you position:Home > us energy stock > us energy stock

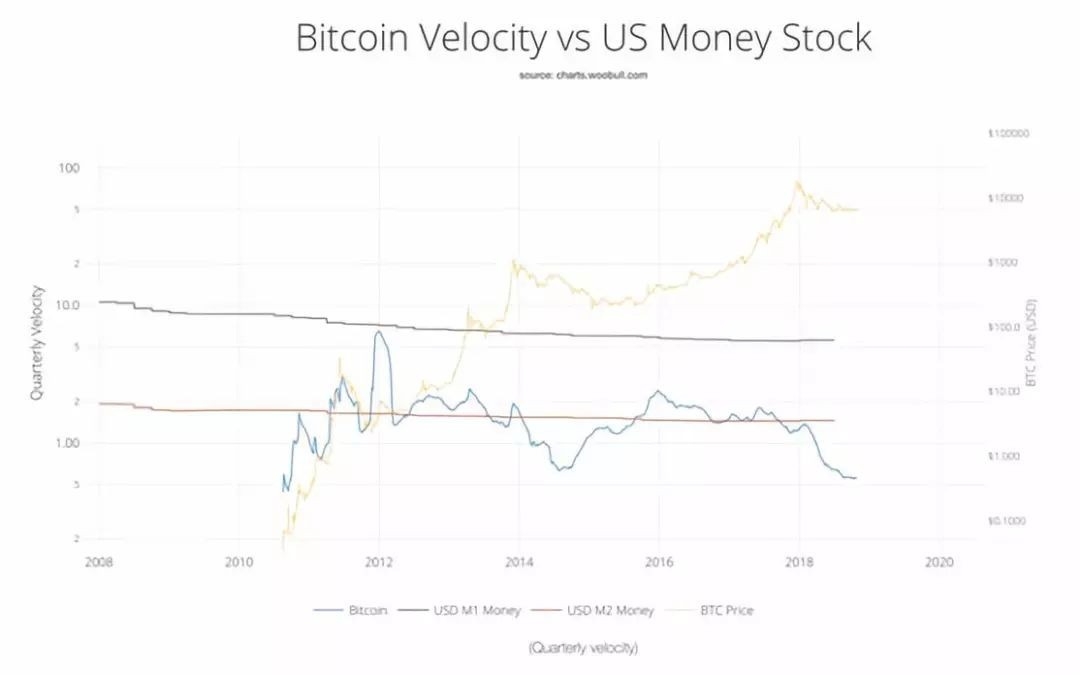

Understanding US Money Stock Measures: M1

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

In the realm of finance, understanding the different measures of money stock is crucial for investors, economists, and policymakers alike. One such measure is M1, which plays a pivotal role in the assessment of the money supply in the United States. This article delves into the intricacies of M1 money stock measures, explaining what it encompasses, its significance, and how it impacts the economy.

What is M1 Money Stock?

M1 money stock is a narrow measure of the money supply that includes the most liquid forms of money. It consists of three main components:

- CASH: This includes physical currency in circulation, such as dollar bills and coins.

- CHECKABLE DEPOSITS: These are funds held in checking accounts that can be easily accessed by the account holder.

- TRAVELER'S CHECKS: These are pre-printed checks that can be used as a form of payment.

The Significance of M1 Money Stock

M1 money stock is a critical indicator of the money supply and its impact on the economy. Here's why:

- Economic Activity: M1 is directly linked to economic activity. An increase in M1 suggests higher consumer spending and business investment, which can stimulate economic growth.

- Interest Rates: Central banks, like the Federal Reserve, use M1 as a tool to manage interest rates. By adjusting the money supply, the Fed can influence borrowing costs and, consequently, economic activity.

- Inflation: M1 is also a key factor in determining inflation. An excessive increase in M1 can lead to higher inflation, as there is more money chasing the same amount of goods and services.

Comparing M1 with Other Measures of Money Stock

It's important to note that M1 is just one of several measures of money stock. Here's a brief overview of the other measures:

- M2: This broader measure includes M1 and other less liquid forms of money, such as savings deposits, money market mutual funds, and certificates of deposit.

- M3: This is the broadest measure of money stock, encompassing M2 and large-denomination time deposits.

Case Study: The 2008 Financial Crisis

The 2008 financial crisis serves as a prime example of how M1 can impact the economy. During the crisis, the Federal Reserve significantly increased the money supply to stabilize the financial system. This injection of liquidity helped prevent a complete collapse of the economy but also led to concerns about inflation and asset bubbles.

Conclusion

Understanding M1 money stock measures is essential for anyone interested in the U.S. economy. By tracking M1, investors and policymakers can gain valuable insights into economic activity, interest rates, and inflation. As the economy continues to evolve, the importance of M1 as a key indicator of the money supply remains unchanged.

so cool! ()

last:US Regulation on Chinese Stocks: What You Need to Know

next:nothing

like

- US Regulation on Chinese Stocks: What You Need to Know

- STN Stock US: A Comprehensive Guide to Understanding and Investing

- Impact of Dollar Decline on US Stocks

- Swedish Companies on the US Stock Exchange: Opportunities and Insights

- US Hoka Stock Clearance: Unbeatable Deals on Top-Notch Running Shoes

- Toys "R" Us Out of Stock FAQ

- How Many US Companies Are Buying Back Their Own Stock?

- Title: Total US Stock Market Capitalization October 2025: A Comprehensive Analysi

- Edu US Stock: Exploring the Intersection of Education and Stock Market Investment

- Empower Clinics Stock: A Game-Changer for the Healthcare Industry

- US Recycling Company Stock: A Growing Investment Opportunity

- NTIOF Stock: Understanding OTC Markets in the US

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

Understanding US Money Stock Measures: M1

Understanding US Money Stock Measures: M1

Top Performing US Stocks Q1 2025: A Deep Dive

US Shipping Company Stocks: A Comprehensive Gu

Latitude 64 Opto Air Bolt in Stock at US Retai

US Remington Model 03-A3 Replacement Stocks: A

Southern Hemisphere Mining Ltd: An Overview of

US Steel Corporation Stocks: A Comprehensive G

Ogi Us Stock: Your Ultimate Guide to Understan

Best Performing US Stocks Past Week: Momentum

Penny Stocks in the Oil Sector: US-Based Oppor

Title: Pharma Stocks US: A Deep Dive into the

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- US Mint Proof Set Stock Photos: The Ultimate G"

- Title: "http stocks.us.reuters.com st"

- Understanding Dividend ETFs: A Comprehensive G"

- Smallcase for US Stocks: A Comprehensive Guide"

- How Many Individuals Are Invested in the US St"

- Market Outlook: Navigating the Future of Busin"

- AMC Stock Invest US: Understanding the Potenti"

- Bytedance Stock US: A Comprehensive Analysis"

- US Graphene Companies Stock: A Comprehensive O"

- Title: "Isrg Us Stock Price: A Compre"