you position:Home > us stock market today > us stock market today

How to Start Investing in the US Stock Market

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

Investing in the US stock market can be a lucrative endeavor, but it’s important to approach it with knowledge and strategy. Whether you’re a beginner or looking to expand your investment portfolio, this guide will walk you through the steps to start investing in the US stock market.

Understanding the Basics

Before diving in, it’s crucial to understand the basics of the stock market. Stocks represent a share of ownership in a company. When you buy a stock, you become a shareholder, which entitles you to a portion of the company’s profits and voting rights in certain matters.

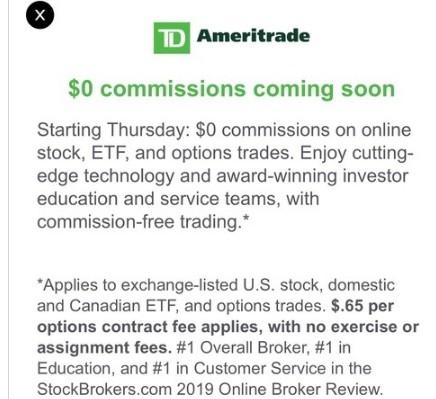

Choose a Brokerage Account

To start investing, you’ll need a brokerage account. This is where you’ll purchase and sell stocks. There are several types of brokerage accounts, including:

- Online Brokerage Accounts: These accounts are typically low-cost and easy to manage online.

- Full-Service Brokerage Accounts: These accounts offer personalized advice and services but come with higher fees.

- Robo-Advisors: These are automated platforms that offer investment advice based on your risk tolerance and financial goals.

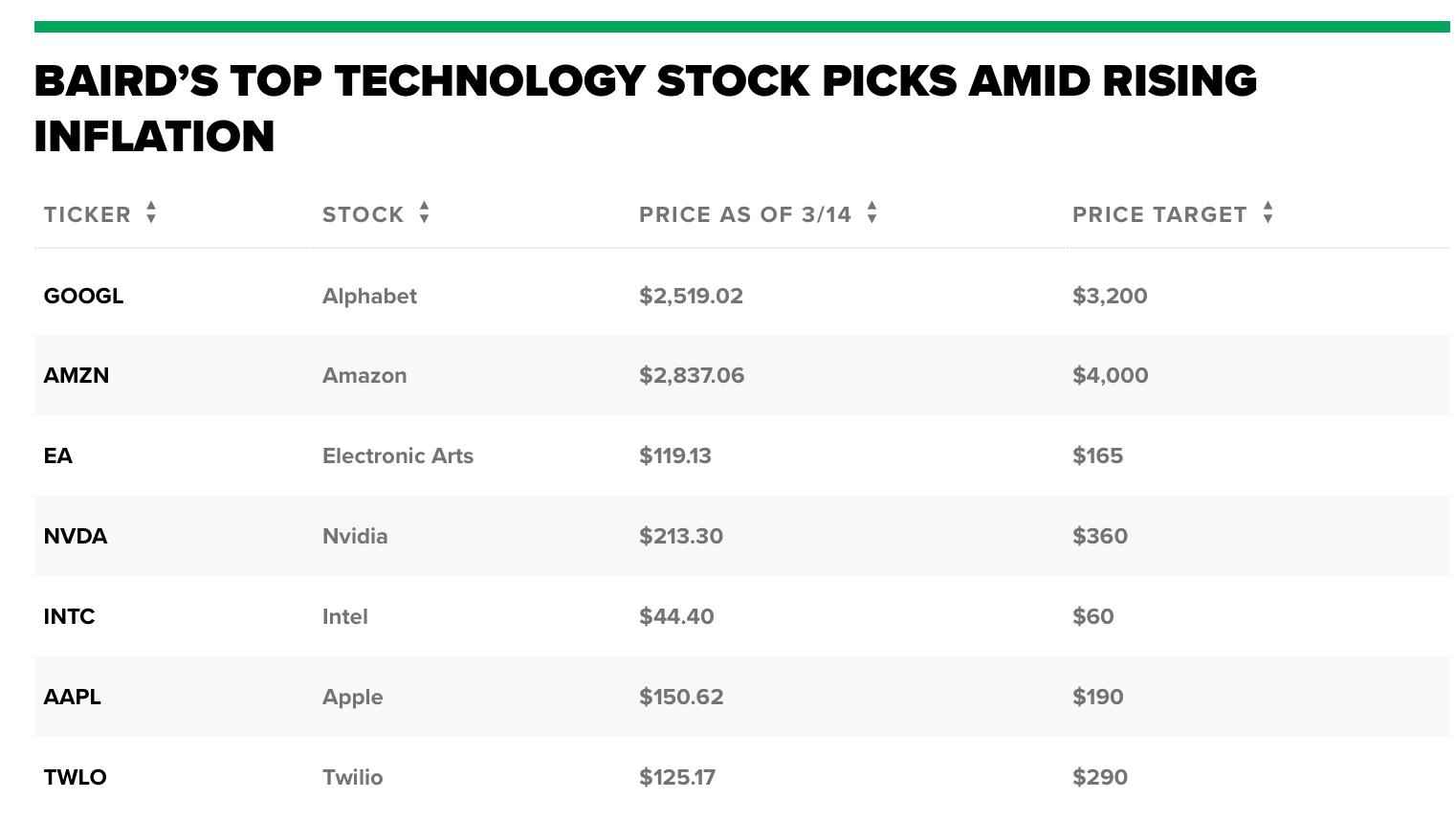

Research and Select Stocks

Once you have a brokerage account, the next step is to research and select stocks. Here are some tips to help you get started:

- Understand Your Investment Strategy: Decide whether you want to invest in individual stocks, exchange-traded funds (ETFs), or mutual funds. Each option has its own advantages and risks.

