you position:Home > us energy stock > us energy stock

US Graphite Stock Price: A Comprehensive Analysis

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

The stock market is a dynamic and unpredictable landscape, with prices fluctuating based on various factors. One such stock that has captured the attention of investors is US Graphite. This article aims to provide a comprehensive analysis of the US Graphite stock price, exploring the factors that influence it and offering insights into its potential future trajectory.

Understanding the US Graphite Stock Price

US Graphite, a leading producer of advanced carbon materials, has seen its stock price fluctuate significantly over the years. The price is influenced by several factors, including the demand for graphite, the company's financial performance, and broader market conditions.

Graphite Demand and Supply

One of the primary drivers of the US Graphite stock price is the demand for graphite. Graphite is a versatile material used in various industries, including automotive, aerospace, and electronics. The growing demand for electric vehicles and renewable energy sources has led to a surge in graphite consumption, thereby positively impacting US Graphite's stock price.

Financial Performance

The financial performance of US Graphite also plays a crucial role in determining its stock price. The company's revenue, profit margins, and growth prospects are closely monitored by investors. A strong financial performance, with consistent growth in revenue and profits, tends to drive the stock price higher.

Market Conditions

The broader market conditions also influence the US Graphite stock price. Stock prices are often affected by economic indicators, political events, and market sentiment. For example, during times of economic uncertainty, investors may seek safer investments, leading to a decline in the stock price.

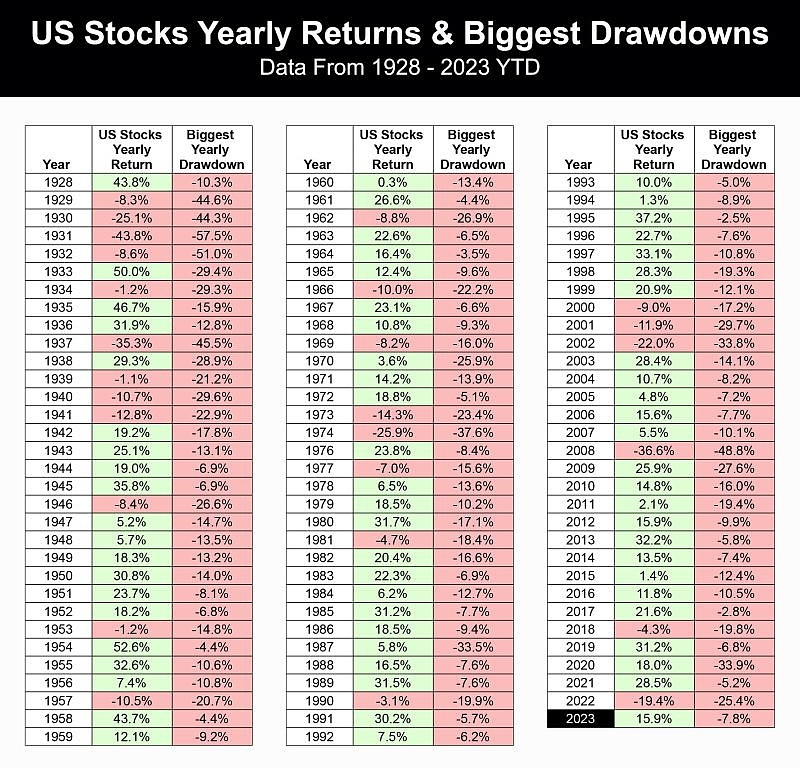

Historical Stock Price Analysis

To better understand the US Graphite stock price, let's take a look at its historical performance. Over the past five years, the stock has experienced several fluctuations, reflecting the factors mentioned above. For instance, in 2017, the stock saw significant growth as a result of strong demand for graphite. However, in 2018, the stock price declined due to a decline in graphite prices and increased supply.

Potential Future Trajectory

Looking ahead, the US Graphite stock price is expected to be influenced by several factors. The growing demand for graphite, especially in the electric vehicle sector, is expected to drive the stock higher. Additionally, the company's expansion into new markets and product lines may contribute to its growth prospects.

Case Studies

To illustrate the impact of demand and supply on the US Graphite stock price, let's consider a case study from 2019. During that year, the global graphite market faced a supply deficit due to production issues in China. As a result, graphite prices surged, leading to a significant increase in the US Graphite stock price.

Similarly, in 2020, the company's strong financial performance, driven by increased sales and improved operational efficiency, resulted in a surge in its stock price.

Conclusion

In conclusion, the US Graphite stock price is influenced by a combination of factors, including graphite demand, financial performance, and market conditions. By understanding these factors and staying informed about the company's developments, investors can make more informed decisions regarding their investments in US Graphite.

so cool! ()

last:Ark Pharm US Stock: A Comprehensive Analysis

next:nothing

like

- Ark Pharm US Stock: A Comprehensive Analysis

- Contact Us Page Corporate Stock Photos: Enhancing Professionalism and Engagement

- Understanding US Money Stock Measures: M1

- US Regulation on Chinese Stocks: What You Need to Know

- STN Stock US: A Comprehensive Guide to Understanding and Investing

- Impact of Dollar Decline on US Stocks

- Swedish Companies on the US Stock Exchange: Opportunities and Insights

- US Hoka Stock Clearance: Unbeatable Deals on Top-Notch Running Shoes

- Toys "R" Us Out of Stock FAQ

- How Many US Companies Are Buying Back Their Own Stock?

- Title: Total US Stock Market Capitalization October 2025: A Comprehensive Analysi

- Edu US Stock: Exploring the Intersection of Education and Stock Market Investment

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

US Graphite Stock Price: A Comprehensive Analy

US Graphite Stock Price: A Comprehensive Analy

Is the US Stock Market Trading Today?

Emerging Markets and Global Growth vs. US Stoc

Delek US Stock Forecast: What to Expect in the

Title: US Digital Currency Stock: The Future o

Unilever US Stock: A Comprehensive Guide to In

Us Marijuana Stocks on Fire: The Rising Wave o

US Government Stocks List: A Comprehensive Gui

Best US Stocks Under $10: A Smart Investment S

US News Articles on Stock Valuation: Unveiling

Title: "Total Market Cap of All US St

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Revenue Growth: Strategies to Skyrocket Your B"

- Trending US Stocks to Buy Today"

- Water Stocks: A Smart Investment in a Thirsty "

- Boeing Earnings: A Deep Dive into the Aviation"

- US Solar Stock Index: A Comprehensive Guide to"

- 2021 US Stock Market Predictions: What to Expe"

- Toys "R" Us Stock Crew Job R"

- US Stock Futures: A Comprehensive Guide to Und"

- US Stock 110V Heat Press Machine: The Ultimate"

- Target Date Fund: Your Ultimate Guide to Retir"