you position:Home > aphria us stock > aphria us stock

Title: US Airways Merger with American Airlines Stock: A Comprehensive Analysis

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

Introduction:

The Merger Background The merger between US Airways and American Airlines was announced in February 2013 and was completed in December 2013. The deal was valued at approximately $11 billion and created the largest airline in the United States, surpassing United Airlines and Delta Air Lines in terms of revenue and fleet size.

Reasons for the Merger The primary reasons behind the merger were to enhance the competitive position of both airlines in the highly fragmented airline industry. By combining their operations, US Airways and American Airlines aimed to achieve several strategic objectives:

- Increased Market Power: The merger allowed the combined entity to have a stronger presence in key markets, giving it more leverage in negotiations with suppliers, such as aircraft manufacturers and fuel providers.

- Cost Savings: The merger aimed to achieve significant cost savings through the elimination of duplicate functions, such as administrative staff and maintenance operations.

- Expanded Network: The combined airline would offer a more extensive network, providing customers with more destinations and better connectivity.

Impact on Stock Market The merger had a significant impact on the stock market, with both US Airways and American Airlines stock experiencing significant volatility during the merger process. Here are some key points to consider:

- Stock Performance: After the merger was announced, the stock of both companies experienced a sharp increase, reflecting the optimism surrounding the deal. However, the stock prices stabilized as the merger progressed and the integration challenges became apparent.

- Market Reaction: The market generally reacted positively to the merger, as it was seen as a strategic move to create a more competitive airline industry. However, some investors were concerned about the potential integration challenges and the impact on profitability.

Long-Term Implications The merger has had several long-term implications for both companies:

- Increased Market Share: The combined entity has a larger market share, making it a more formidable competitor in the airline industry.

- Improved Financial Performance: The merger has led to improved financial performance, with the combined entity achieving record revenue and profitability.

- Enhanced Customer Experience: The merger has allowed the combined entity to offer a more extensive network and improved customer service.

Case Study: United Airlines and Continental Airlines Merger The merger between United Airlines and Continental Airlines in 2010 serves as a case study for the potential benefits and challenges of airline mergers. While the merger has led to significant cost savings and improved financial performance, it has also faced integration challenges, such as IT system integration and workforce consolidation.

Conclusion: The merger between US Airways and American Airlines has had a significant impact on the airline industry, creating a more competitive landscape and enhancing the market power of the combined entity. While the merger has faced challenges, the long-term implications suggest that it has been a strategic move that will benefit both companies and their customers.

so cool! ()

last:US Gov Stock Market Graph: A Comprehensive Analysis

next:nothing

like

- US Gov Stock Market Graph: A Comprehensive Analysis

- US Stock Futures React to Tariffs: A Comprehensive Analysis

- Today's Top Momentum Stocks in the US Markets

- Title: US Stock Hedging Strategies Backfire During Market Rout

- US Petroleum Stock Piles: The Cornerstone of Energy Security

- Battery Stocks US: A Comprehensive Guide to Investing in the Battery Industry

- Title: Us Expat Stock Trader Accounts: A Comprehensive Guide

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol veri.

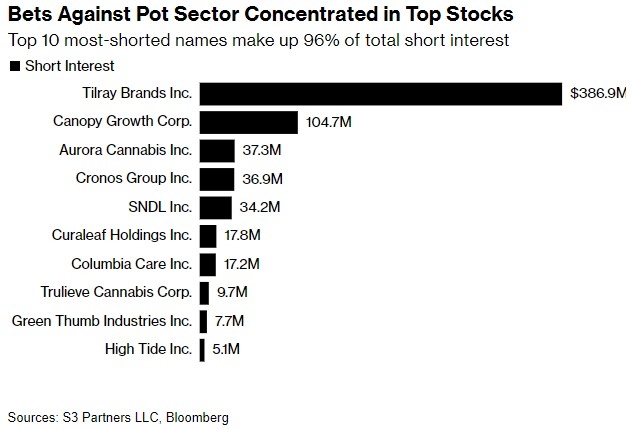

- Can Marijuana Companies Move from Canadian Stock Exchange to US?

- Stock Market Lunch Break: Understanding the Dynamics of US Markets

- Stocks Yesterday Closing Chart: A Comprehensive Analysis

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol msft.

recommend

Title: US Airways Merger with American Airline

Title: US Airways Merger with American Airline

Stock Market Lunch Break: Understanding the Dy

Title: Factors Influencing US Stock Market Per

Foreign Governments Own Us Stocks: The Implica

DeepSeek US Stocks: Unveiling the Hidden Gems

Stock Invest: Palantir – A Game-Changing Inv

US 10Y Stock: A Comprehensive Guide to Underst

US Stock Losers: Understanding the Factors Beh

Title: Stock Invest Us.com - Your Ultimate Gui

Iron Mountain US Stock Price: A Comprehensive

Trading in UK Stock Market vs US: A Comprehens

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Do Foreign Investors Pay Taxes on US Stocks?"

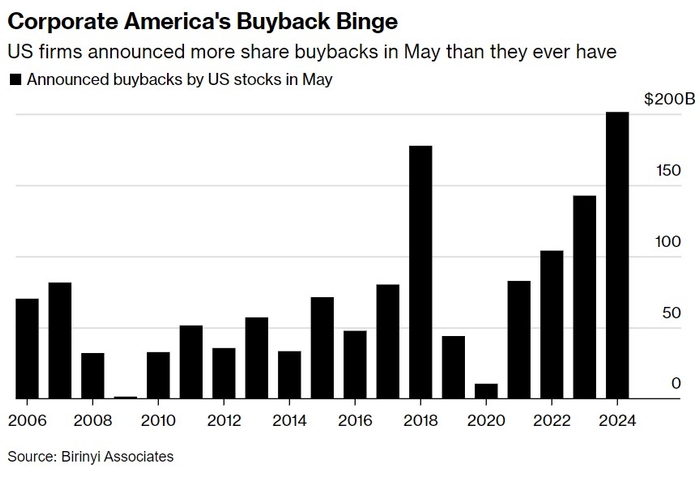

- stock buyback"

- US Bombs Iran Stock Market: The Impact on the "

- US Bank ETF Stock Price: A Comprehensive Guide"

- Best Stocks According to US News: Your Ultimat"

- debt to equity"

- Title: US Role on the 1989 Japanese Stock Mark"

- nasdaq average today"

- Iran-US Stock Market: A Comprehensive Analysis"

- options strategies"