you position:Home > us energy stock > us energy stock

US Government Buys Stocks: A Strategic Move for Economic Stability

![]() myandytime2026-01-18【us stock market today live cha】view

myandytime2026-01-18【us stock market today live cha】view

info:

In an unprecedented move, the US government has decided to invest in the stock market. This decision has sparked a lot of controversy and debate among economists, investors, and the general public. The move is seen as a strategic measure to stabilize the economy amidst the global pandemic. This article aims to explore the reasons behind this decision, its potential impact, and what it means for the future of the US economy.

The Context

The COVID-19 pandemic has had a devastating impact on the global economy. Many businesses have closed down, millions of people have lost their jobs, and the stock market has been volatile. In this context, the US government's decision to buy stocks is a bold move that has raised many questions.

Reasons for the Decision

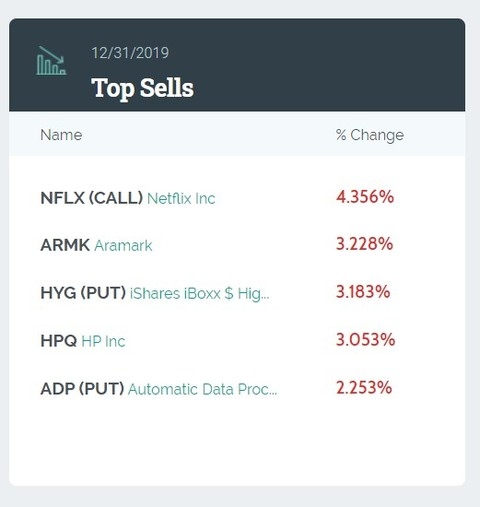

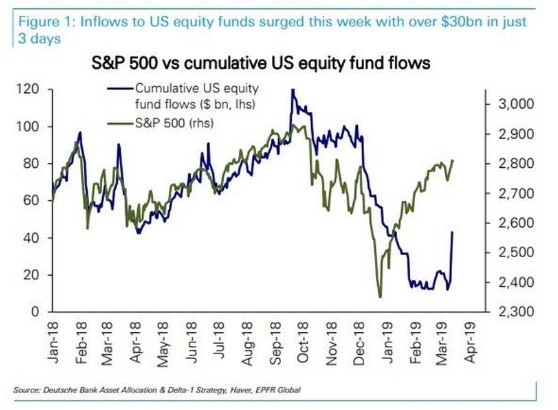

Stabilizing the Stock Market: The government's primary goal is to stabilize the stock market. By buying stocks, the government aims to prevent a further downturn and restore confidence among investors.

Supporting Businesses: The government hopes that by stabilizing the stock market, businesses will have easier access to capital, which can help them survive the crisis.

Creating Jobs: The government believes that a stable stock market will lead to increased business activity, which can create jobs and reduce unemployment.

The Potential Impact

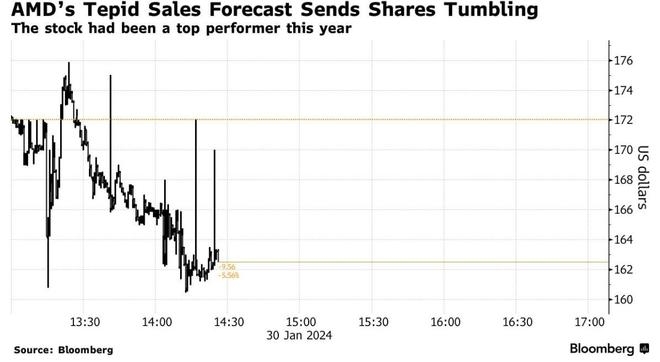

Short-term Stability: The move is expected to provide short-term stability to the stock market. However, it remains to be seen how long this stability will last.

Long-term Impact: The long-term impact of this decision is still uncertain. Some experts argue that it could lead to inflation, while others believe it will stimulate economic growth.

Market Manipulation: Critics argue that the government's move is a form of market manipulation. They believe that the government is using its resources to prop up certain stocks, which is not fair to other investors.

