements in its performance.

- Bank of America: Bank of America is another large US bank with a strong financial position and impressive performance. The bank has a diverse revenue stream and has demonstrated resilience in various market conditions.

Should You Buy US Bank Stock?

Now that you have a better understanding of the factors to consider, you may be wondering whether you should buy US bank stock. Here are a few key points to keep in mind:

- Risk vs. Reward: Bank stocks can offer significant returns, but they also come with higher risk compared to other investments.

- Diversification: Consider diversifying your portfolio to reduce risk.

- Long-Term Perspective: Investing in bank stocks requires a long-term perspective, as the industry can be volatile.

In conclusion, investing in US bank stocks can be a lucrative opportunity. However, it's essential to conduct thorough research and consider various factors before making your decision. Remember to stay informed about market trends and regulatory changes, and don't hesitate to consult with a financial advisor if needed.

so cool! ()

last:Top Trending US Stocks Today: A Comprehensive Guide

next:nothing

like

- Top Trending US Stocks Today: A Comprehensive Guide

- US Military M14 Fiberglass Stock: A Comprehensive Guide

- Understanding the IDBI NS Stock Ratios: A Comprehensive Analysis

- Title: US-Japan Stock Trading Jobs: A Lucrative Career Path in the Financial Worl

- Understanding the US Stock Income Tax Rate: What You Need to Know

- Kratos Defense Stock Surges on New US Drone Export Policy

- Best Momentum Stocks Large Cap US This Week: Your Guide to Investment Opportuniti

- TNA US Stock: Everything You Need to Know

- US Bank Stocks Decline: Understanding the Market Shift

- Stock Market and the US Dollar: A Comprehensive Guide

- Title: How Much Was the US Stock Market Down in 2018?

- High Dividend Stocks US 2023: Your Guide to Top Yielding Investments

recommend

Should I Buy US Bank Stock?

Should I Buy US Bank Stock?

TD Bank Stock: A Comprehensive Guide to Invest

Average Annual Stock Market Return in the US:

Chinese State-Owned Companies Listed on US Sto

Title: Best Stock to Buy in US Market

Should I Buy US Bank Stock?

1994 Pro Stock Car Vets Are Us: Frankie Sanche

Morgan Stanley Strategist Sees US Stock Rally

Lithium Ion Stocks in the US: A Comprehensive

US Silica Stock Forecast: A Comprehensive Anal

Is BYD on the US Stock Market?

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- top gainers"

- Foreign Governments Own Us Stocks: The Implica"

- How to Enter the US Stock Market"

- Title: US Stock Market 2018-2019: A Deep Dive "

- chip stocks"

- US Presidential Election Stock Market: Underst"

- News from the US Stock Market: Key Development"

- US Oil Stock History: A Comprehensive Overview"

- US Stock Market Bubble 2024: Is It Time to Wor"

- US Stock APA Yahoo: A Comprehensive Guide to U"