you position:Home > aphria us stock > aphria us stock

US Companies Stock Index: Key Insights and Trends"

![]() myandytime2026-01-23【us stock market today live cha】view

myandytime2026-01-23【us stock market today live cha】view

info:

The stock market is a dynamic and ever-evolving landscape, especially for US companies. The US Companies Stock Index serves as a critical indicator of market trends and economic health. This article delves into the key insights and trends surrounding the US Companies Stock Index, offering investors and market enthusiasts a comprehensive overview.

Understanding the US Companies Stock Index

The US Companies Stock Index, commonly known as the S&P 500, is a widely followed stock market index that tracks the performance of 500 large companies listed on stock exchanges in the United States. It is considered a benchmark for the overall health of the US stock market and economy.

Key Insights into the US Companies Stock Index

Market Performance: The S&P 500 has historically provided a strong performance over the long term. However, short-term fluctuations are common, influenced by economic, political, and global events.

Sector Distribution: The index is divided into 11 sectors, including technology, healthcare, financials, and consumer discretionary. The performance of these sectors can significantly impact the overall index.

Dividends: Many companies listed in the S&P 500 pay dividends to their shareholders, making it an attractive investment for income-seeking investors.

Trends in the US Companies Stock Index

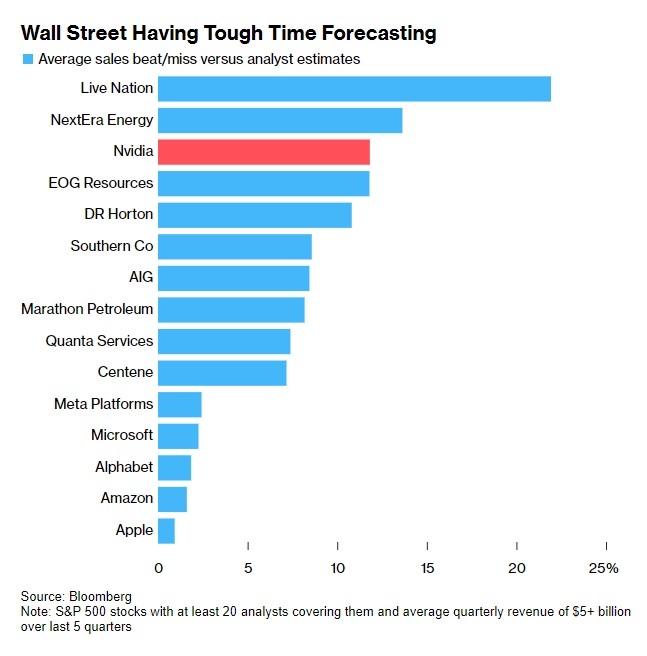

Tech Sector Dominance: The technology sector has been a significant driver of growth in the S&P 500. Companies like Apple, Microsoft, and Amazon have seen substantial increases in their market capitalization.

Economic Recovery: As the US economy continues to recover from the COVID-19 pandemic, many companies are reporting improved financial results, contributing to the overall rise in the index.

Inflation Concerns: The recent rise in inflation has raised concerns among investors. However, many companies have been able to pass on increased costs to consumers, mitigating the impact on their profitability.

Case Studies: S&P 500 Companies

Apple Inc.: Apple has been a significant contributor to the S&P 500, with its market capitalization reaching over $2 trillion. The company's strong product lineup and global presence have propelled its growth.

