you position:Home > us energy stock > us energy stock

How Many US Companies Are Buying Back Their Own Stock?

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

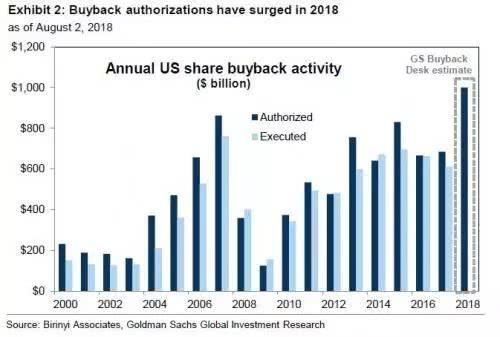

In recent years, there has been a significant trend among U.S. companies to repurchase their own stock. This practice, known as stock buybacks, has become a popular strategy for boosting shareholder value and increasing the company's stock price. But just how many U.S. companies are engaging in this practice, and what does it mean for the broader market?

The Growing Trend of Stock Buybacks

Stock buybacks have been on the rise in the United States for several years. According to data from the Investment Company Institute, U.S. companies spent approximately

The trend of stock buybacks can be attributed to several factors. Firstly, companies have accumulated substantial cash reserves due to the low-interest-rate environment and the strong economic growth in recent years. Secondly, many companies have found that repurchasing their own stock is a more efficient way to return capital to shareholders than paying dividends.

The Impact of Stock Buybacks

The impact of stock buybacks on a company and the broader market can be significant. For companies, stock buybacks can help to:

- Increase earnings per share (EPS): By reducing the number of outstanding shares, a company can increase its EPS, which can boost the stock price.

- Enhance shareholder value: By returning capital to shareholders, companies can increase shareholder wealth.

- Signal confidence: A company's decision to repurchase its own stock can signal to investors that the company believes its stock is undervalued.

However, stock buybacks can also have negative consequences. For example, if a company spends too much on stock buybacks, it may neglect important investments in research and development, capital expenditures, or other strategic initiatives.

Case Studies

Several high-profile companies have engaged in significant stock buyback programs in recent years. For example:

- Apple: Apple has been one of the most active buyers of its own stock, spending over $200 billion on stock buybacks since 2012. This has helped to increase the company's EPS and boost its stock price.

- Microsoft: Microsoft has also been a major buyer of its own stock, spending over $150 billion on stock buybacks since 2013. This has helped to increase the company's EPS and make it one of the most valuable companies in the world.

- Procter & Gamble: Procter & Gamble has spent over $100 billion on stock buybacks since 2005. This has helped to increase the company's EPS and make it one of the most valuable consumer goods companies in the world.

Conclusion

The trend of stock buybacks among U.S. companies is a significant development that has implications for both companies and the broader market. While stock buybacks can boost shareholder value and increase the stock price, they can also have negative consequences if not managed properly. As more companies engage in this practice, it will be important to monitor the impact of stock buybacks on the overall market and individual companies.

so cool! ()

like

- Title: Total US Stock Market Capitalization October 2025: A Comprehensive Analysi

- Edu US Stock: Exploring the Intersection of Education and Stock Market Investment

- Empower Clinics Stock: A Game-Changer for the Healthcare Industry

- US Recycling Company Stock: A Growing Investment Opportunity

- NTIOF Stock: Understanding OTC Markets in the US

- Bloomberg Stocks US: The Ultimate Guide to Navigating the American Stock Market

- US M14 Stock: The Ultimate Guide to Understanding and Appreciating This Iconic Ri

- Stock Price for US Robotics: Insights and Analysis

- Title: Unveiling the Intricacies of US Stock Insider Trading

- Himalaya Capital US Stock Market: A Comprehensive Analysis

- Title: "http stocks.us.reuters.com stocks fulldescription.asp rpc 66&

- US Airways Stock Falls on Disappointing Results

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

How Many US Companies Are Buying Back Their Ow

How Many US Companies Are Buying Back Their Ow

US Companies Listed on Shanghai Stock Exchange

US Stock Future Live: The Ultimate Guide to Un

Best US Rare Earth Stocks: A Guide to Investme

Tesla Stock Risks from US Election

Canadian ETFs Traded on US Stock Exchanges: A

US Stock Futures Mixed Ahead of Inflation Data

6 Major US OTC Marijuana Stocks to Watch in 20

How to Buy US Stocks in Jamaica

Good US Stocks to Buy Now for Long-Term Invest

Stock Price for US Robotics: Insights and Anal

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Toys R Us and Babies R Us Daytime Stock Associ"

- Momentum Stocks in the US Market: September 20"

- Understanding the US Dollar Stock Chart: A Com"

- Blue Chip Stocks: A Solid Investment in the US"

- Cybersecurity Stocks: The Digital Shield Again"

- Momo US Stock Price: What You Need to Know"

- How U.S. Stock Market Performed in 2019"

- Transfer Your US Stocks from UAE Brokerage to "

- RF US Stock Price: A Comprehensive Guide to Un"

- Pelosi Stocks: A Deep Dive into the Investment"