you position:Home > us stock market live > us stock market live

Should You Invest in U.S. Stocks?

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

Are you considering investing in U.S. stocks? It's a big decision, and it's important to understand the risks and rewards before you commit. In this article, we'll explore the factors to consider when deciding whether or not to invest in U.S. stocks, including market trends, economic indicators, and investment strategies.

Understanding the U.S. Stock Market

The U.S. stock market is one of the largest and most diversified in the world. It offers investors a wide range of options, from individual stocks to mutual funds and exchange-traded funds (ETFs). The S&P 500, Dow Jones Industrial Average, and NASDAQ Composite are three of the most well-known indices that track the performance of the U.S. stock market.

Market Trends

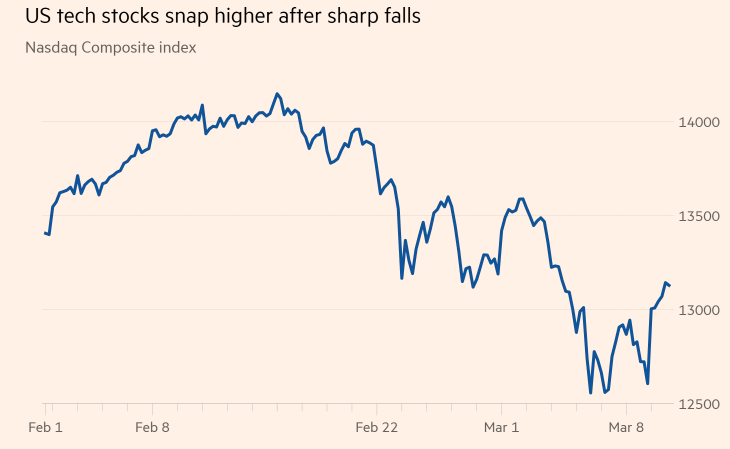

When considering whether to invest in U.S. stocks, it's important to analyze market trends. The U.S. stock market has historically offered positive returns over the long term, but it's important to recognize that there are periods of volatility and market downturns.

Historical Performance: Over the past century, the U.S. stock market has provided an average annual return of around 7% to 10%. This makes it a compelling investment option for long-term growth.

Current Trends: The current market conditions can also provide insights into the potential for future returns. For example, if the U.S. economy is growing, companies are likely to see increased revenue, which can lead to higher stock prices.

Economic Indicators

Economic indicators can help you assess the overall health of the U.S. economy and its impact on the stock market. Some key indicators to consider include:

GDP Growth: A growing GDP suggests a strong economy, which can be positive for stocks.

Unemployment Rate: A low unemployment rate indicates a healthy labor market, which can lead to increased consumer spending and higher corporate profits.

Inflation: Moderate inflation can be positive for stocks, as it can lead to higher corporate profits and increased stock prices. However, high inflation can be detrimental to the stock market.

Investment Strategies

When investing in U.S. stocks, it's important to develop a strategy that aligns with your investment goals and risk tolerance. Here are some common investment strategies:

*Diversification: Diversifying your investments across different sectors and asset classes can help reduce risk. For example, you might invest in a mix of large-cap, mid-cap, and small-cap stocks.

*Index Funds and ETFs: Index funds and ETFs offer a low-cost way to invest in a broad range of stocks. They can be a good option for investors looking for exposure to the overall market.

*Active Management: Some investors prefer active management, where a fund manager makes decisions about which stocks to buy and sell. This can lead to higher returns, but it also comes with higher fees.

Case Studies

To illustrate the potential of investing in U.S. stocks, let's look at a few case studies:

*Apple (AAPL): Over the past 10 years, Apple has seen its stock price increase significantly, offering investors substantial returns. This success can be attributed to the company's strong product offerings and market position.

*Tesla (TSLA): Tesla's stock has seen explosive growth in recent years, driven by the company's innovative electric vehicle technology and growing market share.