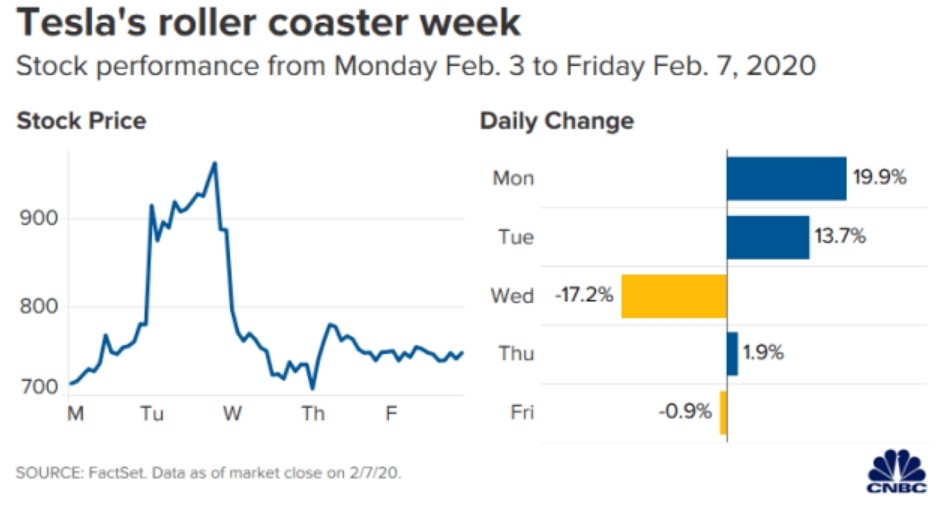

Tesla Inc.: Tesla has seen rapid growth in its stock price, becoming one of the most valuable companies in the world. The company's focus on electric vehicles and renewable energy has attracted investors looking for long-term growth opportunities.

Nike Inc.: Nike has been a steady performer in the S&P 500, with its strong brand and global presence. The company has continued to innovate and expand its product offerings, contributing to its success.

In conclusion, the US Companies Stock Index, particularly the S&P 500, is a critical indicator of market trends and economic health. Understanding the key insights and trends can help investors make informed decisions and capitalize on opportunities in the stock market.

so cool! ()

last:Stocks Tomorrow Predictions: USA Market Insights and Analysis

next:nothing

like

- Stocks Tomorrow Predictions: USA Market Insights and Analysis

- Investing in the US Stock Market as a Foreigner: A Comprehensive Guide

- Closing Stock Market Prices Today: A Comprehensive Overview

- Biggest Losers Today: Stock Market Declines Unveiled"

- Largest NASDAQ Gain in One Day: Unraveling the Record-Breaking Milestone

- After Hours Stock Screener: Unveiling Hidden Opportunities

- Today's Stock Exchange: A Comprehensive Overview

- Nasdaq & S&P 500 Market Sell-Off: Understanding the Recent Turmoi

- Dow Closing Prices: Understanding the Stock Market's Pulse

- BHI Us Stock: A Comprehensive Guide to Boost Your Investment Knowledge

- What Stocks Are Hot Right Now: Top Picks for 2023

- Maximizing Your Returns: A Comprehensive Guide to Understanding Company Shares

recommend

US Companies Stock Index: Key Insights and Tre

US Companies Stock Index: Key Insights and Tre

Can I Hold Us Stocks in My TFSA? A Comprehensi

US Stock Exchange Open Hours: A Comprehensive

Maximizing Returns with FTNT.US Stock: A Compr

US Oil Stocks: A Comprehensive Guide to API an

Haidilao Stock US: A Deep Dive into the Chines

Biggest Losers Today: Stock Market Declines Un

Unlocking the Power of "Y Money&q

Billabong US Stock Symbol: Understanding the S

Best Stock to Buy in the US Market Now: Top Pi

Marihuana Stock Entering the US Market: A Game

tags

-

WeightJunPoxCRSPKiaMonetaryCatalystsPlungeBankingWikiE6603BeneficiarieSalarMisstepComparElectiHarnesRPCCampaignBBCOTUnsoldNastiticPractiseRidePFContinuesBoughtAnnuHigRoughAdaroStocks-USSorosNorthernMcMillanEvenMaricannltcgCROL.SolarWorldStock.InvestAnimeDaiTriangleDynastyParallelsContractorsCSVTreBermudaTransactionIn-GrowerManitexVetPlansBrManchesterPositionsBeefWeightingBuybacAetnawitShareholdeProminentMaximizeResidSSNOftenCouldTDWPremiumShoSPACYumRisinLivestockWarnChangerSalsusETST.PKRaytheonSYRG.KOriginSberJPMorganAPICloud us stocks us stock games silver etf

like

- Small Cap Value Stocks: A Hidden Gem in the US"

- Buy Us Stocks from Kenya: A Lucrative Investme"

- How to Trade HK Stocks in the US: A Comprehens"

- US Money Stocks to But: Top Picks for 2023"

- Top Preferred Stocks in the US: Your Guide to "

- Title: Total US Stock Market Capitalization 20"

- solar stocks"

- Us Long Term Capital Gains Tax Stocks: Unlocki"

- Jamie Dimon Says Stock Prices in the US Are In"

- US Large Cap Stocks: Current Market Cap Over $"