you position:Home > us stock market live > us stock market live

Highest Quality US Stocks: Your Guide to Investment Success

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

Investing in the stock market can be a lucrative venture, but identifying the highest quality US stocks is crucial for long-term success. With numerous companies to choose from, it's essential to conduct thorough research and consider various factors before making investment decisions. This article aims to provide you with valuable insights into identifying the highest quality US stocks and the benefits of investing in them.

Understanding Quality Stocks

Quality stocks are those that possess strong fundamentals, such as a solid financial position, a strong management team, and a sustainable competitive advantage. These companies tend to offer higher returns and lower risk compared to their peers. Here are some key factors to consider when evaluating the quality of a stock:

- Financial Health: Look for companies with strong balance sheets, high profitability, and consistent revenue growth.

- Management Team: Assess the experience, track record, and vision of the company's leadership.

- Competitive Advantage: Identify companies with a unique product or service, strong brand, or innovative technology that gives them an edge over competitors.

Top US Stocks to Consider

Several US companies have consistently demonstrated high-quality characteristics and have the potential to deliver strong returns. Here are some notable examples:

- Apple Inc. (AAPL): As one of the world's largest technology companies, Apple has a strong brand, innovative products, and a loyal customer base. Its financial health is exceptional, with substantial revenue growth and a strong balance sheet.

- Microsoft Corporation (MSFT): Microsoft is a leader in the technology industry, offering a wide range of products and services, including cloud computing, software, and hardware. The company has a strong management team and a competitive advantage in its diverse product portfolio.

- Amazon.com, Inc. (AMZN): Amazon is a dominant player in the e-commerce industry, with a vast product selection and a robust logistics network. The company has a strong competitive advantage and has been able to expand into various markets, including cloud computing and streaming services.

Case Study: Procter & Gamble (PG)

Procter & Gamble (PG) is a consumer goods giant with a long history of delivering strong returns for investors. Here's a breakdown of the factors that contribute to its quality:

- Financial Health: PG has a strong balance sheet, with low debt levels and consistent profitability. The company's revenue has grown steadily over the years, driven by its diverse product portfolio.

- Management Team: PG's management team has a proven track record of delivering strong performance and making strategic decisions that benefit the company and its shareholders.

- Competitive Advantage: PG has a strong brand and a wide range of products that cater to various consumer needs. The company has also been successful in expanding into emerging markets, further enhancing its growth prospects.

Conclusion

Investing in the highest quality US stocks can provide investors with strong returns and lower risk. By focusing on companies with solid fundamentals, a strong management team, and a sustainable competitive advantage, investors can make informed decisions and build a robust investment portfolio. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions.

so cool! ()

like

- Toys "R" Us Stock Clerk Pay: Understanding the Compensation and

- Stock Investment in the US: A Comprehensive Guide

- September 2, 2025 US Stock Market Summary

- Stock Market Mixed After China Retaliates to US Tariffs

- DIA US Stock: A Comprehensive Guide to Understanding and Investing in Diana Shipp

- B Stock US: A Comprehensive Guide to Buying and Selling Undervalued Stocks

- US Stock List Download: How to Access the Best Resources for Investors

- Title: Highest Priced Stock Share Price in US Market

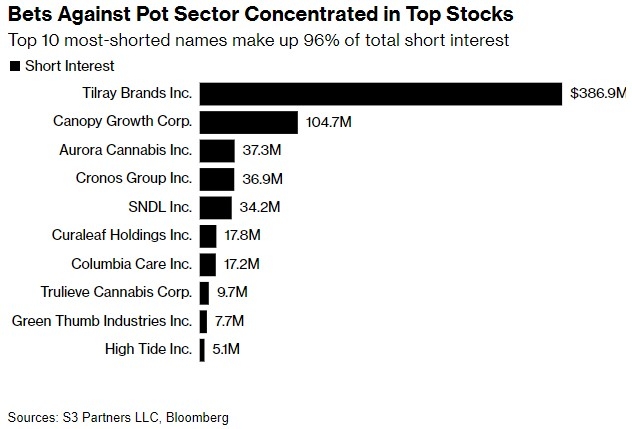

- Understanding the US Cannabis Stock ETF: A Comprehensive Guide

- Understanding the US Clothing Stock Market Logo: A Comprehensive Guide

- US Publicly Traded Pot Stocks: A Comprehensive Guide

- Title: Best Non-US Dividend Stocks to Invest In

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Title: Best Non-US Dividend Stocks to Invest I"

- Buy Us Stock from Malaysia: A Lucrative Invest"

- NVEI US Stock: Unveiling the Investment Potent"

recommend

Highest Quality US Stocks: Your Guide to Inves

Highest Quality US Stocks: Your Guide to Inves

US Steel Stock: A Comprehensive Yahoo Finance

Stock Us Foods: Revolutionizing the Way We Buy

Holidays of the US Stock Market: Understanding

Toys "R" Us Stocker Job Desc

Join Us Stock Photo: Unleash the Power of Visu

Title: Total US Oil Stock: A Comprehensive Ove

Us Gold Corp Stock Forecast: What You Need to

"http stocks.us.reuters.com stocks fu

US Steel Stock Trend: What You Need to Know

How the US Stock Market Did Today: A Comprehen

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Top US Stocks Dividend: Your Guide to High-Yie"

- How to Join the Stock Market in the US: A Comp"

- US Stock List Download: How to Access the Best"

- August 19, 2025: US Stock Market Summary"

- Stocks by Volume Traded in the US: Understandi"

- Top Momentum Stocks Past Week: US Market Insig"

- Understanding the US Clothing Stock Market Log"

- Indian Stocks on the US Stock Exchange: A Comp"

- Is the US Stock Market Closed Right Now?"

- Root Stock US: Exploring the Benefits and Appl"