you position:Home > us stock market live > us stock market live

How Can Canadian Invest in US Stocks?

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

Investing in US stocks from Canada offers a wealth of opportunities for growth and diversification. With the right strategies and knowledge, Canadian investors can capitalize on the robust US stock market. This article delves into the process and provides essential insights to help Canadian investors make informed decisions.

Understanding the Basics

Before diving into the specifics, it's crucial to understand the basics of investing in US stocks. Unlike Canadian stocks, which are listed on Canadian exchanges, US stocks are listed on exchanges such as the New York Stock Exchange (NYSE) and the NASDAQ. Canadian investors can purchase these stocks through various methods, including direct investments, brokerage accounts, and ETFs.

Direct Investments

The most straightforward method for Canadian investors to purchase US stocks is through a direct investment. This involves opening a brokerage account with a Canadian brokerage firm that offers access to US stocks. Once the account is set up, investors can deposit Canadian dollars or USD and purchase US stocks directly.

Brokerage Accounts

A brokerage account is a common tool for Canadian investors looking to invest in US stocks. Many Canadian brokerage firms offer access to the US stock market, allowing investors to trade US stocks as easily as Canadian stocks. Key factors to consider when choosing a brokerage account include fees, minimum investment requirements, and customer support.

ETFs (Exchange-Traded Funds)

ETFs are another popular option for Canadian investors looking to invest in US stocks. These funds track a basket of US stocks and are traded on exchanges like Canadian stocks. ETFs offer diversification and lower fees compared to individual stock purchases, making them an attractive option for many investors.

Tax Implications

It's essential for Canadian investors to understand the tax implications of investing in US stocks. While Canadian tax laws apply to income generated from US stocks, investors must also consider US tax laws. This includes reporting US dividend income and capital gains on Canadian tax returns. It's advisable to consult a tax professional to ensure compliance with both Canadian and US tax laws.

Tips for Canadian Investors

Research and Due Diligence: Conduct thorough research on the companies you're interested in investing in. Analyze financial statements, market trends, and industry outlooks to make informed decisions.

Diversification: Diversify your investment portfolio to mitigate risks. Consider investing in a mix of sectors, industries, and geographic regions.

Risk Management: Understand your risk tolerance and invest accordingly. Avoid investing more than you can afford to lose.

Stay Informed: Keep up-to-date with market news, economic indicators, and company developments to make informed investment decisions.

Use Technology: Leverage technology and online resources to streamline your investment process. Many brokerage firms offer advanced trading platforms and tools to help investors make informed decisions.

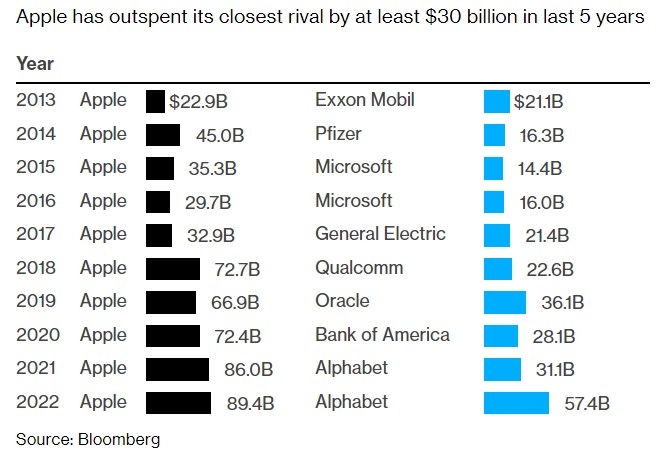

Case Study: Invest in Apple (AAPL)

Consider Apple (AAPL), one of the most successful companies in the world. As a Canadian investor, you can purchase Apple stocks through a brokerage account or ETF. Over the past decade, Apple has consistently delivered strong returns, making it an attractive investment for many.

In conclusion, investing in US stocks from Canada is a viable option for Canadian investors looking to diversify their portfolios. By understanding the process, considering tax implications, and conducting thorough research, Canadian investors can successfully invest in US stocks and potentially benefit from the growth and stability of the US stock market.

so cool! ()

last:Impact of US Interest Rate Cuts on US Stock Market

next:nothing

like

- Impact of US Interest Rate Cuts on US Stock Market

- Title: Top US Stocks 2023: A Comprehensive Guide to Investment Opportunities

- Best US Pot Stock: Your Ultimate Guide to Investing in the Cannabis Industry

- 2023 Stock Market Predictions: What to Expect in the US

- US IT Stocks List: Your Ultimate Guide to Investing in the Tech Sector

- Title: Top Momentum US Large Cap Stocks Last 5 Days

- Samsung Stock During US Recession: What You Need to Know

- Highest Quality US Stocks: Your Guide to Investment Success

- Toys "R" Us Stock Clerk Pay: Understanding the Compensation and

- Stock Investment in the US: A Comprehensive Guide

- September 2, 2025 US Stock Market Summary

- Stock Market Mixed After China Retaliates to US Tariffs

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Title: Best Non-US Dividend Stocks to Invest I"

- Buy Us Stock from Malaysia: A Lucrative Invest"

- NVEI US Stock: Unveiling the Investment Potent"

recommend

How Can Canadian Invest in US Stocks?

How Can Canadian Invest in US Stocks?

The Price of US Oil Stock: What You Need to Kn

How Many Stock Traders Are There in the US?

Us Cannalytics Stock Ticker: Unveiling the Fut

Current US Stock Market Overview: April 2025

Good US Stocks: A Comprehensive Guide to Inves

Understanding the US Oil Stock Market: A Compr

2023 Stock Market Predictions: What to Expect

US Stock Earnings Season: What You Need to Kno

How Is the US Stock Market Performing Today?

Binance US Stock Symbol: Everything You Need t

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Toys "R" Us Stock Clerk Pay:"

- ASX US Stock: Understanding the Intersection o"

- Can I Buy US Stocks in Singapore? A Comprehens"

- How Many Countries Invest in the US Stock Mark"

- Understanding the US Clothing Stock Market Log"

- The Most Expensive Publicly Traded Stock in th"

- Title: TFSA Buy US Stocks: A Guide for Canadia"

- Highest Quality US Stocks: Your Guide to Inves"

- B Stock US: A Comprehensive Guide to Buying an"

- Title: How Many Stock Markets Are in the US?"