you position:Home > us stock market today live cha > us stock market today live cha

Swiss Central Bank Sells US Stocks: Implications and Analysis

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

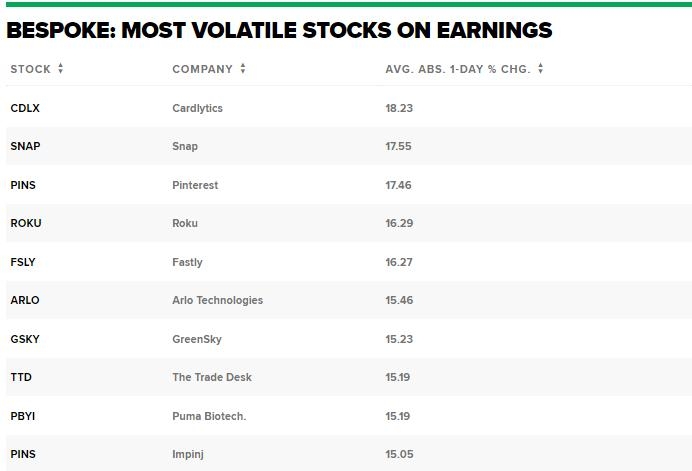

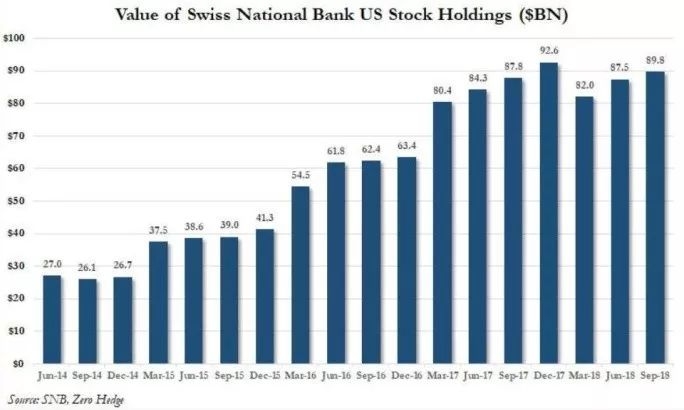

In a significant move, the Swiss National Bank (SNB) has recently announced its decision to sell a substantial portion of its US stock holdings. This decision has sparked considerable interest and debate among investors and financial analysts worldwide. This article delves into the reasons behind this move, its potential implications, and the broader impact on the global financial landscape.

Reasons for the Move

The SNB's decision to sell US stocks can be attributed to several factors. Firstly, the bank has been under pressure to reduce its foreign currency reserves, which have soared due to its efforts to keep the Swiss franc weak. Secondly, the SNB has been seeking to diversify its investment portfolio to mitigate risks associated with a single currency. Lastly, the bank has been concerned about the potential negative impact of rising US interest rates on its investment returns.

Implications of the Sale

The sale of US stocks by the SNB is expected to have several implications. Firstly, it may lead to increased volatility in the US stock market, as the SNB's massive stake in the market could influence stock prices. Secondly, the move could put downward pressure on the Swiss franc, as the SNB may need to sell more assets to meet its reserve reduction target. Lastly, the sale could impact the global financial landscape, as it could lead to a reallocation of capital away from the US and towards other markets.

Broader Impact on the Global Financial Landscape

The SNB's decision to sell US stocks is part of a broader trend of central banks reassessing their investment strategies in light of changing economic conditions. This trend is likely to have several long-term implications for the global financial landscape. Firstly, it may lead to increased competition for investment opportunities, as central banks seek to diversify their portfolios. Secondly, it could lead to greater volatility in financial markets, as central banks adjust their investment strategies. Lastly, it could prompt a shift in global capital flows, as central banks reallocate capital away from traditional safe havens like the US and towards emerging markets.

Case Studies

Several case studies illustrate the potential impact of central bank investment decisions on financial markets. For instance, the Federal Reserve's decision to taper its quantitative easing program in 2013 led to significant volatility in global financial markets. Similarly, the Bank of Japan's massive bond buying program has had a profound impact on the Japanese stock market.

Conclusion

The SNB's decision to sell US stocks is a significant move that has the potential to impact the global financial landscape. While the immediate implications are unclear, the long-term consequences could be far-reaching. As central banks reassess their investment strategies, it is essential for investors and policymakers to closely monitor these developments and understand their potential impact on financial markets.

so cool! ()

last:SK Hynix Stock Symbol: US - A Comprehensive Guide

next:nothing

like

- SK Hynix Stock Symbol: US - A Comprehensive Guide

- The Largest Market Cap Stock in the US: A Closer Look at Apple's Dominance

- US Hot Stocks: Dow Jones' Top Picks for 2023

- Swiss Central Bank Buys US Stocks: A Strategic Move for Economic Stability

- US Stocks Struggle on Wall Street: What You Need to Know"

- Understanding US Stock Capital Gain Tax for Foreigners

- Important Dates for Us Stock Market Investors: What You Can't Miss

- Target US Stock Price: A Comprehensive Guide to Understanding TGT's Market V

- Hong Kong-US Stock Market Pullback: Insights and Implications

- Are U.S. Stock Markets Closed Tomorrow? Here’s What You Need to Know

- Total Dollar Value of the US Stock Market: Current Trends and Implications&qu

- US Oil Stock Split: What You Need to Know

hot stocks

HBHarat Electronic Stock on US Market: A Compr

HBHarat Electronic Stock on US Market: A Compr- HBHarat Electronic Stock on US Market: A Compr"

- Best Performing Large Cap US Stocks This Week:"

- US Stock Futures Rise Amid Government Shutdown"

- June 8, 2025: US Stock Market Summary"

- US Passport and Shell Stock Photo High Resolut"

- PS5 Stock Update: What You Need to Know in the"

- US Refineries Stocks: A Comprehensive Guide to"

- Title: Understanding the Real Return on Your I"

recommend

Swiss Central Bank Sells US Stocks: Implicatio

Swiss Central Bank Sells US Stocks: Implicatio

Stock Market US Buying: Top Strategies for Suc

Stocks Against Us: Understanding the Risks and

Momentum Stocks: US Large Cap August 2025 Outl

US Gaming Stocks: A Thriving Industry with Luc

Title: Stock to Buy US: Top 5 Investment Oppor

Ex-US Stocks: Exploring Investment Opportuniti

Title: 2022 US Stock Market Performance: A Com

Education Stocks in US: A Comprehensive Guide

Can You Buy Hyundai Stock in the US?

Holding Dividend Stocks in a TFSA: A Strategic

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Top Stock US: Unveiling the Most Promising Inv"

- Top Momentum Stocks: Large Cap US Market This "

- Life Before the Stock Market in the US"

- Top US Oil Stocks: A Comprehensive Guide to In"

- Sonoma Pharmaceuticals US Stock: A Comprehensi"

- http stocks.us.reuters.com stocks fulldescript"

- US Cannabis Stock IPO: What You Need to Know"

- Stocks Have Been Good to Us: A Look at the Imp"

- Soybean Stocks US: The Current State and Futur"

- Title: Total US Stock Value: A Comprehensive O"