you position:Home > us stock market live > us stock market live

1990-2010 US Stock Market Volatility: A Comprehensive Analysis

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

The stock market is often considered the heartbeat of the economy. It reflects the overall health and stability of a nation's financial system. In this article, we delve into the volatility of the US stock market from 1990 to 2010, exploring the factors that influenced its fluctuations and the impact these changes had on investors.

Introduction to Stock Market Volatility

Stock market volatility refers to the degree of variation in stock prices over a certain period. It is often measured using the standard deviation of returns over a given time frame. High volatility indicates that stock prices are fluctuating widely, while low volatility suggests that prices are stable and predictable.

The 1990s: A Decade of Growth and Stability

The 1990s were marked by significant growth in the US stock market. The technology boom, particularly the rise of the internet, led to the creation of numerous new companies and a surge in stock prices. The NASDAQ, which is home to many technology companies, saw its value skyrocket during this period.

Key Events and Factors

- Dot-com Bubble: One of the most notable events of the 1990s was the dot-com bubble. This bubble, which began in the mid-1990s, saw the stock prices of technology companies soar to unsustainable levels. The bubble burst in 2000, leading to a significant decline in stock prices.

- Economic Policies: The economic policies implemented during the 1990s, such as tax cuts and deregulation, played a crucial role in fostering growth in the stock market. These policies helped to create a favorable environment for businesses to thrive and investors to make profits.

- Interest Rates: The Federal Reserve's decision to keep interest rates low throughout the 1990s also contributed to the growth in the stock market. Low interest rates made borrowing cheaper, encouraging businesses to invest and consumers to spend.

The 2000s: A Decade of Crisis and Recovery

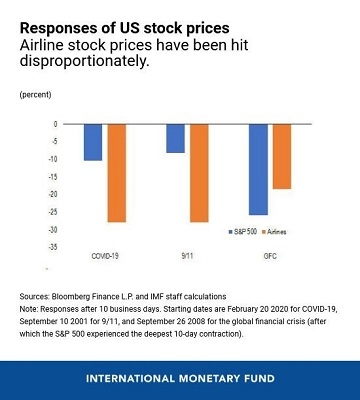

The 2000s were a period of significant volatility in the US stock market. The bursting of the dot-com bubble was followed by the September 11 attacks in 2001, which led to a sharp decline in stock prices. The decade was further marked by the financial crisis of 2008, which caused the stock market to plummet to its lowest levels in decades.

Key Events and Factors

- Financial Crisis of 2008: The financial crisis of 2008 was triggered by the collapse of the housing market and the subsequent failure of several major financial institutions. This crisis led to a global economic downturn and a significant drop in stock prices.

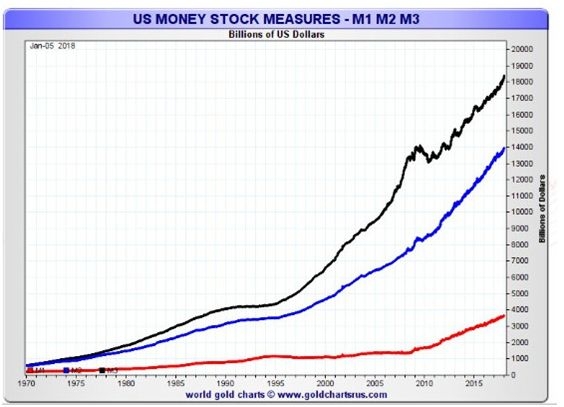

- Quantitative Easing: In response to the financial crisis, the Federal Reserve implemented a policy known as quantitative easing, which involved purchasing large quantities of government securities to stimulate economic growth and stabilize the stock market.

- Economic Stimulus: The US government also implemented various economic stimulus measures to help the economy recover from the crisis.

Conclusion

The period from 1990 to 2010 was marked by significant volatility in the US stock market. While the 1990s saw a period of growth and stability, the 2000s were characterized by crisis and recovery. Understanding the factors that influenced this volatility can help investors make informed decisions and navigate the complex world of the stock market.

so cool! ()

last:How Much Does Questrade Charge for US Stocks?

next:nothing

like

- How Much Does Questrade Charge for US Stocks?

- US Navy Officer Stock Image: A Glimpse into the Heart of American Maritime Excell

- CHL US Stock: Understanding the Key Insights for Investors

- Unilever US Stock: A Comprehensive Analysis

- How to Buy Stocks in the US: A Comprehensive Guide

- Toys "R" Us Seasonal Overnight Stock Associate Hours: Your Ulti

- New Listed Companies in the US Stock Market: A Closer Look

- Understanding the Potential of US Stocks in India

- Title: "https www.cnbc.com 2017 06 30 us-stocks-last-day-of-quarter-bank

- Title: US Stock Exchange Free Logos: The Ultimate Guide to Free Stock Exchange Lo

- Citi Upgrades US Stocks: A Comprehensive Analysis

- Should You Invest in U.S. Stocks?

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Title: Best Non-US Dividend Stocks to Invest I"

- Kraken Launches Commission-Free Trading of US "

- US Stock Exchange Holiday List 2018: A Compreh"

recommend

1990-2010 US Stock Market Volatility: A Compre

1990-2010 US Stock Market Volatility: A Compre

Is the US Stock Exchange Open on Columbus Day?

CBL US Stock: A Comprehensive Guide to Underst

Unilever US Stock: A Comprehensive Analysis

Title: Is It a Good Time to Buy US Stocks?

US Debt and Stock Market Graph: Unveiling the

Stock Quote: Sonneborn US Holdings Inc – A C

Holidays of the US Stock Market: Understanding

Altice US Stock Price: A Comprehensive Guide

Small Cap US Stock Growth Potential: A Compreh

Understanding the US Residential Housing Stock

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Top Momentum Stocks: US Equities to Watch"

- Title: FDI Stock by Region in the US: An Insig"

- US Small Cap Biotech Stocks: A Lucrative Inves"

- Title: US Stock Market 2015 Holidays: A Compre"

- Title: Schp Stock vs. US Treasury: A Comprehen"

- Is the US Stock Market Open on Presidents Day "

- Title: September 1, 2025: A Closer Look at the"

- Is US Stock Swimsuits the Same as Their Pricie"

- The Lunar Cycle in US Stock Prices: A Research"

- The Price of US Oil Stock: What You Need to Kn"