you position:Home > us stock market today > us stock market today

Unusual Options Activity Today: US Stocks in the Spotlight

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

The stock market is a dynamic and ever-evolving landscape, and today, it's no different. Unusual options activity has been observed in the US stock market, sparking interest and intrigue among investors and market analysts. In this article, we'll delve into the reasons behind this heightened activity and examine the potential implications for the market.

What is Unusual Options Activity?

Unusual options activity refers to a significant increase in trading volume or activity for options contracts on a particular stock. This activity can be indicative of underlying market sentiment, potential market movements, or strategic trading strategies.

Possible Reasons for Today's Activity

There are several factors that could contribute to the unusual options activity observed today in the US stock market:

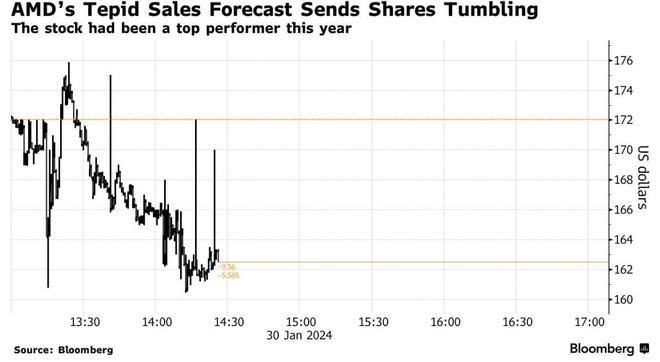

- Market Volatility: The stock market has been experiencing heightened volatility lately, and this can lead to increased options trading as investors look to hedge their positions or speculate on future movements.

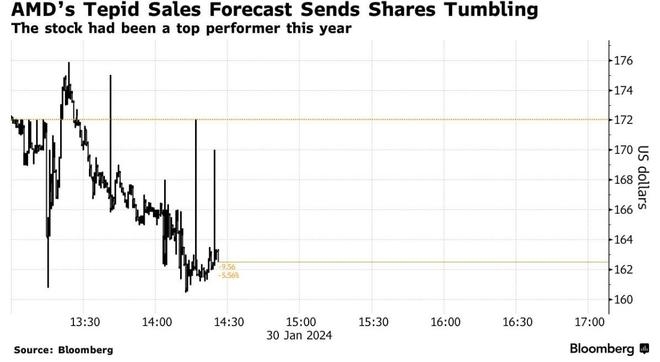

- Earnings Reports: With many companies releasing earnings reports, investors may be using options to gain exposure to stocks that have reported strong or weak results.

- Economic News: The release of key economic data can impact stock prices, and options traders may be positioning themselves for potential market movements.

Specific Stock Examples

Let's take a look at a couple of specific examples where unusual options activity has been observed:

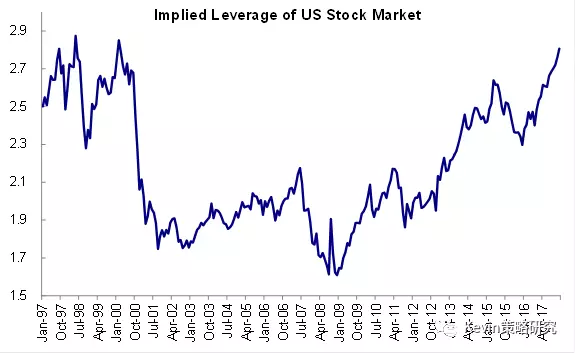

- Company A: Options volume for Company A has surged as investors anticipate a significant move in the stock following its earnings report. The options are being used to either bet on a price increase or to hedge against a potential decline.

- Company B: Options volume for Company B has also seen a significant increase, but this time due to a merger announcement. Traders are speculating on the potential benefits of the merger and the resulting stock price movement.

Implications for the Market

While unusual options activity can be a useful tool for investors and traders, it's important to approach it with caution. Here are a few key implications to consider:

- Potential for Gains: Unusual options activity can be indicative of significant market movements, providing opportunities for investors to capitalize on these trends.

- Increased Volatility: Higher options trading can lead to increased market volatility, which can be unsettling for some investors.

- Speculation: Unusual options activity can sometimes be driven by speculation rather than fundamental analysis, so it's important to do your due diligence before making investment decisions.

In conclusion, today's unusual options activity in the US stock market is a topic worth paying attention to. While it can provide valuable insights into market sentiment and potential movements, it's important to approach it with a critical eye and consider the potential risks involved. As always, it's crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

so cool! ()

last:Most US Focused Stocks: Top Picks for 2023

next:nothing

like

- Most US Focused Stocks: Top Picks for 2023

- Title: Us Cattle Stocks: The Heart of America's Beef Industry

- US Military Small Arms Stock: A Comprehensive Guide

- US Stock Hammer GPU: Unleashing the Power of Graphics Processing

- US Stock Circuit Breaker: Understanding Its Role in Market Stability

- Title: US Stock Holder vs. Canadian Share Holder: Understanding the Differences

- Title: US Stock Brokers for Non-Residents: Your Gateway to the American Stock Mar

- Title: Standard Chartered US Stock Price: A Comprehensive Guide

- Understanding US Stock Futures: A Comprehensive Guide

- Understanding the Tencent US ADR Stock Price: A Comprehensive Guide

- US Stock Market 2 Year Chart: A Comprehensive Analysis

- Is the US Stock Market Open Today 2020? A Comprehensive Guide

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- http www.mdcdiamonds.com engagementdetails.cfm"

recommend

Unusual Options Activity Today: US Stocks in t

Unusual Options Activity Today: US Stocks in t

Byrna Stock Price: What You Need to Know

International vs US Stocks: A Comparative Anal

When Does the US Stock Market Close Today? Und

Is There a New Stock Market Opening in the US?

US Coronavirus Stocks: Opportunities Amidst th

Bavarian Nordic Stock: The US Perspective on a

US Elections Impact on Stock Market: Understan

US Stock Earnings Surprise, AI Semiconductor P

May 27, 2025 US Stock Market Closing Summary

Toys R Us Stock Checker UK: The Ultimate Guide

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- High Dividend US Stocks 2017: A Guide to Top-Y"

- US Large Cap Stocks Momentum Leaders: Unveilin"

- Fred and the U.S. Stock Market Volatility: Nav"

- US Listed Pot Stocks: A Comprehensive Guide to"

- Primers in Stock: Your Ultimate Guide to High-"

- Stock Split Announced in US: What You Need to "

- Top Performing US Stocks Past 5 Days: Unveilin"

- Barclays Strategists Believe US Stocks Are Ove"

- Title: US Cyclical Stock ETF: A Strategic Inve"

- Nike Stock US: What You Need to Know About the"