you position:Home > us stock market today > us stock market today

US Company Stocks Below 30: Opportunities and Risks

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

Are you looking to invest in US company stocks but unsure where to start? One approach that has gained popularity is focusing on stocks below $30. In this article, we'll explore the opportunities and risks associated with investing in such companies.

Understanding the Market

Stocks below

Opportunities

Potential for Growth: Companies below $30 often have significant growth potential. These businesses may be in the early stages of expansion or just beginning to tap into new markets.

Value Investing: These stocks can be attractive for value investors. They might be undervalued due to market volatility or temporary setbacks, offering an opportunity to buy at a low price.

Dividends: Some mid-cap companies offer dividends, providing investors with a steady income stream.

Access to the Market: Investing in these stocks gives you access to a broad range of industries, from technology to healthcare to consumer goods.

Risks

Market Volatility: Stocks below $30 can be more volatile than larger companies, leading to higher risk.

Economic Factors: Economic downturns can significantly impact mid-cap companies, as they may not have the financial stability of larger corporations.

Regulatory Changes: Changes in regulations can have a more significant impact on smaller companies.

Case Studies

Apple: Once a mid-cap company, Apple has grown to become one of the world's most valuable companies. Investing in Apple when it was a mid-cap could have been highly profitable.

Amazon: Similarly, Amazon started as a mid-cap company and has since become a global powerhouse. Investing in Amazon in its early days could have yielded substantial returns.

How to Invest in US Company Stocks Below 30

Research: Conduct thorough research on the company's financial health, growth prospects, and industry trends.

Diversify: Don't put all your money in one stock. Diversify your portfolio to reduce risk.

Stay Informed: Keep up with market trends and economic news that could impact your investments.

Consult a Financial Advisor: If you're unsure, it's always a good idea to consult a financial advisor.

Investing in US company stocks below $30 can be a lucrative venture, but it comes with its own set of risks. Understanding these opportunities and risks can help you make informed decisions. Always remember to do thorough research and consider seeking advice from a financial professional.

so cool! ()

like

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol kget.

- Buying Canadian Stocks in the US: A Strategic Guide

- Us Plexiglass Manufacturers Stock: Your Ultimate Guide to Quality & Selec

- Total Number of US Listed Stocks: A Comprehensive Overview"

- "Cannabis Stocks and the US Election: A Comprehensive Analysis"

- "https Simplywall.st Stocks US Household NYSE-ELF ELF-Beauty: A Deep Div

- Si1935b Stock in US: The Ultimate Guide to Investment Opportunities

- Best Japanese Stocks to Invest In the US Market

- US Stock Indices Performance: October 2025 Review

- Graphene US Stock: A Game-Changer in the Tech Industry

- Small Cap Tech Stocks: Unveiling the US Growth Potential

- Superhero US Stocks: Unveiling the Powerhouse Performers

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

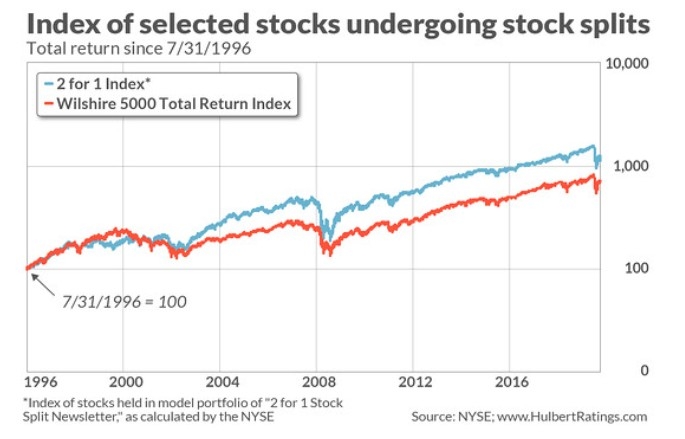

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- http www.mdcdiamonds.com engagementdetails.cfm"

recommend

US Company Stocks Below 30: Opportunities and

US Company Stocks Below 30: Opportunities and

Samsung Note 5 US Cellular Stock ROM: A Compre

Sephora US Stock Price: A Comprehensive Analys

Boeing Stock Price Today: Key Insights and Ana

Understanding the "US Natural Gas Sto

March 2022 IPOs: A Deep Dive into the US Stock

US Gold Miner Stocks: A Comprehensive Guide to

Stock Invest: Understanding WTW in the US Mark

Lithium Mine Stocks: The US Market's Brig

SNES Mini Stock US: The Ultimate Guide to Find

Kuvera Invest in US Stocks: Your Ultimate Guid

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Total Number of US Listed Stocks: A Comprehens"

- US IT Stocks List: A Comprehensive Guide to In"

- Title: Top 25 Stock Brokers in the US Online"

- Stock Trading Holidays in the US: What You Nee"

- Title: US Gas Company Stocks: A Comprehensive "

- Palantir US Stock: A Deep Dive into the Data A"

- Stream for Us TV Subscription Out of Stock: Wh"

- Best US Cannabis Stocks to Watch in 2023"

- How to Start Investing in the US Stock Market"

- Si1935b Stock in US: The Ultimate Guide to Inv"