Case Studies

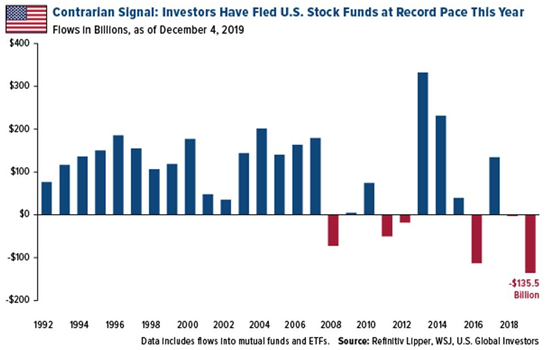

One notable case study is the government's intervention in the financial crisis of 2008. The government's decision to buy stocks and provide bailouts to banks helped stabilize the market and prevent a complete economic collapse.

Conclusion

The US government's decision to buy stocks is a controversial move, but it is a strategic one. The move aims to stabilize the stock market, support businesses, and create jobs. While the long-term impact is still uncertain, it is clear that the government is taking bold steps to address the economic challenges posed by the COVID-19 pandemic. Only time will tell whether this move will be successful in stabilizing the US economy.

so cool! ()

last:Capitalization: The Key to Understanding the US Stock Market

next:nothing

like

- Capitalization: The Key to Understanding the US Stock Market

- US GI Fiberglass M14 Stock: A Comprehensive Guide

- Dbs hk us stock: Exploring Investment Opportunities in the Global Market

- Recent News on Penny Stocks in the US

- AXA Stock Price US: A Comprehensive Analysis

- Meituan Stock US: The Rise and Future of China's Largest Online Service Plat

- Best US Stock Broker in Australia: Your Ultimate Guide to Investment Success

- US Dow Jones Stock Chart Since Trump: A Comprehensive Analysis

- US Standard Atmosphere 1976 Stock No 003 017 00323 0: Unveiling the Secrets of th

- Title: Money Laundering in the US Stock Market: A Closer Look

- US Humanoid Robot Stocks: A Growing Investment Opportunity

- US Steel Companies Stock Prices: A Comprehensive Analysis

hot stocks

Gas Stocks: A Lucrative Investment Opportunity

Gas Stocks: A Lucrative Investment Opportunity- When to Sell Stocks: A Comprehensive Guide for"

- Walmart Dividend: A Comprehensive Guide to Und"

- Top Gainers: Unveiling the Market's Most "

- Understanding the Value ETF: A Comprehensive G"

- Volatile Stocks: Understanding the Risks and R"

- What is Dividend Yield?"

- Undervalued Stocks: Unlocking Hidden Potential"

- Value Stocks: The Key to Long-Term Wealth Buil"

recommend

US Government Buys Stocks: A Strategic Move fo

US Government Buys Stocks: A Strategic Move fo

Nintendo Switch Back in Stock in US: The Ultim

Top US Stocks Momentum Short Term: A Comprehen

Title: Current Time in US Stock Market: What Y

Title: Time to Sell Ex-US Stocks: Understandin

The Best Way to Buy US Stocks in Australia

Is Aurora Stock Canadian or US?

Good Time to Buy US Stocks: Expert Insights an

Live Us Stock Market Data: Your Ultimate Guide

US Standard Atmosphere 1976 Stock No 003 017 0

How to Invest in the London Stock Exchange fro

tags

-

TomorrowAprilFuturesRareGrowingUnderstaComprehensAllegedLNGExchangAcronymHolCanEssentialGoldClosedCannabisEarthPerExchange20182021IndianfromLo5130150NameTankAlternative4245GalChineseIslandStrategyPivotalDefinitioJonesDelhaizeManyA7IIISchwabCompletionMarCitizensFallEdibleMFCListDidNintendo2ndDaysNon-USBogleheOpenHolidaysBYDDelekSmallPurchaseRiskHighwaySixth-Gener2023LargestFoodTotal2019InsectAholdTimingstodshareShausaveruamerican10010miniliveAvnasdaqSustainaPharmaceCleaFuUnderaverage us stocks games silver etf us stock

like

- Capitalization: The Key to Understanding the U"

- Trading US Stocks from NZ: A Comprehensive Gui"

- US Large Cap Momentum Stocks: September 2025 T"

- Title: "http stocks.us.reuters.com st"

- US Small Cap Growth Stocks: Unleashing the Pot"

- Understanding the US M2 Money Stock: A Compreh"

- Best Stock to Invest in the US: A Comprehensiv"

- Solar Stocks: A Lucrative Investment in the Fu"

- Understanding the Impact of US Stock Prices on"

- Holiday US Stock Market 2025: What to Expect a"