you position:Home > aphria us stock > aphria us stock

US Money Stocks to But: Top Picks for 2023

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

Are you looking to invest in money stocks but unsure where to start? Look no further! In this article, we delve into the top money stocks to consider for 2023. Whether you're a seasoned investor or just starting out, these picks could be your gateway to financial success.

Understanding Money Stocks

Before we dive into the specifics, let's clarify what money stocks are. Money stocks are shares of companies that primarily deal with lending and borrowing activities. These companies often include banks, savings and loans associations, and credit unions. They are known for their stability and consistent dividends, making them appealing to investors seeking income and growth potential.

Top Money Stocks to Consider

JPMorgan Chase & Co. (NYSE: JPM)

- Why Invest? As one of the largest banks in the United States, JPMorgan Chase offers a strong presence in various financial sectors, including retail banking, investment banking, and asset management. The company has a history of solid performance and a robust dividend yield.

- Dividend Yield: 2.4%

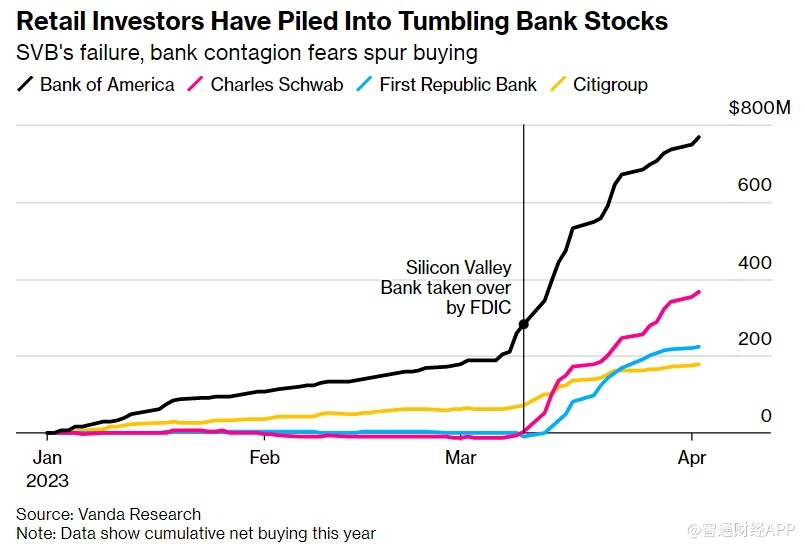

Bank of America Corporation (NYSE: BAC)

- Why Invest? Bank of America is another major player in the financial industry, offering a wide range of services, including retail banking, wealth management, and investment banking. The bank has shown resilience throughout economic downturns and offers a competitive dividend yield.

- Dividend Yield: 2.1%

Wells Fargo & Company (NYSE: WFC)

- Why Invest? Wells Fargo is known for its extensive network of branches and ATMs, making it a convenient choice for consumers. The bank has been working on improving its reputation and financial performance, offering a potentially undervalued investment opportunity.

- Dividend Yield: 1.9%

Goldman Sachs Group, Inc. (NYSE: GS)

- Why Invest? Goldman Sachs is a leading investment bank and financial services firm, known for its expertise in global markets. The company has a strong track record of generating consistent returns and offers a decent dividend yield.

- Dividend Yield: 1.6%

Charles Schwab Corporation (NYSE: SCHW)

- Why Invest? Charles Schwab is a well-known brokerage firm that has expanded its offerings to include banking services. The company has a reputation for customer satisfaction and offers a solid dividend yield.

- Dividend Yield: 1.5%

Factors to Consider When Investing in Money Stocks

When considering money stocks, it's important to take several factors into account:

- Financial Health: Look for companies with strong financial ratios, such as low debt levels and a solid capital cushion.

- Dividend Yield: A higher dividend yield can indicate a company's commitment to returning profits to shareholders.

- Market Trends: Stay informed about the financial market and economic trends that could impact the performance of money stocks.

- Management Team: A strong and experienced management team can make a significant difference in a company's success.

Case Study: Bank of America Corporation

To illustrate the potential of money stocks, let's look at Bank of America Corporation. Over the past five years, the company has faced challenges, including legal issues and economic downturns. Despite these setbacks, Bank of America has managed to maintain a strong presence in the financial industry and has shown resilience in its financial performance.

In 2018, Bank of America reported a net income of

By investing in money stocks like Bank of America, investors can potentially benefit from the company's stability and growth potential.

Conclusion

Investing in money stocks can be a smart move for investors seeking stability and income. By carefully selecting companies with strong financial health and a solid dividend yield, you can position yourself for long-term success. Remember to stay informed about market trends and economic conditions to make informed investment decisions.

so cool! ()

last:Understanding Today's PE Ratio in the US Stock Market

next:nothing

like

- Understanding Today's PE Ratio in the US Stock Market

- Best US Stocks to Buy in 2021: Top Picks for Investors

- Infosys in the US Stock Market: A Comprehensive Analysis

- Unlocking the Potential of Us Steel Canada Stock

- Unlocking the Potential of 601398.ss: A Deep Dive into China's Stock Market

- RDS Stock: A Smart Investment for US Citizens

- Understanding Canadian Capital Gains Tax on US Stocks

- Exchanges to Buy US Stock: Your Ultimate Guide

- How Many US Stocks Have Options? A Comprehensive Guide"

- Toys "R" Us Overnight Stocker Salary: What You Need to Know

- Understanding the iShares Total Stock Market US ETF: A Comprehensive Guide

- First US Stock Market: A Comprehensive Guide to America's Financial Frontier

recommend

US Money Stocks to But: Top Picks for 2023

US Money Stocks to But: Top Picks for 2023

Is the US Stock Market Open Easter Monday? A C

HMMJ Stock US: The Ultimate Guide to Investing

How Will Russia and Ukraine Affect the US Stoc

Recommended Us Stock: How to Make Informed Inv

Samsung Electronics Stock Purchase in the US:

Understanding the US Residential Housing Stock

Title: Japan Stock Banks in US Markets: A Comp

2025 US Stock Market Outlook: Second Half of 2

Title: Global Financial Collapse and the Impac

Safe US Stocks: Your Guide to Secure Investmen

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Large Cap Stocks Momentum Leaders: Unveilin"

- Kratos Defense Stock Surges on New US Drone Ex"

- How Are US Stocks Doing? A Comprehensive Analy"

- FBTC US Stock: A Comprehensive Guide to FuboTV"

- Hatchimals Toys R Us Stock: A Comprehensive Gu"

- Total Return of the US Stock Market: A Compreh"

- Understanding the Dynamics of US Banks' P"

- lucid stock"

- Unlocking the Potential of US Health Stocks: A"

- How to Buy Eutelsat Stock in the US"