you position:Home > us stock market today > us stock market today

How Much Has the US Stock Market Dropped?

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

The US stock market has been a hot topic of discussion among investors, economists, and market analysts. With the recent volatility and downturns, many people are wondering: How much has the US stock market dropped? In this article, we'll delve into the various factors contributing to the market's decline and provide a comprehensive analysis of the extent of the drop.

Understanding the Stock Market Decline

The US stock market, represented by indices like the S&P 500 and the Dow Jones Industrial Average, has experienced several periods of decline in recent years. The decline can be attributed to a variety of factors, including economic uncertainties, geopolitical tensions, and changes in market sentiment.

Economic Uncertainties

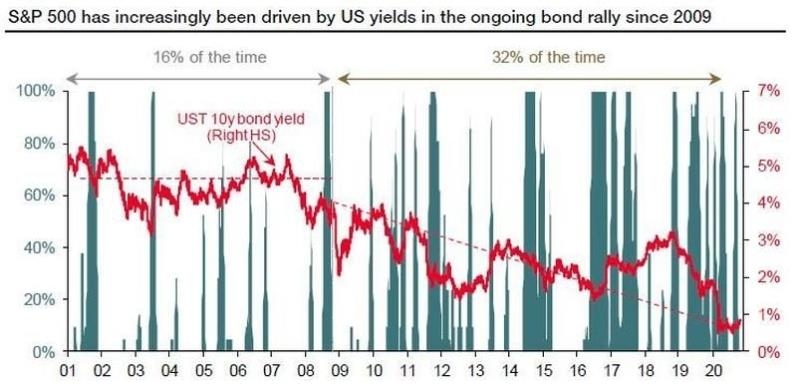

One of the primary reasons for the stock market's decline is economic uncertainties. Factors such as rising interest rates, inflation concerns, and trade wars have created a tense environment for investors. For instance, the Federal Reserve's decision to raise interest rates has had a significant impact on the stock market, as it affects borrowing costs and corporate earnings.

Geopolitical Tensions

Geopolitical tensions, such as those between the US and China, have also contributed to the stock market's decline. These tensions have raised concerns about global trade and economic growth, leading to a cautious approach among investors.

Market Sentiment

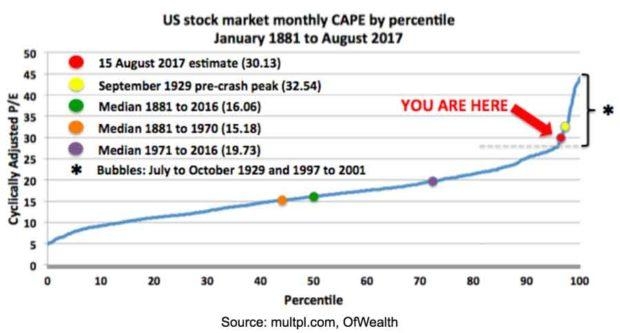

Market sentiment plays a crucial role in the stock market's performance. When investors become overly optimistic, they may drive the market to unsustainable levels. Conversely, when investors become overly pessimistic, it can lead to a sharp decline in stock prices.

The Extent of the Stock Market Drop

The extent of the stock market drop varies depending on the time frame and the specific index being considered. For example, in the first half of 2022, the S&P 500 experienced a decline of approximately 20% from its highs. This decline was a result of various factors, including rising inflation and concerns about the Federal Reserve's monetary policy.

Case Studies

To provide a clearer picture, let's consider a few case studies:

- COVID-19 Pandemic: In 2020, the stock market experienced one of the most significant declines in history due to the COVID-19 pandemic. However, it recovered quickly, with the S&P 500 returning to its pre-pandemic levels within a year.

- Dot-Com Bubble: In the early 2000s, the dot-com bubble burst, leading to a significant decline in the stock market. The NASDAQ Composite, which was heavily weighted in technology stocks, fell by over 70% from its peak.

- 2008 Financial Crisis: The financial crisis of 2008 resulted in a severe stock market decline, with the S&P 500 falling by approximately 50% from its peak.

Conclusion

In conclusion, the US stock market has experienced several periods of decline in recent years. The extent of the drop varies depending on the factors contributing to the downturn and the specific index being considered. As investors, it's crucial to stay informed about the market's performance and the factors driving it. By understanding the reasons behind the stock market's decline, investors can make more informed decisions and navigate the volatile market more effectively.

so cool! ()

last:Title: Stock Market Capitalization in the US: A Comprehensive Guide

next:nothing

like

- Title: Stock Market Capitalization in the US: A Comprehensive Guide

- EV Charging US Stock: The Future of Electric Vehicle Infrastructure

- US Stock Data: A Comprehensive Guide to Understanding the Market

- US Marijuana Stocks List: A Comprehensive Guide for Investors

- Toys "R" Us Stock Crew Interview Questions: What You Need to Kn

- Cresco Labs US Stock: A Comprehensive Overview

- Understanding US Stock Exchange Gold Prices: The Ultimate Guide

- Title: US Stock Market - A Comprehensive Guide for Investors

- Title: Top Large Cap Growth Stocks to Watch in the US for 2025

- London Stock Exchange: A Gateway for US Companies

- June 22, 2025 US Stock Market Summary

- Understanding the US Preferred Stock Tax Implications

hot stocks

When Does the US Stock Market Open?

When Does the US Stock Market Open?- US Rare Earth Stock: A Lucrative Investment Op"

- When Does the US Stock Market Open?"

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Stock Split Announced in US: What You Need to "

- Title: US Stock Market Adhere to International"

- Title: US Government Stock Market: A Comprehen"

- Funeral Home Stocks: A Glimpse into the US Mar"

- Toys "R" Us Items Located in"

recommend

How Much Has the US Stock Market Dropped?

How Much Has the US Stock Market Dropped?

How to Buy a US Stock: A Step-by-Step Guide

Title: US Stock Investment Group WhatsApp: Rev

EV Charging US Stock: The Future of Electric V

US Airline Stock Price: What You Need to Know

Mounjaro Stock Availability in the US: What Yo

Title: US Alliance Stock Price: A Comprehensiv

US Large Cap Stocks: Best Performers in Septem

Title: Current US and Europe Stock Market: Ins

Indian ADRs in the US Stock Market: A Comprehe

Accounting for Stock Options under US GAAP: A

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- IBM US Stock: A Comprehensive Guide to Investi"

- Title: US Stock Low Price: Understanding the O"

- Best US Stocks for DCA Long-Term Investment in"

- Manipulate the US Stock Market: Understanding "

- Highest P/E Ratio Stocks in the US: A Deep Div"

- Good Stocks to Buy Now: Top Picks for Investor"

- US China Trade Stock Market: A Comprehensive A"

- Short-Term High Momentum US Stocks: A Guide to"

- Tilt Stock: US Ticker to Watch"

- How Much Is the Total US Stock Market Worth?"