you position:Home > us stock market live > us stock market live

Stock Market Mixed After China Retaliates to US Tariffs

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

In a swift and decisive move, China has retaliated against the United States' recent imposition of tariffs, leading to a mixed reaction in the stock market. As tensions escalate between the world's two largest economies, investors are left grappling with uncertainty and the potential for broader market implications.

The Retaliatory Measures

China's Ministry of Commerce announced that it would impose tariffs on

Market Reactions

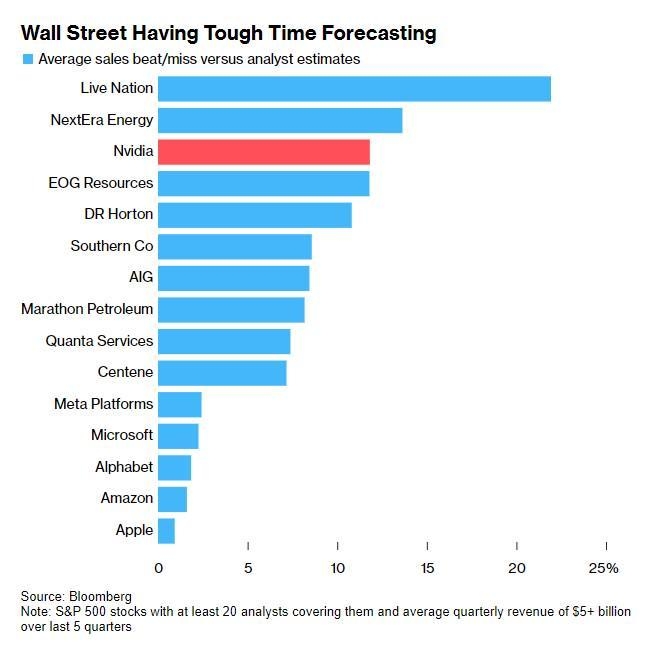

The stock market's initial reaction to China's retaliatory measures was mixed. While some sectors experienced significant declines, others remained relatively stable. The technology sector, heavily reliant on Chinese exports, saw some of the steepest declines, with shares of major tech companies like Apple and Intel falling sharply.

Agricultural Stocks Take a Hit

Agricultural stocks were particularly hard hit, as China's retaliatory measures targeted a wide range of U.S. agricultural products, including soybeans, pork, and wheat. Companies like Archer-Daniels-Midland and Bunge saw their shares drop significantly, reflecting the potential impact of the trade tensions on the agricultural sector.

Tech Stocks Under Pressure

Tech stocks also came under pressure, as the trade tensions raised concerns about the potential impact on global supply chains. Companies like Broadcom and Micron Technology saw their shares decline, reflecting broader concerns about the impact of the trade war on the technology sector.

Consumer Stocks Remain Stable

In contrast, consumer stocks remained relatively stable, with companies like Procter & Gamble and Johnson & Johnson experiencing minimal declines. This suggests that investors are somewhat optimistic about the long-term prospects of the consumer sector, despite the short-term impact of the trade tensions.

Impact on Global Markets

The trade tensions between the U.S. and China have raised concerns about the potential impact on global markets. Analysts are closely monitoring the situation, as the trade war could have broader implications for the global economy, including higher inflation and slower economic growth.

Case Study: Apple and China

One notable case study is Apple, which relies heavily on Chinese exports. The company's shares fell sharply following China's announcement of retaliatory measures, reflecting concerns about the potential impact on its global supply chain. However, Apple has also been working to diversify its supply chain, which may help mitigate the impact of the trade tensions in the long term.

Conclusion

The stock market's mixed reaction to China's retaliatory measures highlights the uncertainty and potential volatility that come with the ongoing trade tensions between the U.S. and China. As investors grapple with the potential impact on various sectors, it remains to be seen how the situation will unfold in the coming months.

so cool! ()

like

- DIA US Stock: A Comprehensive Guide to Understanding and Investing in Diana Shipp

- B Stock US: A Comprehensive Guide to Buying and Selling Undervalued Stocks

- US Stock List Download: How to Access the Best Resources for Investors

- Title: Highest Priced Stock Share Price in US Market

- Understanding the US Cannabis Stock ETF: A Comprehensive Guide

- Understanding the US Clothing Stock Market Logo: A Comprehensive Guide

- US Publicly Traded Pot Stocks: A Comprehensive Guide

- Title: Best Non-US Dividend Stocks to Invest In

- Top Performing US Stocks 2025 Outlook: What to Expect and How to Invest Wisely

- Title: US Cell Stock: A Comprehensive Guide to Understanding and Investing

- Konica Minolta Stock US: A Comprehensive Analysis

- US Foods Stock Yards Meat Aurora IL 60502: A Comprehensive Overview

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Title: Best Non-US Dividend Stocks to Invest I"

- Buy Us Stock from Malaysia: A Lucrative Invest"

- NVEI US Stock: Unveiling the Investment Potent"

recommend

Stock Market Mixed After China Retaliates to U

Stock Market Mixed After China Retaliates to U

Enterprise Stocks in the US: A Comprehensive G

Title: TFSA Buy US Stocks: A Guide for Canadia

Title: State Az US Stocking Schedule: The Ulti

US Asphalt Stock: The Ultimate Guide to Invest

Stocks by Volume Traded in the US: Understandi

HelloFresh US Stock: An In-Depth Look at the M

How to Search Australian Stocks from the US

Buy Us Stock from Malaysia: A Lucrative Invest

Understanding the US Cannabis Stock ETF: A Com

Computershare US Stock Price: What You Need to

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Title: Does the U.S. Military Protect Us Stock"

- Title: UK Investing in US Stocks: A Boglehead&"

- Total US Stock Market Vanguard Fund: A Compreh"

- Undervalued Us Stocks: Unveiling Hidden Opport"

- Is the US Stock Market Open on Columbus Day 20"

- Title: US Stock Market in 2004: A Look Back at"

- Invest in US Stocks from Singapore: A Guide fo"

- Holidays of the US Stock Market: Understanding"

- Is US Stock Swimsuits the Same as Their Pricie"

- Indian Stocks on the US Stock Exchange: A Comp"