you position:Home > us stock market today > us stock market today

Title: Mid Cap Stocks: Growth Companies in the US

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

Are you looking to diversify your investment portfolio with high-growth companies? Mid cap stocks might just be the answer. These companies, with market capitalizations between

Understanding Mid Cap Stocks

Mid cap stocks represent a significant portion of the US stock market. They are considered less risky than small-caps due to their larger market capitalization but still offer the potential for rapid growth. These companies are often in the middle stages of their development, with a strong business model and a clear path to growth.

The Benefits of Investing in Mid Cap Stocks

Investing in mid cap stocks can offer several advantages:

Potential for High Growth: Mid cap companies often experience rapid growth as they expand their market share and increase their revenue. This can lead to significant returns for investors.

Stability: While mid cap stocks are less stable than large-cap stocks, they are generally more stable than small-caps. This means they can offer a balance between growth potential and risk.

Access to the Market: Mid cap companies are often well-established and have access to the capital markets. This can help them fund their growth initiatives and expand their operations.

Growth Companies to Watch

Several mid cap growth companies in the US have caught the attention of investors:

Amazon Web Services (AWS): As part of Amazon, AWS is a leader in cloud computing. It offers a wide range of cloud services, including computing power, database storage, and analytics.

Intuit: Intuit is a financial software company that offers products like QuickBooks, TurboTax, and Mint. The company has a strong presence in the small business market and is constantly innovating to meet the needs of its customers.

Workday: Workday is a cloud-based enterprise software company that provides applications for human resources, finance, and planning. The company is known for its innovative approach to software development and its focus on customer satisfaction.

Case Study: Netflix

A prime example of a mid cap stock that has turned into a high-growth company is Netflix. Founded in 1997, Netflix started as a DVD rental company. However, the company quickly shifted its focus to streaming and has become a dominant player in the entertainment industry. Today, Netflix has over 200 million subscribers worldwide and continues to grow at a rapid pace.

Conclusion

Investing in mid cap stocks can be a great way to achieve high returns while managing risk. By focusing on growth companies, investors can capitalize on the potential for rapid expansion and increased profitability. Whether you're a seasoned investor or just starting out, mid cap stocks are a valuable addition to any investment portfolio.

so cool! ()

last:Undervalued US Stocks 2015: Opportunities Amidst the Market Turmoil

next:nothing

like

- Undervalued US Stocks 2015: Opportunities Amidst the Market Turmoil

- US Quantum Stocks: The Future of Innovation and Investment

- Title: US Oil Companies Stock Symbols: Your Guide to Investing in Energy

- Top Ten US Stocks by Market Cap: A Comprehensive Guide

- US Auto Parts Stocks: A Comprehensive Guide to the Market

- Total Market Cap US Stock Market 2025: What to Expect and How It Impacts Your Inv

- Roblox US Stock: A Thriving Investment Opportunity in the Gaming Industry

- Unusual Options Activity Today: US Stocks in the Spotlight

- Most US Focused Stocks: Top Picks for 2023

- Title: Us Cattle Stocks: The Heart of America's Beef Industry

- US Military Small Arms Stock: A Comprehensive Guide

- US Stock Hammer GPU: Unleashing the Power of Graphics Processing

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

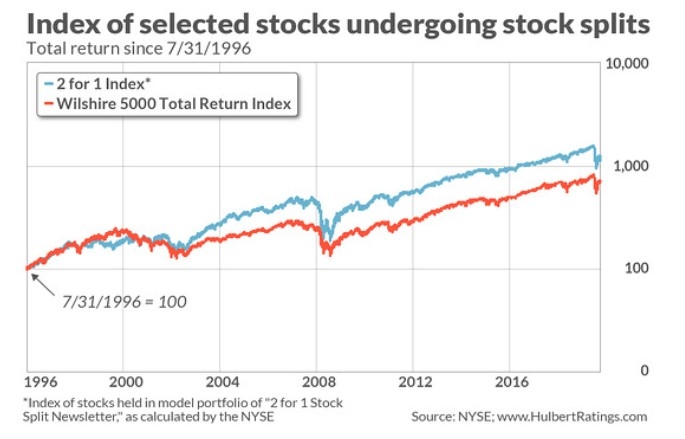

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- http www.mdcdiamonds.com engagementdetails.cfm"

recommend

Title: Mid Cap Stocks: Growth Companies in the

Title: Mid Cap Stocks: Growth Companies in the

Stock R Us Cebu: Your Ultimate Destination for

MPX International Stock: An In-Depth Look into

Title: Top Large Cap Growth Stocks to Watch in

Organigram Stock US: A Comprehensive Guide to

T-Mobile US to Give Away Stock to Customers: A

US Health Officials Stock Up on Necessities: P

Title: The Effect of US Interest Rate Cut on J

Superhero Us Stocks: The Unstoppable Force of

Switch 2 Stock Tracker US: Your Ultimate Tool

Tax Treatment of Stock Options in the U.S.

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Ericsson Stock US: A Comprehensive Guide to In"

- Title: US Oil Companies Stock Symbols: Your Gu"

- When Does the US Stock Market Open?"

- Stock Trading Holidays in the US: What You Nee"

- How to Buy MediaTek Stock in the US"

- Live Indian ADR Price in US Stock Market: Ever"

- Title: App for US Stocks: The Ultimate Investm"

- US Long-Term Stocks to Invest: Apple – A Sma"

- US Senators Selling Stock: A Closer Look at th"

- Title: US Cyclical Stock ETF: A Strategic Inve"