you position:Home > us energy stock > us energy stock

Understanding the Dynamics of US Stock Industry Groups

![]() myandytime2026-01-20【us stock market today live cha】view

myandytime2026-01-20【us stock market today live cha】view

info:

In the vast and dynamic world of the stock market, industry groups play a crucial role in shaping the performance and trends of various sectors. The United States, being a global financial powerhouse, hosts a diverse array of stock industry groups, each with its unique characteristics and investment opportunities. This article delves into the intricacies of these groups, highlighting their significance and how investors can leverage this knowledge to make informed decisions.

The Importance of Stock Industry Groups

Stock industry groups are essentially categories that classify companies based on their primary business activities. These groups help investors and analysts understand the market dynamics and identify potential investment opportunities. By analyzing the performance of a particular industry group, investors can gain insights into the broader market trends and make more informed decisions.

Major Stock Industry Groups in the US

The US stock market is divided into several major industry groups, each representing a distinct sector. Some of the most prominent ones include:

Technology (Technology Select Sector SPDR Fund - XLK)

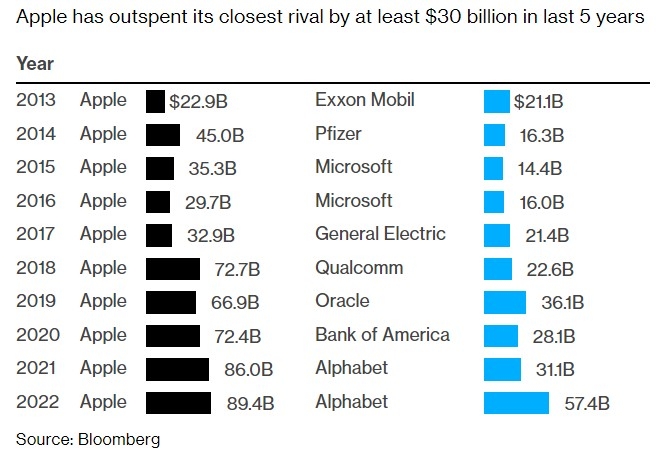

- This group includes companies involved in the development, manufacturing, and distribution of technology products and services. It encompasses giants like Apple, Microsoft, and Google.

Healthcare (Health Care Select Sector SPDR Fund - XLV)

- This group covers companies involved in the healthcare industry, including pharmaceuticals, biotechnology, medical devices, and healthcare services. Notable companies in this group include Johnson & Johnson and Pfizer.

