you position:Home > us stock market today live cha > us stock market today live cha

Maximizing Counterparty Trading Success with a US Stock Broker

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

In the fast-paced world of finance, counterparty trading has emerged as a critical aspect for investors looking to diversify their portfolios. A skilled US stock broker can significantly enhance your trading experience, ensuring you make informed decisions in the ever-evolving market. This article delves into the intricacies of counterparty trading, highlighting the role of a US stock broker and offering valuable insights to maximize your trading success.

Understanding Counterparty Trading

Counterparty trading refers to the process of buying and selling financial instruments with another party, typically through a broker. This type of trading involves various assets, including stocks, bonds, commodities, and derivatives. While it offers numerous advantages, such as liquidity and flexibility, it also comes with its own set of risks and complexities.

The Role of a US Stock Broker in Counterparty Trading

A reputable US stock broker plays a pivotal role in facilitating counterparty trading. They act as intermediaries between you and the counterparty, ensuring a smooth and transparent trading experience. Here’s how they contribute to your success:

- Access to a Wide Range of Markets: A US stock broker provides access to a diverse array of markets, allowing you to trade in various financial instruments from a single platform.

- Risk Management: Brokers offer risk management tools and strategies to help you mitigate potential losses and protect your investments.

- Regulatory Compliance: Ensuring that all trades comply with regulatory requirements is crucial. A reliable broker will take care of this, giving you peace of mind.

- Expertise and Guidance: With years of experience, a skilled broker can offer valuable insights and guidance, helping you make informed trading decisions.

Key Considerations for Counterparty Trading

When engaging in counterparty trading, it’s essential to consider the following factors:

- Counterparty Reputation: Before entering into a trade, research the reputation and reliability of the counterparty. A trustworthy counterparty minimizes the risk of fraud or default.

- Market Conditions: Stay updated on market trends and conditions to make informed trading decisions. A skilled broker can provide valuable insights into market dynamics.

- Liquidity: Ensure that the financial instrument you are trading is liquid, meaning it can be easily bought or sold without significantly impacting its price.

- Transaction Costs: Be aware of transaction costs, including fees, commissions, and spreads, as they can impact your overall profitability.

Case Study: Successful Counterparty Trading with a US Stock Broker

Consider the case of John, an experienced investor looking to diversify his portfolio. After thorough research, John chose a reputable US stock broker with a strong track record in counterparty trading. The broker provided John with access to a wide range of markets, including stocks, bonds, and commodities. Using the broker’s expertise and risk management tools, John successfully executed multiple trades, achieving significant returns.

Conclusion

Counterparty trading can be a powerful tool for investors looking to diversify their portfolios and maximize returns. By partnering with a reputable US stock broker, you can enhance your trading experience, mitigate risks, and increase your chances of success. Remember to conduct thorough research, stay informed, and leverage the expertise of your broker to make informed trading decisions.

so cool! ()

last:Intel US Stock Market: A Comprehensive Analysis

next:nothing

like

- Intel US Stock Market: A Comprehensive Analysis

- Last Trading Day of Q1 2024: Key Insights for US Stock Market Investors

- Nuclear Energy Stocks in the US: A Lucrative Investment Opportunity

- US and European Stocks Rally After Sell-Off: A Strong Recovery in the Market

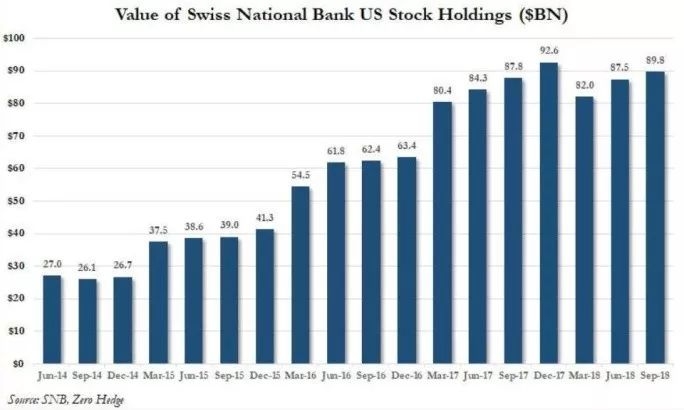

- Swiss Central Bank Sells US Stocks: Implications and Analysis

- SK Hynix Stock Symbol: US - A Comprehensive Guide

- The Largest Market Cap Stock in the US: A Closer Look at Apple's Dominance

- US Hot Stocks: Dow Jones' Top Picks for 2023

- Swiss Central Bank Buys US Stocks: A Strategic Move for Economic Stability

- US Stocks Struggle on Wall Street: What You Need to Know"

- Understanding US Stock Capital Gain Tax for Foreigners

- Important Dates for Us Stock Market Investors: What You Can't Miss

hot stocks

HBHarat Electronic Stock on US Market: A Compr

HBHarat Electronic Stock on US Market: A Compr- HBHarat Electronic Stock on US Market: A Compr"

- Best Performing Large Cap US Stocks This Week:"

- US Stock Futures Rise Amid Government Shutdown"

- June 8, 2025: US Stock Market Summary"

- US Passport and Shell Stock Photo High Resolut"

- PS5 Stock Update: What You Need to Know in the"

- US Refineries Stocks: A Comprehensive Guide to"

- Title: Understanding the Real Return on Your I"

recommend

Maximizing Counterparty Trading Success with a

Maximizing Counterparty Trading Success with a

Title: Medical Marijuana US Stock: A Growing I

Nxe Stock US: A Comprehensive Guide to Underst

US Passport and Shell Stock Photo High Resolut

Unlock the Potential of US Medical Equipment S

Total US Stock Market Capitalization: Understa

US Holiday Stock Market Closed: What You Need

Title: Rosneft Stock US: A Comprehensive Analy

DeepSeek's AI Model Disrupts US Stock Mar

Should I Buy US Stocks Now? A Comprehensive Gu

High Momentum US Stocks: Technical Analysis Un

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Title: Stocks Impacted by US and China Trade"

- How to Trade US Stocks in India: A Comprehensi"

- US Stock Crash 2019: Causes, Effects, and Less"

- US Stock for E-Cigarettes: A Comprehensive Gui"

- US Penny Stocks High Volume: A Comprehensive G"

- Title: Percentage of US Households That Hold S"

- US Cirremcy Paper Stock Supplier: The Ultimate"

- Top 20 Traded US Stocks: A Comprehensive Overv"

- Is the US Stock Market Open on December 31? A "

- Adyen Stock US: A Comprehensive Guide to the P"