you position:Home > us stock market today live cha > us stock market today live cha

Title: Stocks Impacted by US and China Trade

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

Introduction

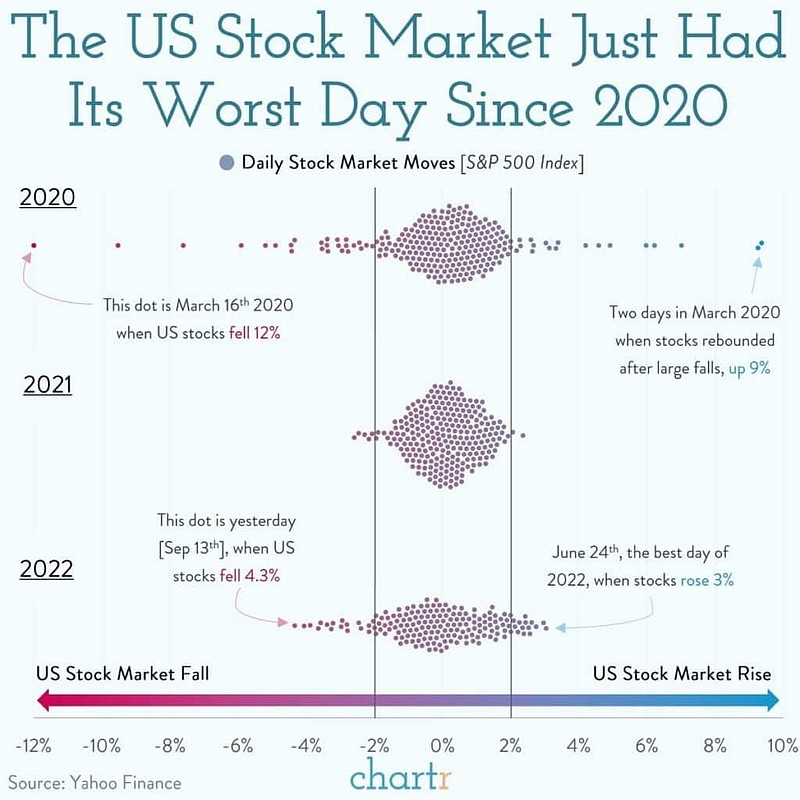

In the ever-evolving global economic landscape, the relationship between the United States and China remains a pivotal factor in shaping the global stock market. The ongoing trade tensions between the two superpowers have sparked significant volatility in various sectors, causing investors to reconsider their portfolio allocations. This article delves into the impact of US-China trade on stocks, highlighting key sectors most affected and offering insights for investors navigating these turbulent times.

The Trade War's Ripple Effect

The US-China trade war, which began in 2018, has had a profound impact on the global stock market. Automotive, technology, and agriculture sectors have been among the most affected, experiencing both direct and indirect consequences of the trade disputes.

Automotive Sector

One of the earliest victims of the trade war was the automotive sector. Tariffs imposed by the US on Chinese-made vehicles have significantly increased the cost of importing cars from China, leading to higher prices for consumers. Consequently, major automakers like Tesla and Ford have seen their stocks fall as the demand for their Chinese-made vehicles diminishes.

Technology Sector

The technology sector has also been disrupted by the trade war. US companies such as Apple and Qualcomm rely heavily on Chinese manufacturers for components and production. The ban on US companies exporting certain technologies to China has caused a ripple effect across the industry, with stock prices of major tech companies suffering.

Agriculture Sector

The agriculture sector has not been immune to the trade war's impact. The US imposing tariffs on Chinese goods has led to a decline in Chinese imports of American agricultural products. Conversely, China has retaliated by imposing tariffs on US agricultural products, causing significant financial losses for US farmers and negative impact on their stocks.

Investor Insights

As the trade war continues, investors must remain vigilant about the potential risks and opportunities presented by this volatile situation. Diversifying portfolios across various sectors can help mitigate risks associated with the US-China trade tensions.

Case Study: Tesla

A prime example of the impact of the trade war on stocks is Tesla. In 2018, the company announced plans to expand its production in Shanghai, China, to reduce production costs and avoid tariffs. However, the increase in production costs due to the trade war forced Tesla to increase prices for its vehicles in China. This, in turn, led to a decline in sales and negative impact on its stock price.

Conclusion

The US-China trade war has caused significant volatility in the global stock market, affecting various sectors. As investors navigate these turbulent times, it is crucial to stay informed and remain diversified to mitigate potential risks. By understanding the impact of the trade war on key sectors, investors can make more informed decisions and position their portfolios for long-term success.

so cool! ()

last:US Stock Gainers & Losers: Analyzing Market Movements

next:nothing

like

- US Stock Gainers & Losers: Analyzing Market Movements

- US Antimony Corp Stock: A Comprehensive Analysis

- Ice Us Stock: Unveiling the Iceberg of Opportunities in the US Stock Market

- US Stock by Market Cap: A Comprehensive Guide

- US Stock Market Black and White: A Comprehensive Guide

- Sonoma Pharmaceuticals US Stock: A Comprehensive Analysis

- Singapore Stocks Listed in the US: A Comprehensive Guide

- AXA US Stock Price: A Comprehensive Analysis

- Title: The Biggest Oil Companies in the US Stock Market

- Panasonic Canada Stock Price in US Dollars: A Comprehensive Guide

- US Bank Stocks Symbol List: A Comprehensive Guide

- The Best Way to Buy US Stocks from Canada

hot stocks

HBHarat Electronic Stock on US Market: A Compr

HBHarat Electronic Stock on US Market: A Compr- HBHarat Electronic Stock on US Market: A Compr"

- Best Performing Large Cap US Stocks This Week:"

- US Stock Futures Rise Amid Government Shutdown"

- June 8, 2025: US Stock Market Summary"

- US Passport and Shell Stock Photo High Resolut"

- PS5 Stock Update: What You Need to Know in the"

- US Refineries Stocks: A Comprehensive Guide to"

- Title: Understanding the Real Return on Your I"

recommend

Title: Stocks Impacted by US and China Trade

Title: Stocks Impacted by US and China Trade

Momentum Stocks: US Large Cap August 2025 Outl

US Stock Futures Rise Amid Government Shutdown

US-China Stock Trade Guy: Navigating the Compl

Title: Top Stock Market Companies in the US

Tilray US Stock Price: Everything You Need to

Title: The Biggest Oil Companies in the US Sto

Cannibus Stocks on US Markets: A Comprehensive

Unlocking the Potential of PCEF.k: A Comprehen

Title: "http stocks.us.reuters.com st

Total Value If the US Stock Market: What Inves

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Oil Companies on the Stock Market: A Compre"

- All Public US Dividend Paying Stocks: A Compre"

- Title: China and the US Stock Market: A Compre"

- US Capitol Stock Video: Capturing the Iconic L"

- Daily US Stock Market Update"

- Can a Non-US Citizen Own Stock? A Comprehensiv"

- Gold and US Stock Market: A Comprehensive Anal"

- Cannibus Stocks on US Markets: A Comprehensive"

- Top US Defence Stocks: A Comprehensive Guide"

- http://stocks.us.reuters.com/stocks/fulldescri"