you position:Home > us stock market live > us stock market live

Title: Schp Stock vs. US Treasury: A Comprehensive Analysis

![]() myandytime2026-01-17【us stock market today live cha】view

myandytime2026-01-17【us stock market today live cha】view

info:

Introduction:

Investors often face the dilemma of choosing between stocks and fixed-income securities like U.S. Treasury bonds. In this article, we will delve into the comparison between Schp Stock and U.S. Treasury securities to help you make an informed decision for your investment portfolio.

Schp Stock: Understanding the Basics

Schp Stock, also known as the Schlumberger Limited stock, represents one of the largest oilfield services companies in the world. This stock is typically seen as a volatile investment that can offer high returns, especially during periods of energy sector growth.

The Schlumberger stock has experienced fluctuations over the years, reflecting the dynamics of the oil and gas industry. Investors who are willing to bear the risk of market volatility may find substantial rewards by investing in this stock.

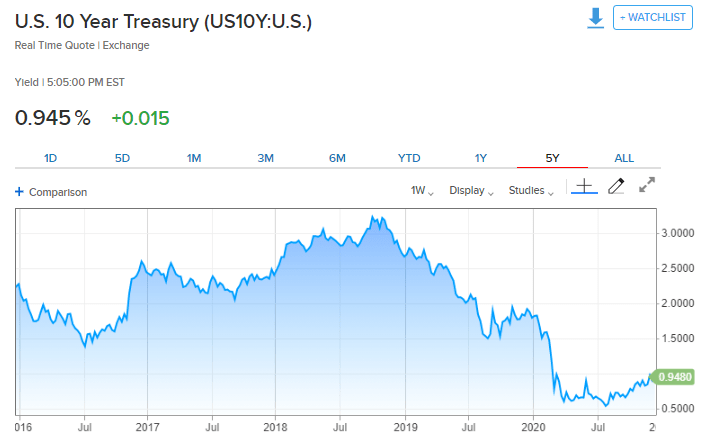

U.S. Treasury: The Safe Haven

On the other hand, U.S. Treasury securities are considered to be one of the safest investments in the world. They are issued by the U.S. Department of the Treasury and are backed by the full faith and credit of the U.S. government.

US Treasury offers a fixed interest rate and regular payments to investors. These securities include U.S. Treasury bills, notes, and bonds, with varying maturities. They are popular among investors seeking stable income and capital preservation.

Comparison: Performance, Risk, and Diversification

When comparing Schp Stock and U.S. Treasury securities, it is essential to consider performance, risk, and diversification.

Performance:

Schp Stock has the potential for high returns, but these are often accompanied by higher volatility. The stock's performance is heavily influenced by the energy sector, making it susceptible to fluctuations in oil and gas prices.

On the other hand, U.S. Treasury securities provide stable and predictable returns, although the yields are generally lower compared to stocks. They are considered to be a safe haven during market downturns, as they often outperform riskier assets.

Risk:

The risk profile of Schp Stock is significantly higher compared to U.S. Treasury securities. Investors who are risk-averse may prefer the lower risk associated with Treasuries.

During periods of economic uncertainty, the demand for U.S. Treasury securities tends to rise, as they are perceived as a safer investment option. In contrast, Schp Stock may experience substantial declines during such periods.

Diversification:

Investing in both Schp Stock and U.S. Treasury securities can help diversify your investment portfolio. While stocks offer the potential for high returns, Treasuries can provide stability and reduce the overall risk of the portfolio.

Case Study: Energy Sector Boom and Downturn

Consider a scenario where the energy sector is experiencing a boom. In this case, Schp Stock would likely perform well, as the demand for oilfield services increases. Investors who held Schp Stock during this period could benefit from substantial gains.

Conversely, during an energy sector downturn, Schp Stock may suffer significant losses. However, U.S. Treasury securities would likely remain stable, providing a source of income and capital preservation.

Conclusion:

Choosing between Schp Stock and U.S. Treasury securities depends on your investment goals, risk tolerance, and market outlook. By understanding the performance, risk, and diversification aspects of these investments, you can make a well-informed decision for your portfolio.

so cool! ()

last:Title: Current Market Conditions: US Stocks in October 2025

next:nothing

like

- Title: Current Market Conditions: US Stocks in October 2025

- Futu US Stock: The Ultimate Guide to Trading and Investing

- Best Broker for US Stocks in UK: A Comprehensive Guide

- US Copper Stocks List: A Comprehensive Guide to Investing in Copper

- US Penny Stocks List: Current Opportunities for Investors

- Toys R Us Altoona Overnight Stocker: Your Guide to a Rewarding Career

- Title: Latest US Stock Market News June 29, 2025

- "Royal Caribbean Stock: What You Need to Know About the Cruise Line'

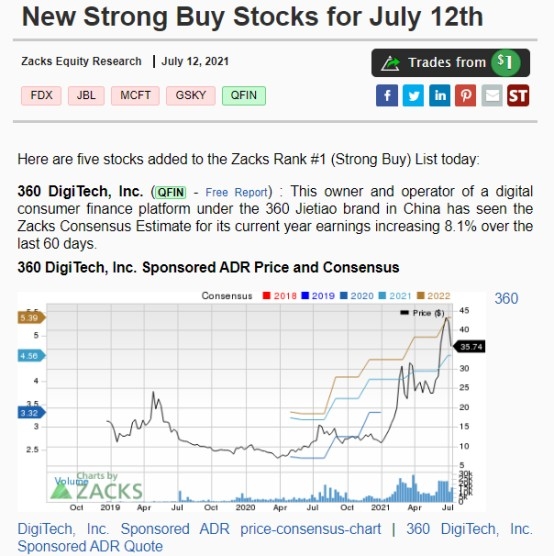

- China Companies Listed in US Stock Market: Opportunities and Challenges

- US Steel Stock Charts: A Comprehensive Guide to Understanding the Market Trends

- US Stock 3D Sublimation Vacuum Heat Press: Revolutionizing Custom Printing

- Piperdoll US Stock: A Comprehensive Analysis of Investment Opportunities

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Title: Best Non-US Dividend Stocks to Invest I"

- Kraken Launches Commission-Free Trading of US "

- US Stock Exchange Holiday List 2018: A Compreh"

recommend

Title: Schp Stock vs. US Treasury: A Comprehen

Title: Schp Stock vs. US Treasury: A Comprehen

Metatrader US Stocks: The Ultimate Trading Sol

Undervalued Us Stocks: Unveiling Hidden Opport

How to Search Australian Stocks from the US

Average US Stock Market Growth: Understanding

Top Momentum Stocks Past Week: US Market Insig

Total Value of US Housing Stock: A Comprehensi

Toys "R" Us Stock Clerk Pay:

May 19, 2025 US Stock Market Summary

Best Platform to Trade US Stocks: A Comprehens

Upcoming IPO Stocks in the US: What You Need t

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Best US Stocks to Invest In: A Comprehensive G"

- US IT Stocks List: Your Ultimate Guide to Inve"

- Us Nash Stock Pot: The Ultimate Kitchen Essent"

- Title: TCS on US Stocks: Unveiling the Truth A"

- US Stock Market Bubble Commentary 2025: Naviga"

- US Penny Stock to Buy: How to Identify and Inv"

- Understanding the US Stock Dollar Volume Trade"

- Small Cap US Stock Growth Potential: A Compreh"

- Is Aurora on the US Stock Exchange?"

- Understanding the Difference Between REITs and"