*Facebook (now Meta Platforms, Inc.) (META): Despite facing challenges, Facebook's stock has shown resilience and potential for growth, especially as the company expands into new areas like the metaverse.

Conclusion

Investing in U.S. stocks can be a valuable part of your investment portfolio, but it's important to do your research and consider the risks and rewards. By understanding market trends, economic indicators, and investment strategies, you can make informed decisions that align with your financial goals.

so cool! ()

like

- http stocks.us.reuters.com stocks fulldescription.asp rpc 66&symbol gdi:

- How to Buy US Stocks in Germany

- Can You Trade Us Stocks While Traveling? The Ultimate Guide

- US Large Cap Momentum Stocks This Week

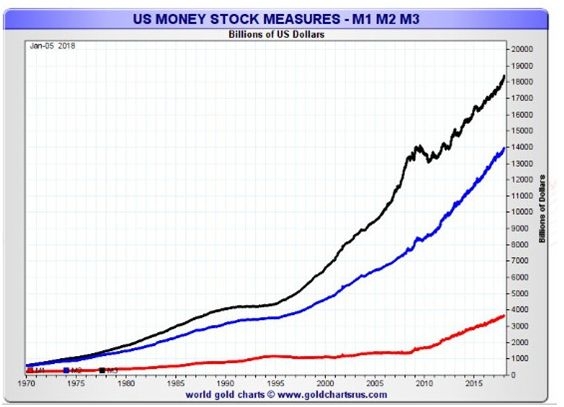

- One Surprising Thing About the US Money Stock

- How Many People Invest in Stocks in the US?

- Title: Crown Castle US Real Estate Stocks: A Golden Investment Opportunity

- ATVI Stock US: A Comprehensive Guide to Understanding and Investing in Activision

- 2x4 With Us Flag Blowing Stock Video Loop: Capturing the Spirit of American Indep

- http stocks.us.reuters.com stocks ratios.asp rpc 66&symbol smn.v: Unveili

- How to Buy US Stocks Online: A Comprehensive Guide

- 2018 US Stock Splits: A Comprehensive Overview

hot stocks

Indivior Stock in US Dollars: A Comprehensive

Indivior Stock in US Dollars: A Comprehensive - Indivior Stock in US Dollars: A Comprehensive "

- Title: US Government Shutdown: The Impact on t"

- Title: "ADAR 2-15: Why Buying Stock i"

- How to Buy Stock Outside the US: A Comprehensi"

- Lly Us Stock: Unlocking the Potential of Stock"

- Title: Best Non-US Dividend Stocks to Invest I"

- Kraken Launches Commission-Free Trading of US "

- US Stock Exchange Holiday List 2018: A Compreh"

recommend

Should You Invest in U.S. Stocks?

Should You Invest in U.S. Stocks?

Trade Japanese Stocks in the US SEC: A Compreh

Should I Invest in US Stocks from India?

"Royal Caribbean Stock: What You Need

How to Trade on the NATO US Stock Exchange

2x4 With Us Flag Blowing Stock Video Loop: Cap

Momentum Stocks: Top Performers in the US Larg

US Interest Rate Cut: Stock Market Impact and

Title: FTSE 100 vs US Growth Stocks: A Compreh

Most Traded Stocks in the US: The Top Contende

US Biggest Stock Exchange: A Comprehensive Ove

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Is the Stock Market Just the US?"

- Title: "http stocks.us.reuters.com st"

- Futu US Stock: The Ultimate Guide to Trading a"

- US Foods Stock Yards Meat Aurora IL 60502: A C"

- How to Buy US Stocks Online: A Comprehensive G"

- Most Traded Stocks in the US: The Top Contende"

- Live Us Stock Market TV: Your Ultimate Guide t"

- American Stock Dog Registry Contact Us: Your G"

- Toys "R" Us Stock Clerk Pay:"

- Holidays of the US Stock Market: Understanding"