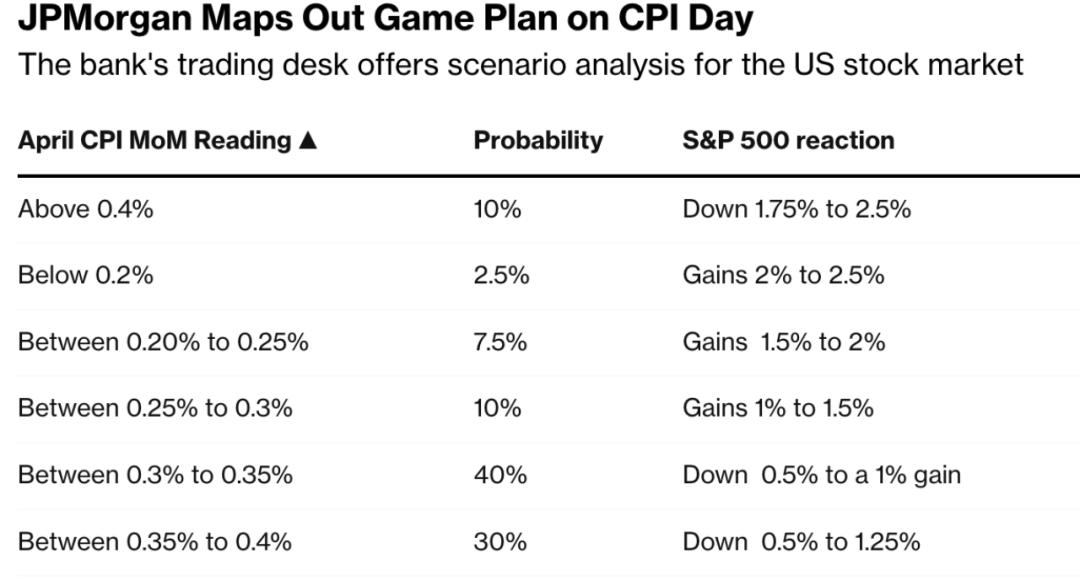

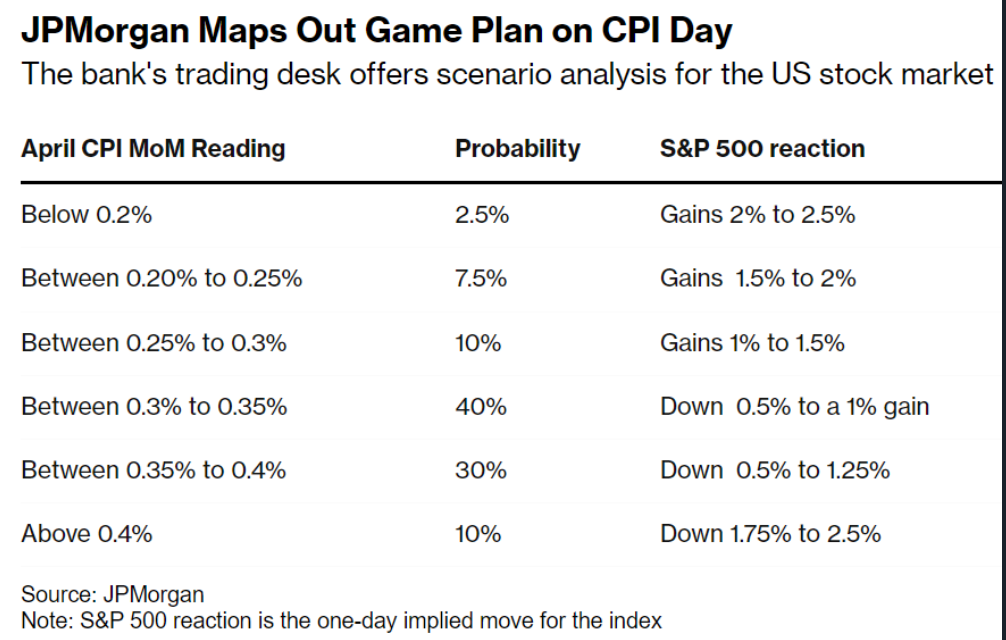

Financials (Financial Select Sector SPDR Fund - XLF)

- This group includes companies involved in the financial services industry, such as banking, insurance, and real estate. Major players in this group include JPMorgan Chase and Wells Fargo.

Consumer Discretionary (Consumer Discretionary Select Sector SPDR Fund - XLY)

- This group covers companies involved in consumer goods and services, such as retail, leisure, and entertainment. Notable companies in this group include Amazon and Disney.

Consumer Staples (Consumer Staples Select Sector SPDR Fund - XLP)

- This group includes companies involved in the production and distribution of essential consumer goods, such as food, beverages, and household products. Procter & Gamble and Coca-Cola are prominent players in this group.

Investment Opportunities and Risks

Investing in stock industry groups offers several advantages, including diversification and exposure to market trends. However, it is essential to understand the risks associated with each group. For instance, the technology sector may experience rapid growth but is also subject to regulatory changes and market volatility.

Case Study: The Tech Sector

The technology sector has been a significant driver of growth in the US stock market over the past few decades. Companies like Apple and Microsoft have revolutionized the industry and generated substantial wealth for investors. However, the sector is also subject to intense competition and regulatory scrutiny, which can lead to volatility in stock prices.

Conclusion

Understanding the dynamics of US stock industry groups is crucial for investors looking to make informed decisions. By analyzing the performance and trends of these groups, investors can identify potential investment opportunities and manage risks effectively. Whether you are a seasoned investor or just starting out, familiarizing yourself with these industry groups can provide valuable insights into the stock market and help you achieve your investment goals.

so cool! ()

like

- Exploring the Number of Stock Exchanges in the US: A Comprehensive Overview&q

- In the Year of the US Stock Market Collapsed: A Comprehensive Analysis

- Old US Shotgun Gold Emblem: A Glimpse into Historical Firearms

- Is China Buying All US Stocks? A Closer Look at the Truth

- Unlocking the Potential of US Ethanol Stocks: A Comprehensive Guide

- Total US Stock Market Capitalization in 2025: A Comprehensive Analysis

- Best Intraday Stocks in the US: Your Ultimate Guide

- US Binocular M16 Stock No 7578343: A Comprehensive Guide

- Neodymium Stocks: A Lucrative Investment in the US

- Can Vietnamese Investors Dive into US Stock Market?"

- June 26, 2025: US Stock Market News Roundup

- Can SoftBank Stock Be Purchased on US Markets? A Comprehensive Guide

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Understanding the Dynamics of US Stock Industr

Understanding the Dynamics of US Stock Industr

Are Bump Stocks Illegal in the US?

Title: The Effect of Sino-US Talks on Stocks

How Malaysians Buy US Stock: A Comprehensive G

Title: CSL Behring US Stock: An In-Depth Look

Glaxosmithkline Stock Price US: A Comprehensiv

US Government Stocks List: A Comprehensive Gui

US North Korea Stock: Unveiling the Complex Dy

Exploring the Number of Stock Exchanges in the

Himalaya Capital US Stock Market: A Comprehens

Honour Us Latex Stocking Size: Finding the Per

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Stock Chart Patterns: Your Ultimate Guide to U"

- US Steel Stock Investigation: A Comprehensive "

- Is the US Stock Market in Trouble?"

- How Can an Indian Invest in US Stocks?"

- http stocks.us.reuters.com stocks fulldescript"

- Fibonacci Retracement: A Game-Changing Tool fo"

- Best ETFs to Buy: Top Picks for Investors"

- US 30 Stocks: A Comprehensive Guide to the Mos"

- Walmart Dividend: A Comprehensive Guide to Und"

- Can Non-US Citizens Invest in Stocks?"