you position:Home > us energy stock > us energy stock

Is the US Stock Market in Trouble?

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

The stock market is a barometer of the economy, and lately, there's been quite a bit of buzz about whether the US stock market is in trouble. In this article, we will delve into the factors that might be contributing to this concern, the history of market volatility, and what it could mean for investors.

Understanding the Current Market Scenario

The US stock market has seen significant fluctuations in recent years, with periods of rapid growth followed by downturns. While some investors might be concerned about the current state of the market, it's essential to understand the broader economic context.

One of the key factors contributing to market volatility is the uncertainty surrounding the global economy. Issues such as trade tensions, political instability, and geopolitical risks can all have a significant impact on the stock market. In addition, the Federal Reserve's monetary policy and its impact on interest rates also play a crucial role.

Historical Perspective

Looking back at history, we can see that the stock market has always been subject to cycles of growth and decline. The Great Depression of the 1930s, the dot-com bubble in the 1990s, and the 2008 financial crisis are just a few examples of major market downturns. However, it's important to note that the stock market has generally recovered and continued to grow over time.

Key Factors Contributing to Market Volatility

Trade Tensions: The ongoing trade disputes between the US and China have raised concerns about the global economy. A trade war could lead to higher prices for consumers and a slowdown in economic growth.

Political Instability: The political environment in the US and other countries has been volatile, with numerous political events and elections impacting market sentiment.

Geopolitical Risks: Issues such as geopolitical tensions and conflicts in various parts of the world can cause market uncertainty.

Monetary Policy: The Federal Reserve's decision to raise interest rates has raised concerns about the potential impact on the economy and the stock market.

Tech Stocks: The recent decline in tech stocks has contributed to the overall market volatility. Companies like Facebook, Amazon, and Google have been under scrutiny due to antitrust concerns and privacy issues.

Case Studies

Let's take a look at a couple of recent examples that illustrate the impact of these factors on the stock market:

2018 Market Downturn: The US stock market experienced a significant downturn in 2018, largely due to trade tensions and rising interest rates. The S&P 500 index fell by over 6% in December 2018 alone.

2020 Market Crash: The COVID-19 pandemic caused a historic market crash in March 2020. The S&P 500 fell by nearly 34% in just two months, marking the fastest decline in the index's history.

What Should Investors Do?

While it's challenging to predict market movements, there are some strategies investors can consider to navigate these uncertain times:

Diversification: Diversifying your portfolio across various asset classes can help reduce risk.

Long-Term Perspective: Focus on your long-term investment goals rather than short-term market fluctuations.

Stay Informed: Stay updated on economic news and market trends to make informed investment decisions.

Seek Professional Advice: Consider consulting with a financial advisor to get personalized investment advice.

In conclusion, while there are concerns about the current state of the US stock market, it's important to keep a long-term perspective and stay informed. By understanding the factors contributing to market volatility and adopting a strategic approach, investors can navigate these challenging times.

so cool! ()

last:Are the US Stock Markets Open on Presidents Day?

next:nothing

like

- Are the US Stock Markets Open on Presidents Day?

- The 25 Biggest Pharmaceutical Stocks Trading in the US

- RSI Analysis of US Stocks in July 2025: Predictions and Insights

- Understanding US Stock Exchange Market Hours in EST

- Best Brokerage for US Stocks in Singapore: Your Ultimate Guide

- Trading US Stocks from Dubai: A Comprehensive Guide

- PlayStation 5 Console in Stock US: Your Ultimate Guide to Availability and Purcha

- Did Us Tax Stocks? Understanding the Impact of Capital Gains Tax on Stockholders

- Oil and Gas Stocks in the US: A Comprehensive Guide to Investment Opportunities

- Toys "R" Us Public Stock: A Comprehensive Analysis

- Pharmacare US Inc Stock: A Comprehensive Analysis

- How to Invest in US Stocks from Pakistan

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

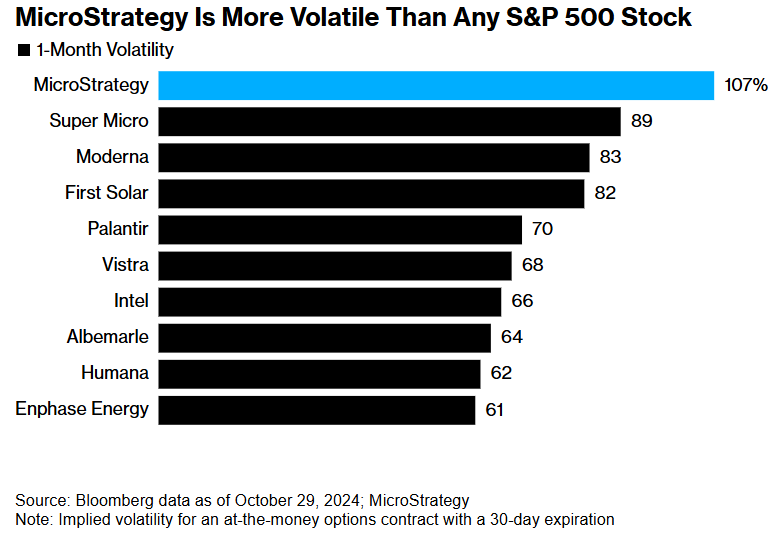

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Is the US Stock Market in Trouble?

Is the US Stock Market in Trouble?

How U.S. Stock Market Performed in 2019

InventionMed S.A. US Stock Symbol: A Deep Dive

Title: Unveiling the US Dividend Stock Phenome

http://stocks.us.reuters.com/stocks/fulldescri

Cannabis Stock News US: The Latest Development

US Solar Stock Index: A Comprehensive Guide to

Title: Levi Strauss US Stock: A Comprehensive

The Biggest Marijuana Stocks in the US

Analysis: Hedge Fund Crowded Exit Timing for U

Multibagger Stocks: How US Paid Services Can H

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Mid Cap Stocks: A Golden Middle Ground for Inv"

- Small Cap Stocks: The Hidden Gems of the US Ma"

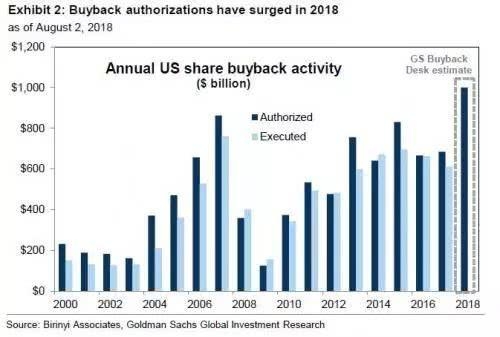

- Stock Buybacks: A Strategic Move for Investors"

- US Shipping Company Stocks: A Comprehensive Gu"

- Operational Non-US Stock Index Fund: A Strateg"

- US Stock Market: Bear or Bull? A Comprehensive"

- US Stock Live Quote: Real-Time Market Data for"

- Title: Black Monday: The 1987 Stock Market Cra"

- Multibagger Stocks: How US Paid Services Can H"

- Best ETFs to Buy: Top Picks for Investors"