you position:Home > us energy stock > us energy stock

How Can an Indian Invest in US Stocks?

![]() myandytime2026-01-15【us stock market today live cha】view

myandytime2026-01-15【us stock market today live cha】view

info:

Investing in US stocks can be an exciting opportunity for Indian investors, offering a diverse range of companies and potentially high returns. However, navigating the complexities of the US stock market can be daunting. In this article, we will explore the steps and considerations for Indian investors looking to invest in US stocks.

Understanding the US Stock Market

The US stock market is one of the largest and most developed in the world, with several major exchanges such as the New York Stock Exchange (NYSE) and the NASDAQ. It offers a wide range of stocks across various sectors, including technology, healthcare, finance, and consumer goods.

Steps to Invest in US Stocks from India

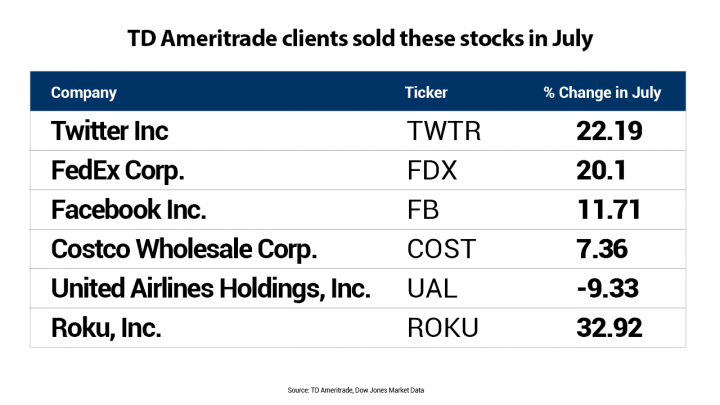

Open a US Brokerage Account: The first step is to open a brokerage account with a reputable US-based brokerage firm. This will allow you to buy and sell US stocks. Some popular options for Indian investors include TD Ameritrade, E*TRADE, and Fidelity.

Understand the Risks: It's crucial to understand the risks involved in investing in US stocks. The market can be volatile, and currency fluctuations can impact returns. Make sure to research and assess your risk tolerance before investing.

Choose Your Investments: Once you have a brokerage account, you can start researching and selecting stocks to invest in. Consider factors such as the company's financial health, industry trends, and growth potential.

Currency Conversion: Since the US dollar is the primary currency for the stock market, you'll need to convert your Indian rupees to US dollars. You can do this through your brokerage account or a currency exchange service.

Monitor Your Investments: Regularly monitor your investments to stay informed about market trends and company news. This will help you make informed decisions and adjust your portfolio as needed.

Popular US Stocks for Indian Investors

Several US stocks have gained popularity among Indian investors. Here are a few examples:

- Apple (AAPL): As the world's largest technology company, Apple offers a wide range of products and services, including smartphones, laptops, and services like Apple Music and iCloud.

- Microsoft (MSFT): A leading technology company known for its software products, including Windows, Office, and Azure cloud services.

- Amazon (AMZN): The e-commerce giant offers a vast range of products and services, including online shopping, cloud computing, and digital streaming.

- Tesla (TSLA): The electric vehicle manufacturer has revolutionized the automotive industry and is also involved in renewable energy and energy storage solutions.

Case Study: Investing in Tesla (TSLA)

Let's consider an example of investing in Tesla (TSLA) from India. Assume you want to invest

After a year, the price of TSLA increases to

Conclusion

Investing in US stocks can be a valuable addition to an Indian investor's portfolio. By following these steps and understanding the risks involved, you can make informed decisions and potentially benefit from the growth of leading US companies. Remember to do thorough research and consult with a financial advisor if needed.

so cool! ()

last:US Stock Market Bubble Indicators: October 2025

next:nothing

like

- US Stock Market Bubble Indicators: October 2025

- Us Stock Market 2016 Growth: An In-Depth Analysis

- US Solar Stock Index: A Comprehensive Guide to Solar Energy Investment

- AFI US Stock: Your Ultimate Guide to American Film Industry Investments

- Best Performing US Stocks Last 5 Days: Momentum to Watch in August 2024

- High Yield Dividend US Stocks: The Ultimate Guide to Maximizing Returns

- US Offshore Drilling Stocks: A Deep Dive into the Ocean's Goldmine

- US Cocoa Stock: A Comprehensive Guide to the Market

- Title: Natural Gas Companies Stock Us: The Growing Influence and Investment Oppor

- Good Time to Buy US Stocks: Expert Insights and Analysis

- Agrimonia Pilosa Powder Extract US Stock Available: A Natural Remedy for Modern H

- February 2020 IPOs: A Deep Dive into the US Stock Market

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

How Can an Indian Invest in US Stocks?

How Can an Indian Invest in US Stocks?

Kraken US Stocks: A Comprehensive Guide to Tra

US Government Stocks List: A Comprehensive Gui

Companies Listed on US Stock Markets: A Compre

Title: Head of US Stock Exchange: The Visionar

Title: Total US Stock Market Capitalization: A

Title: Does Ubq Israeli Company Trade on US St

High Potential US Stocks: Your Guide to Invest

US Nonwoven Stocks: The Future of Sustainable

Paytm Money US Stocks: A Comprehensive Guide f

AMC Stock Invest US: Understanding the Potenti

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Best Performing US Stocks Last 5 Days: Momentu"

- http stocks.us.reuters.com stocks fulldescript"

- Top Lithium Stocks in the US: A Comprehensive "

- Is Now a Good Time to Buy Stocks?"

- RF US Stock Price: A Comprehensive Guide to Un"

- 6 Major US OTC Marijuana Stocks to Watch in 20"

- Copper Stocks: The Investment Opportunity You "

- The Best Way to Buy US Stocks in Australia"

- Cision US Stock: A Comprehensive Guide to Unde"

- Best US Stock Market App: Your Ultimate Invest"