- Analyze Financial Statements: Look at the company’s financial statements, including its income statement, balance sheet, and cash flow statement. This will give you an idea of the company’s financial health and profitability.

- Consider Market Trends: Keep an eye on market trends and economic indicators that can impact stock prices.

Diversify Your Portfolio

Diversification is key to managing risk in your investment portfolio. This means investing in a variety of stocks across different industries and geographical regions. Here are some ways to diversify:

- Index Funds: These funds track a specific market index, such as the S&P 500, and provide exposure to a wide range of stocks.

- Sector Funds: These funds focus on a particular industry, such as technology or healthcare.

- International Funds: These funds invest in stocks outside of the United States.

Monitor Your Investments

Once you’ve made your investments, it’s important to monitor them regularly. This will help you stay informed about market trends and make adjustments to your portfolio as needed. Here are some tips for monitoring your investments:

- Use Online Tools: Many brokerage firms offer online tools and resources to help you track your investments.

- Set Realistic Goals: Establish realistic goals for your investments and review them periodically.

- Stay Informed: Keep up with the latest news and events that can impact the stock market and your investments.

Case Study: Apple Inc.

A classic example of a successful stock investment is Apple Inc. (AAPL). When Steve Jobs returned to Apple in 1997, the company was on the brink of bankruptcy. However, through strategic decisions and innovative products, Apple transformed into one of the most valuable companies in the world. Investors who bought Apple stock in the 1990s and held onto it have seen their investments soar.

Conclusion

Starting to invest in the US stock market can be daunting, but with the right knowledge and approach, it can be a rewarding experience. By understanding the basics, choosing the right brokerage account, researching stocks, diversifying your portfolio, and monitoring your investments, you can increase your chances of success. Remember, investing involves risk, so always do your research and seek professional advice if necessary.

so cool! ()

last:US Airport Stocks: A Flight Path to Profitability

next:nothing

like

- US Airport Stocks: A Flight Path to Profitability

- Title: US Marijuana Stocks Listed in Canada: A Comprehensive Guide

- TSMC US Stock Today: A Comprehensive Analysis

- Understanding the Challenges of the U.S. Aging Housing Stock

- Can I Trade US Stocks from Europe?

- Average Dividend Yield of US Stocks: A Comprehensive Guide

- Fred and the U.S. Stock Market Volatility: Navigating the Storm

- Title: US Foods Stock Yards Meat Buffalo NY 14219: A Hub for Premium Meat Solutio

- How Will Brexit Affect the US Stock Market?

- US Steel Stock Q: A Comprehensive Guide to Understanding and Investing in US Stee

- Title: US Mexico Tariff Stock Market: Understanding the Impacts

- US Stock Market 2022 Performance: A Comprehensive Analysis

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Pyrogenesis Stock US: A Deep Dive into Investm"

- Highest Dividend Yield Stocks in the US: Top P"

- Is the US Stock Market Open Today on Columbus "

- Infineon US Stock: A Comprehensive Analysis"

- Does Among Us Have Stock? A Comprehensive Guid"

- How to Buy a US Stock: A Step-by-Step Guide"

recommend

How to Start Investing in the US Stock Market

How to Start Investing in the US Stock Market

How to Buy a US Stock: A Step-by-Step Guide

Top Stocks to Buy in July 2025: US Market Insi

Title: US Stock Market Performance on May 9, 2

Jet's US Stock: Unveiling the Investment

107 Stockings Brook Rd, Berlin, CT, US: A Prim

IBM US Stock: A Comprehensive Guide to Investi

TSMC US Stock Today: A Comprehensive Analysis

Title: US Stock Low Price: Understanding the O

Reuters US Stock News: Stay Ahead of the Curve

Is the US Stock Market Open Next Monday?

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Most Expensive US Stocks: A Closer Look at the"

- How to Buy MediaTek Stock in the US"

- Title: ETF US Stock: A Comprehensive Guide to "

- How Many Trillions is the US Stock Market Wort"

- Palantir US Stock: A Deep Dive into the Data A"

- 107 Stockings Brook Rd, Berlin, CT, US: A Prim"

- Title: US Stock Market Performance on May 9, 2"

- Highest Dividend Yield Stocks in the US: Top P"

- Safest US Stocks: How to Invest Wisely in the "

- US Large Cap Momentum Stocks: Best Performers "